You are here

Home Blogs Nicholas Winton's blogINK Canadian Insider Index's momentum falls again

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

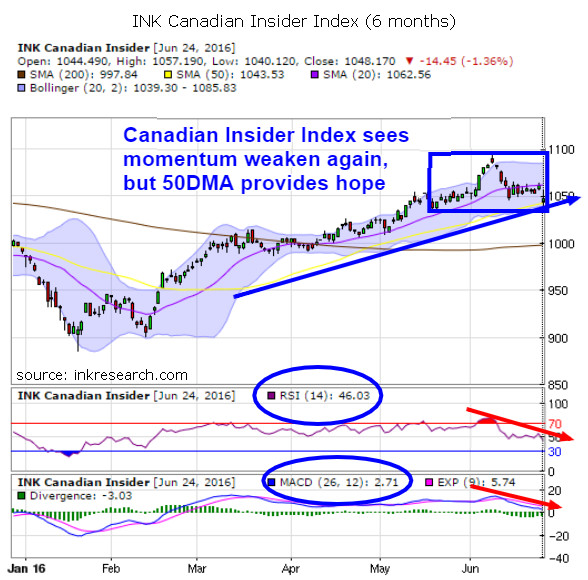

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week's dramatic Brexit vote resulted in soaring gold and silver prices, but the tremendous investor fear it generated caused major indices to plunge worldwide, including the Dow Jones Industrial Average which tumbled 3.4% and, for instance, the iShares China large caps (US*FXI) which pancaked 6%. By contrast, the INK CIN Index outperformed, dropping a relatively modest 5 points, registering barely any loss last week to close at 1048.17.

Momentum, however, has been on sharp decline since mid-June, and last week we saw RSI drop a further 3.75 points (or 7.5%) to 46.03 and it remains under the key 50 RSI level. Even more dramatically, MACD tumbled from 6.13 to 2.71 for a decline of 3.42 or 55%. Many wonder if we'll continue to see this weakness snowball even further or if this major extreme in investor fear will result in a market turnaround.

One saving grace from the bulls' point of view is the CIN Index's major support held intraday Friday at 1040, its 50-day moving average. Its second support is located at 1026. Major resistance is at 1054 and, above that, at 1079. Bulls will want to see a dramatic upturn for the Index and a close above its 20-day moving average (purple line) around 1063, for indeed the 20-day moving average has supported the Index's dramatic comeback since late February. It will be interesting to see if the Index's relative strength versus other stocks and markets last week is a sign of continued outperformance in the weeks ahead.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.