Money Is Moving

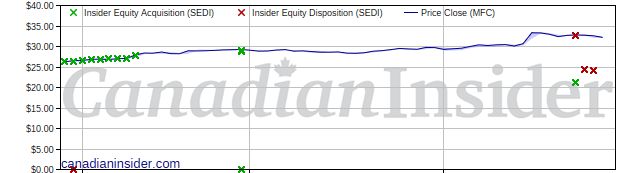

Public market insider selling at Manulife Financial (T:MFC)

Damien Allen Green, a Subsidiary Executive, disposed of 39,521 Common Shares on a direct ownership basis at a price of $24.320USD on February 26th, 2024. This represents a $1,298,995 divestment of the company's shares and an account share holdings change of -58.8%.

Paul Lorentz, a Senior Officer, disposed of 37,239 Common Shares on a direct ownership basis at a price of $32.760 on February 23rd, 2024. This represents a $1,219,950 divestment of the company's shares and an account share holdings change of -43.6%.

James D. Gallagher, a Senior Officer, disposed of 27,453 Common Shares on a direct ownership basis at a price of $32.760 on February 23rd, 2024. This represents a $899,360 divestment of the company's shares and an account share holdings change of -62.5%.

Scott Hartz, a Senior Officer, disposed of 18,873 Common Shares on a direct ownership basis at a price of $32.760 on February 23rd, 2024. This represents a $618,279 divestment of the company's shares and an account share holdings change of -13.8%.

Rahim Hirji, a Senior Officer, disposed of 10,861 Common Shares on a direct ownership basis at a price of $32.760 on February 23rd, 2024. This represents a $355,806 divestment of the company's shares and an account share holdings change of -32.2%.

Steve Finch, a Senior Officer, disposed of 10,294 Common Shares on a direct ownership basis at a price of $32.760 on February 23rd, 2024. This represents a $337,231 divestment of the company's shares and an account share holdings change of -27.1%.

Brooks Tingle, a Senior Officer and Subsidiary Executive, disposed of 3,317 Common Shares on a direct ownership basis at a price of $32.760 on February 23rd, 2024. This represents a $108,665 divestment of the company's shares and an account share holdings change of -3.7%.

Anthony Alex Silva, a Subsidiary Executive, disposed of 1,600 Common Shares on a direct ownership basis at a price of $24.070USD on February 27th, 2024. This represents a $52,072 divestment of the company's shares and an account share holdings change of -33.9%.

Manulife Financial is in the Life & Health Insurance Sub Industry Group under the Financials Sector.

Manulife Financial Corporation is a Canada-based international financial services company. The Company operates as Manulife across its offices in Asia, Canada, and Europe, and primarily as John Hancock in the United States. It provides financial advice, insurance, and wealth and asset management solutions for individuals, institutions, and retirement plan members worldwide. Its segments include Asia, Canada, Global WAM, and Corporate and Other. The Asia segment provides insurance products and insurance-based wealth accumulation products. The Canada segment provides insurance products, insurance-based wealth accumulation products, and banking services and has an in-force variable annuity business. Global WAM segment provides investment advice and solutions to its retail, retirement, and institutional clients. It provides life insurance products, insurance-based wealth accumulation products and has an in-force long-term care insurance business.

INK Edge Outlook

View outlooks on all Canadian listed stocks at inkresearch.com.

Two-week free trial for first time users.

No Comments