Wesdome Extends High Grade 7 Zone 150 Metres Towards Surface

Wesdome Extends High Grade 7 Zone 150 Metres Towards Surface

Canada NewsWire

TORONTO, Feb. 23, 2016

TORONTO, Feb. 23, 2016 /CNW/ - Wesdome Gold Mines Ltd. (TSX: WDO) is pleased to announce encouraging early underground drill results from the 2016 exploration program at its wholly-owned Eagle River Mine, located west of Wawa, Ontario.

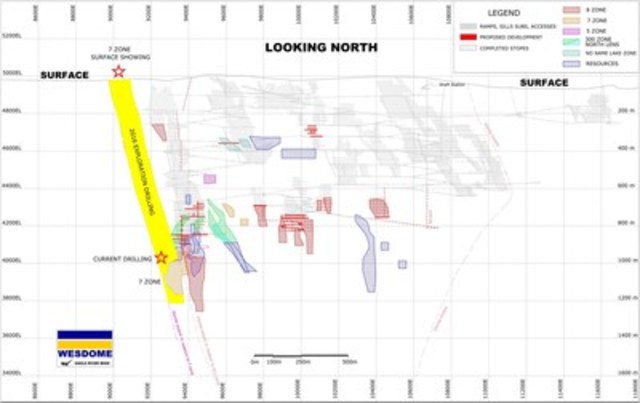

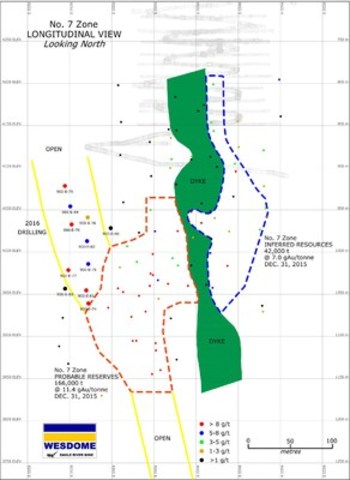

The program that commenced in January is targeting parallel gold zones to the north of the main No. 8 Zone orebody. Initial drilling in the western portion of the mine has traced the No. 7 Zone approximately 150 metres (500 feet) up-plunge to the 900 metre level where it remains open to surface. (Figures 1 & 2, and Table 1).

HIGHLIGHTS (see Table 1):

- Hole 900-E-75: 14.82 grams per tonne ("gAu/t") over 3.37 metres true width

- Hole 900-E-78: 13.63 gAu/t over 5.50 metres true width

- Hole 900-E-79: 13.97 gAu/t over 6.22 metres true width

- Hole 900-E-81: 19.57 gAu/t over 2.95 metres true width

- Hole 900-E-82: 9.72 gAu/t over 4.71 metres true width

- Hole 900-E-84: 7.09 gAu/t over 7.49 metres true width

Rolly Uloth, President and CEO, commented, "We have had a strong start to 2016 on one of our principal exploration targets. Drilling has traced the No. 7 Zone up-plunge from 1,000 metre depth. We are mobilizing a surface drill to test below the surface showing and in April an additional underground drill will move to the 350 metre level to test intermediate depths. As this Zone is located close to existing infrastructure, success on the target could have broad implications for future mine planning and production flexibility, particularly if these strong grades and substantial widths persist."

GEOLOGICAL CONTEXT / IMPLICATIONS

The Eagle River Mine is hosted by a 2.0 km by 0.5 km elliptical quartz diorite stock. Mineralization is hosted by east-west, steeply north dipping laminated quartz veins. The mine is serviced by a shaft and ramp system with the deepest mining level currently at 900 metres. Drilling to date has traced mineralization to 1,200 metre depth, beyond which it remains open.

To date, the mine has produced 1,051,000 ounces of gold from 3,600,000 tonnes at a recovered grade of 9.1 gAu/tonne with the bulk of production coming from the main No. 8 vein structure.

The recent recognition of two new parallel structures, the No. 7 and No. 300 structures, located 200m and 400m, respectively, to the north has prompted an aggressive exploration and development program. In 2015, the 300 Zone commenced initial production.

In 2016, a key target of the exploration effort is to trace the up-plunge projection of the No. 7 Zone structure from a reserve block at 1,000 metre depth to an existing surface showing (Figure 2). These initial drill results support this thesis and may provide an opportunity to advance the high grade No. 7 Zone more rapidly into the production sequence. The No. 7 Zone currently carries our best grade reserves (Press Release dated February 10, 2016) and these new drill results continue to demonstrate strong grades over substantial true widths.

Two additional drills will be added to more rapidly define this target. A surface drill program commencing March 1, 2016, will explore the near surface projection of 7 Zone. In April a third underground drill will be mobilized to the 350 metre level of the mine to further test the 7 Zone at intermediate depths.

TECHNICAL DISCLOSURE

The technical disclosure in this press release has been compiled and reviewed by George N. Mannard, PGeo., VP Exploration of Wesdome and "Qualified Person" as defined by National Instrument 43-101 disclosure standards. Assaying is performed at the Eagle River Mine Assay office by fire assay methods on 25 gram aliquots. QA/QC protocols involve regular lab duplicates and replicates, standards and blanks.

ABOUT WESDOME

Wesdome Gold Mines Ltd. is in its 28th year of continuous gold mining operations in Canada. The Company is currently producing gold at the Eagle River Complex located near Wawa, Ontario from the Eagle River and Mishi gold mines. Wesdome's goal is to expand current operations at both mines over the next four years through mill expansion and exploration. Wesdome has significant upside through ownership of its two other properties, the Kiena Mine Complex in Val d'Or, Quebec and the Moss Lake gold deposit located 100 kilometres west of Thunder Bay, Ontario. These assets are being explored and evaluated to be developed in the appropriate gold price environment. The Company has approximately 118 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol "WDO."

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management's estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company has included in this news release certain non-IFRS performance measures, including, but not limited to, mine operating profit, mining and processing costs and cash costs. Cash costs per ounce reflect actual mine operating costs incurred during the fiscal period divided by the number of ounces produced. These measures are not defined under IFRS and therefore should not be considered in isolation or as an alternative to or more meaningful than, net income (loss) or cash flow from operating activities as determined in accordance with IFRS as an indicator of our financial performance or liquidity. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow

Table 1

|

NO. 7 ZONE SIGNIFICANT INTERSECTIONS | ||||||

|

Hole No. |

From |

To |

Corelength |

True Width |

Grade |

Cut Grade * |

|

900-E-74 |

199.35 |

201.10 |

1.75 |

1.52 |

51.15 |

26.99 |

|

900-E-75 |

159.60 |

164.00 |

4.40 |

3.37 |

14.82 |

7.71 |

|

900-E-76 |

122.50 |

124.65 |

2.15 |

1.52 |

1.29 |

1.29 |

|

900-E-77 |

174.90 |

177.65 |

2.75 |

1.77 |

15.57 |

14.88 |

|

900-E-78 |

131.25 |

139.80 |

8.55 |

5.50 |

13.63 |

12.47 |

|

900-E-79 |

117.20 |

126.00 |

8.80 |

6.22 |

13.97 |

11.55 |

|

900-E-80 |

124.00 |

125.95 |

1.95 |

1.49 |

0.06 |

0.06 |

|

900-E-81 |

184.50 |

189.65 |

5.15 |

2.95 |

19.57 |

12.44 |

|

900-E-82 |

139.75 |

145.50 |

5.75 |

4.71 |

9.72 |

7.28 |

|

900-E-83 |

193.00 |

195.60 |

2.60 |

1.49 |

0.97 |

0.97 |

|

900-E-84 |

122.65 |

130.40 |

7.75 |

7.49 |

7.09 |

6.65 |

*high assays are cut to 60 gAu/t

SOURCE Wesdome Gold Mines Ltd.

Image with caption: "Figure 1 (CNW Group/Wesdome Gold Mines Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160223_C5471_PHOTO_EN_627141.jpg

Image with caption: "Figure 2 (CNW Group/Wesdome Gold Mines Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160223_C5471_PHOTO_EN_627139.jpg