Money Is Moving

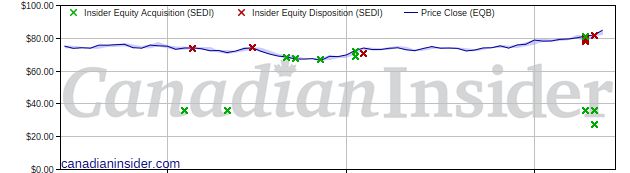

Public market insider net selling at EQB (T:EQB)

Andrew Moor, CEO, disposed of 18,900 Common Shares on a direct ownership basis at prices ranging from $80.800 to $81.090 on December 11th, 2023. This represents a $1,532,746 net divestment of the company's shares and an account share holdings change of -22.7%.

Darren Lorimer, a Subsidiary Executive, disposed of 5,764 Common Shares on a direct ownership basis at prices ranging from $77.950 to $80.220 on December 11th, 2023. This represents a $454,774 divestment of the company's shares and an account share holdings change of -44.3%.

Timothy Paul Charron, a Subsidiary Executive, disposed of 1,000 Common Shares on a direct ownership basis at a price of $82.000 on December 12th, 2023. This represents a $82,000 divestment of the company's shares and an account share holdings change of -32.1%.

EQB is in the Consumer Lending Sub Industry Group under the Financials Sector.

EQB Inc. is a Canada-based company, which operates through its wholly owned subsidiary Equitable Bank. Equitable Bank provides diversified personal and commercial banking through its EQ Bank platform. The Company operates through two main divisions each with multiple diverse business lines: Personal Banking and Commercial Banking. The Personal Banking segment consists of deposits, single family residential mortgage loans, home equity lines of credit, reverse mortgages, insurance lending, and payment infrastructure partnerships. Its savings products are offered through EQ Bank, Equitable Bank, Equitable Trust, and a network of independent financial planners and brokers. The Commercial Banking segment lends loans through a network of mortgage and leasing brokers, lending partners, and other financial institutions. Commercial loans involve lending on multi-unit residential, industrial and office buildings, and other commercial properties.

INK Edge Outlook

View outlooks on all Canadian listed stocks at inkresearch.com.

Two-week free trial for first time users.

No Comments