Battle North Gold Delivers McFinley Zone Mineral Resource Estimate, Outlining Potential for Incremental Mill Feed for the Bateman Gold Project

Battle North Gold Delivers McFinley Zone Mineral Resource Estimate, Outlining Potential for Incremental Mill Feed for the Bateman Gold Project

Canada NewsWire

TORONTO, Dec. 14, 2020

TORONTO, Dec. 14, 2020 /CNW/ - Battle North Gold Corporation (TSX: BNAU) (OTCQX: BNAUF) ("Battle North" or the "Company") is pleased to report a Mineral Resource estimate for the McFinley Zone ("McFinley MRE"), prepared in accordance with National Instrument 43-101 of the Canadian Securities Administrators ("NI 43-101") by the Nordmin Group of Companies Ltd. ("Nordmin"). An NI 43-101 technical report for the McFinley Zone reflecting the McFinley MRE will be filed on www.sedar.com within 45 days.

Table 1: McFinley MRE 1 at 3.0 grams per tonne of gold ("g/t Au") Cut-Off Grade

Category | Quantity | Grade | Contained Gold |

Measured (M) | 45,300 | 5.40 | 7,900 |

Indicated (I) | 160,400 | 6.22 | 32,100 |

M + I | 205,700 | 6.04 | 40,000 |

Inferred | 259,300 | 8.53 | 71,100 |

Notes:

- Effective date is December 10, 2020;

- Based on a break-even incremental economic cut-off grade2 of 3.0 g/t Au, assuming the utilization of the Bateman Gold Project (the "Project") infrastructure and processing facilities, a gold price of US$1,400/oz, an exchange rate of US$/C$ 0.74, mining cash costs3 of C$92/t, processing costs of C$25/t, G&A of C$2/t, sustaining capital C$34/t, refining, transport and royalty costs of C$54/oz, and average gold recoverability of 86%;

- Excludes unclassified mineralization located within several pillars (crown, mill, shaft, and lake);

- Reported from within an envelope accounting for mineral continuity; and

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

CEO Comment

Battle North President and Chief Executive Officer George Ogilvie, P.Eng., stated, "The McFinley MRE provides an encouraging step towards outlining future potential incremental mill feed to the Bateman Gold Project, which could potentially enhance the overall economics of the Project. The McFinley Zone benefits from more than 3,900 m of existing underground development that is connected to the Project shaft and underground infrastructure. The existing development and close proximity to the Project processing facilities allows us to potentially expedite the inclusion of the McFinley Zone mineralized material to the Project mine plan. Importantly, the McFinley MRE only extends down to the 162 m Level, but the zone remains open at depth and along strike. Given the success of our initial exploration program and the potential to enhance the Project economics, our plan is to continue to prioritize exploration activity at the McFinley Zone."4

1 See the Cautionary Statements starting at page 5 of this news release. | |||

2 The incremental economic cut-off grade does not include fixed operating and capital costs attributed to the Bateman Gold Project as a stand-alone operation. | |||

3 Mining cash cost components include in-stope mining costs, underground utilities, material handling, and development costs. | |||

4 For more information on the Project, including economics and mine plan, see the Technical Report for the Project filed on December 3, 2020 and dated December 1, 2020 (the "Project Technical Report"), available under the Company's profile at www.sedar.com and on its website at www.battlenorthgold.com. | |||

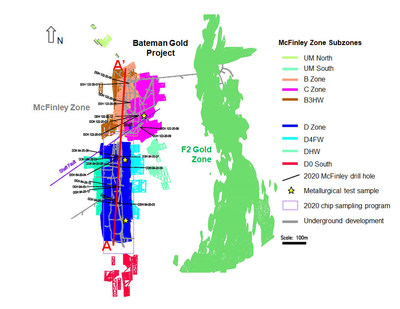

McFinley Zone Geological Model

The McFinley Zone forms part of the "String of Pearls" exploration targets located near the Bateman Gold Project infrastructure. The McFinley MRE covers a strike length of approximately 1,160 m at a depth of 162 m below surface, and remains open at depth and along strike. Gold mineralization at the McFinley Zone is primarily hosted in gold-bearing quartz veins and sulphides in the banded-iron formation ("BIF"), basaltic unit, and ultramafic settings. The McFinley Zone is comprised of 9 subzones: D Zone, B Zone, C Zone, DHW, D0 South, D4FW, B3HW, UMN, and UMS. Some of the gold occurs in native form (i.e., coarse gold) and is primarily associated with sulphides, in fractures, and minor veining. Some of the highest gold grade intersections5 appear to occur when east-west structures crosscut the north-south oriented veins; these appear to occur near the ultramafic (C Zone and UMS) and BIF (D Zone, B Zone, DHW, D4FW, B3HW) units, where there are favourable chemical and structural traps for developing disseminated sulphides and gold-bearing veins.

McFinley MRE

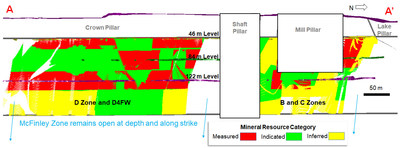

The McFinley MRE benefits from approximately 1,620 m of recent confirmatory diamond drilling, 57,945 m of historical drilling, historical chip sampling (7,940 chip samples) and 2020 chip sampling (371 chip samples). The results from the 2020 drilling and chip sampling program appear to broadly confirm the historical drilling, chip sampling and mapping results4. McFinley MRE wireframes were first created using an approximate cut-off grade of 2.0 g/t Au. The wireframes were then grouped into nine domains, representing the nine different subzones of mineralization. These mineralized domains are based upon geological, spatial, grade differences and geochemical differences identified through sample testing done with synchrotron technology. The D Zone represents the largest domain by tonnes of mineralized material and estimated Mineral Resources. Composites are capped up to 90 g/t Au (depending upon the domain) and have a minimum composite width of 1.0 m. Block size dimensions were 2.0 m height by 2.0 m width by 2.0 m depth and sub-blocked. Four Mineral Resource estimation methods – Nearest Neighbour ("NN"), Inverse Distance Squared ("ID2"), Inverse Distance Cubed ("ID3") and Ordinary Kriging ("OK") – were run as part of the Mineral Resource estimate check. ID2 was used as the grade interpolation method for the McFinley MRE. The McFinley MRE is represented in the following tables and diagrams:

- Table 1: McFinley MRE summary at a 3.0 g/t Au cut-off grade

- Table 2: McFinley MRE sensitivity analysis at various potential mining cut-off grades

- Table 3: McFinley MRE by underground level

- Diagram 1 – McFinley MRE mineralized domains – plan view

- Diagram 2 – McFinley MRE – longitudinal view looking west

5 For more information, please refer to the Battle North's August 11, 2020 and September 24, 2020 (the "2020 McFinley News Releases"), which is found on the Company's profile on www.sedar.com and on the Company's website at www.battlenorthgold.com. | |||

Table 2: McFinley MRE1 – sensitivity analysis at various potential mining cut-off grades3

Cut-off | Measured | Indicated | Inferred | ||||||||

Quantity | Grade | Contained | Quantity | Grade | Contained | Quantity | Grade | Contained Gold | |||

2.0 | 74,400 | 4.24 | 10,200 | 263,500 | 4.75 | 40,200 | 441,800 | 5.99 | 85,000 | ||

2.5 | 57,300 | 4.84 | 8,900 | 205,700 | 5.45 | 36,100 | 314,600 | 7.51 | 76,000 | ||

3.0 | 45,300 | 5.40 | 7,900 | 160,400 | 6.22 | 32,100 | 259,300 | 8.53 | 71,100 | ||

3.5 | 35,500 | 6.00 | 6,800 | 131,500 | 6.88 | 29,100 | 202,000 | 10.04 | 65,200 | ||

4.0 | 25,800 | 6.85 | 5,700 | 108,600 | 7.53 | 26,300 | 172,100 | 11.13 | 61,600 | ||

Additional Considerations for the McFinley Zone

The McFinley Zone benefits from more than 3,900 m of existing underground development that is connected to the Project shaft and underground infrastructure. Furthermore, the planned Project decline ramp from surface will also connect to the McFinley Zone underground development, providing another point of access to the zone. Due to the average horizontal widths of the gold mineralization at the McFinley Zone, the future mining of the McFinley Zone could consist of the mass-blast raise mining ("MBRM") method (which can be utilized on stopes as narrow as 1.2 m mining width) and more selective mining methods such as cut-and-fill. Further work and a future potential test trial mining program may be required to determine the appropriate mining method(s) for the McFinley Zone. Initial metallurgical testing has indicated the amenability of the McFinley Zone material to be processed at the Project mill; however, further metallurgical testing and future bulk sample processing are required.

Qualified Persons and Quality Assurance / Quality Control (QA/QC)

The content of this news release has been read, verified and approved by Michael Willett, P.Eng., Vice President, Operations and Projects for Battle North, and Isaac Oduro, P.Geo., Manager of Technical Services for Battle North, and Glen Kuntz, P.Geo., Consulting Specialist for Nordmin (who is independent of the Company), each of whom is a Qualified Person as defined by NI 43-101.

Underground drilling was conducted by Boart Longyear Drilling of Haileybury, Ontario and was supervised by the Battle North exploration team. All assays reported are uncut unless otherwise stated. Samples reported herein were assayed by SGS Mineral Services of Red Lake, Ontario and Activation Laboratories Ltd., Dryden, Ontario, both of which are independent of Battle North. All NQ core assays reported were obtained by fire assay with AA-finish or using gravimetric finish for values over 10.0 g/t Au.

Intercepts cited do not necessarily represent true widths, unless otherwise noted, however drilling is generally intersecting interpreted mineralized zones at angles between -30o and +30o. True widths determinations were based upon the 'Actual Width (m)' multiplied by the 'Cosine of the Drill Trace Angle' to the mineralized zone. Drill trace angles are determined using a downhole Gyro Survey instrument. Battle North Gold's quality control checks include insertion of certified reference materials, blank and duplicate samples to ensure laboratory accuracy and precision 6.

6 For more information on applicable QA/QC procedures, see the Project Technical Report, available under the Company's profile at www.sedar.com and on its website at www.battlenorthgold.com | |||

About Battle North Gold Minerals Corporation

Battle North is a Canadian gold mine developer led by an accomplished management team with successful underground gold mine operations, finance, and capital markets experience. Battle North owns the significantly de-risked and shovel-ready Bateman Gold Project, located in the renowned Red Lake gold district in Ontario, Canada and controls the strategic and second largest exploration ground in the district. Battle North also owns a large gold exploration land package on the Long Canyon gold trend near the Nevada-Utah border in the United States. Battle North's shares are listed on the Toronto Stock Exchange (BNAU) and the OTCQX markets (BNAUF). For more information, please visit our website at www.battlenorthgold.com.

BATTLE NORTH GOLD CORPORATION

George Ogilvie, P.Eng.

President, CEO, and Director

Diagram 1: McFinley MRE mineralized domains – plan view

Diagram 2: McFinley MRE – longitudinal view looking west

Table 3: McFinley MRE by underground level

Below | Measured | Indicated | Inferred | ||||||

Quantity | Grade | Contained | Quantity | Grade | Contained | Quantity | Grade | Contained | |

46-84 | 21,000 | 6.16 | 4,100 | 57,500 | 5.60 | 10,300 | 91,000 | 8.38 | 24,500 |

84-122 | 16,600 | 4.63 | 2,500 | 53,600 | 7.44 | 12,800 | 104,500 | 9.16 | 30,800 |

122-162 | 7,700 | 4.99 | 1,200 | 49,000 | 5.63 | 8,900 | 63,700 | 7.71 | 15,800 |

Cautionary Statements regarding Forward-Looking Statements and Other Matters

All statements, other than statements of historical fact, contained or incorporated by reference in this news release constitute "forward-looking statements" and "forward looking information" (collectively, "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "amenability", "anticipated", "appear", "assumptions", "contingencies", "could", "demonstrate", "developing", "encouraging", "enhanced", "estimate", "expectations", "exploration", "factors", "favourable", "forward", "future", "initial", "interpretation", "may", "model", "outlining", "planned", "possible", "potential", "prioritize", "program", "project", "prospect", "risk", "sensitivity", "shovel-ready", "strategic", "study", "target", "test", "towards", "trend", "trial", "uncertainties", and "will", or variations of such words, and similar such words, expressions or statements that certain actions, events or results can, could, may, should, will (or not) be achieved, occur, provide, result or support in the future. In some cases, forward-looking information may be stated in the present tense, such as in respect of current matters that may be continuing, or that may have a future impact or effect. Forward-looking statements include statements regarding Mineral Resources (which are estimates only) and other mineralization; block models and mineralized domains; the results of historical and the 2020 McFinley Zone drilling and chip sampling programs including openness across strike or at depth thereof; potential to use mineralized material from the McFinley Zone as incremental mill feed for the Project and impact on its economics and mine plan; and the Project including economics and mine plan.

Forward-looking statements are based on assumptions, estimates, expectations and opinions, which are considered reasonable and represent best judgment based on available facts, as of the date such statements are made. If such assumptions, estimates, expectations and opinions prove to be incorrect, actual and future results may be materially different than expressed or implied in the forward-looking statements. The assumptions, estimates, expectations and opinions referenced, contained or incorporated by reference in this news release which may prove to be incorrect include those set forth herein and the 2020 McFinley News Releases as well as: (1) permitting, exploration and development at the Project, including the McFinley Zone, being consistent with the Company's current expectations including the maintenance of existing permits, licenses and other approvals and the timely receipt of other permits, licenses and other approvals necessary from time to time; (2) political and legal developments being consistent with its current expectations; (3) the completion of necessary work, evaluations and studies on the timelines currently expected (notwithstanding the risks, uncertainties, contingencies and other factors described below including COVID-19) and the results being consistent with the Company's current expectations; (4) the exchange rate between the Canadian dollar and the U.S. dollar being approximately consistent with current expectations; (5) price assumptions for gold; (6) price assumptions for diesel, natural gas, electricity and other key supplies; (7) the accuracy of the Company's internal models; (8) labour and materials costs being consistent with the Company's current expectations; (9) continuing amenable relations with key stakeholders including the local communities and First Nations; and (10) the Company's ability to meet current and future debt obligations or to complete future financings to raise additional capital as and when needed including to fund development of the Project.

Forward-looking statements are inherently subject to known and unknown risks, uncertainties, contingencies and other factors which may cause the actual results, performance or achievements of Battle North to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks, uncertainties, contingencies and other factors include, among others: gold price fluctuations; possible variations in mineralization, grade or recovery or throughput rates; uncertainty of Mineral Resource estimates; inability to realize exploration potential, mineral grades and mineral recovery estimates; actual results of exploration activities including their impact; delays in completion of exploration and other drilling or plans, and any modelling, re-interpretations or studies, for any reason including insufficient capital and other risks, uncertainties, contingencies and factors identified herein; labour issues at the Company or third parties, such as government and regulatory agencies, suppliers and service providers, including labour shortages and/or work curtailments or stoppages as may result from COVID-19; conclusions of economic, geological or structural evaluations and models including those reflected in Mineral Resource estimates; changes in Project parameters as plans continue to be refined; failure of equipment or processes to operate as anticipated; accidents and other risks of the mining industry; delays and other risks related to operations; the ability to obtain and maintain permits and other regulatory approvals (as well as the timing and terms thereof) and to comply with such permits, approvals and other applicable regulatory requirements; the ability of Battle North to comply with its obligations under material agreements including its current loan facility and other financing agreements; the availability of financing for proposed programs and working capital requirements on reasonable terms and in a timely manner; the ability to meet, repay, or refinance, or replace, or renegotiate current and future debt obligations on reasonable terms and in a timely manner including the current loan facility and closure and reclamation surety bond; the ability of third-party service providers and other suppliers to deliver on reasonable terms and in a timely manner; risks associated with the ability to retain key executives and key operating personnel; cost of environmental expenditures and potential environmental liabilities; relations with local communities including First Nations; failure of plant, equipment or processes to operate as anticipated; cost of supplies; market conditions and general business, economic, competitive, political and social conditions; our ability to generate sufficient cash flow from operations or obtain adequate financing to fund our capital expenditures and working capital needs and meet our other obligations; the volatility of the Company's share price, and the ability of our common shares to remain listed and traded on the TSX; epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses; and the "Risk Factors" in the Company's annual information form dated March 27, 2020 ("2020 AIF") as well as the risks, uncertainties, contingencies and other factors identified in the 2020 McFinley News Releases, the Project Technical Report and the Company's Management's Discussion and Analysis for the quarter ended September 30, 2020 (the "Q3, 2020 MD&A") and accompanying financial statements, all of which are available under the Company's profile at www.sedar.com and on its website at www.battlenorthgold.com. The foregoing list of risks, uncertainties, contingencies and other factors is not exhaustive; readers should consult the more complete discussion of the Company's business, financial condition and prospects that is provided in the 2020 AIF.

The forward-looking statements referenced or contained herein are expressly qualified by these Cautionary Statements as well as the Cautionary Statements in the 2020 McFinley News Releases, the 2020 AIF, the Project Technical Report and the Q3, 2020 MD&A (and accompanying financial statements). Forward-looking statements contained herein are made as of the date of this news release (or as otherwise expressly specified) and Battle North disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable laws.

Cautionary Statement regarding Mineral Resource Estimates

Until mineral deposits are actually mined and processed, Mineral Resources must be considered as estimates only. Mineral Resource estimates that are not Mineral Reserves do not have demonstrated economic viability. The estimation of Mineral Resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the foregoing Cautionary Statements, as well as those described in the 2020 McFinley News Releases, the 2020 AIF, the Q3, 2020 MD&A (and accompanying financial statements) and the Project Technical Report. The quantity and grade of reported "Inferred" Mineral Resource estimates are uncertain in nature and there has been insufficient exploration to define "Inferred" Mineral Resource estimates as an "Indicated" or "Measured" Mineral Resource and it is uncertain if further exploration will result in upgrading "Inferred" Mineral Resource estimates to an "Indicated" or "Measured" Mineral Resource category. The accuracy of any Mineral Reserve and Mineral Resource estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral reserve and Mineral Resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in mineral prices; (ii) results of drilling, and development; (iii) results of test stoping and other testing; (iv) metallurgical testing and other studies; (v) results of geological and structural modeling including stope design; (vi) proposed mining operations, including dilution; (vii) the evaluation of mine plans subsequent to the date of any estimates; and (viii) the possible failure to receive required permits, licenses and other approvals. It cannot be assumed that all or any part of a "inferred", "Indicated" or "Measured" Mineral Resource estimate will ever be upgraded to a higher category. The Mineral Resource estimates disclosed in this news release were reported using Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (the "CIM Standards") in accordance with National Instrument 43-101 of the Canadian Securities Administrators ("NI 43-101").

Cautionary Statement to U.S. Readers

This news release uses the terms "Mineral Reserve", "Proven Mineral Reserve", "Probable Mineral Reserve", "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" as defined in the CIM Standards (collectively, the "CIM Definitions") in accordance with NI 43-101. While these terms are recognized and required by the Canadian Securities Administrators in accordance with Canadian securities laws, they are not recognized by the United States Securities and Exchange Commission (the "SEC") and differ materially from the definitions in the SEC Industry Guide 7 under the United States Securities Act of 1933, as amended. Under SEC Industry Guide 7, a "final" or "bankable" feasibility study is required to report "Reserves", the three-year historical average price is used in any "Reserve" or cash flow analysis to designate "Reserves" and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" as defined in NI 43-101 are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be upgraded to SEC Industry Guide 7 "Reserves". The estimation of "Measured Mineral Resources" and "Indicated Mineral Resources" involves greater uncertainty as to their existence and economic and legal feasibility than the estimation of SEC industry Guide 7 "Reserves". Under SEC Industry Guide 7, mineralization may not be classified as a "Reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the Reserve determination is made. The estimation of "Inferred Mineral Resources" involves far greater uncertainty as to their existence and economic and legal viability than the estimation of other categories of "Mineral Resources". Under NI 43-101, estimates of "Inferred Mineral Resources" may not form the basis of feasibility studies, pre-feasibility studies or other economic studies, except in prescribed cases, such as in a preliminary economic assessment (or PEA) under certain circumstances. The SEC normally only permits issuers to report mineralization that does not constitute "Reserves" as in-place tonnage and grade without reference to unit measures. It cannot be assumed that any part or all of a "Inferred Mineral Resource", "Measured Mineral Resource" or "Indicated Mineral Resource" estimate exists or is economically or legally mineable.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934. These amendments became effective February 25, 2019 (the "SEC Modernization Rules") and, on January 1, 2021, will replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7, which will be rescinded from and after such date.

The SEC Modernization Rules include the adoption of terms describing "mineral reserves" and "mineral resources" that are "substantially similar" to the corresponding terms under NI 43-101. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definitions. U.S. investors are cautioned that while the above terms are "substantially similar" to CIM Definitions, there are differences between the definitions ascribed to such terms under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance that any "Mineral Reserve" or "Mineral Resource" estimate that the Company may report as "Proven Mineral Reserves", "Probable Mineral Reserves", "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" under NI 43-101 would be the same had the Company prepared such estimates under the standards adopted under the SEC Modernization Rules.

For the above reasons, the "Mineral Reserve" and "Mineral Resource" estimates and related information in this news release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The Company is not required to provide disclosure on its mineral properties under SEC Industry Guide 7 or the SEC Modernization Rules and will continue to provide disclosure under NI 43-101.

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/battle-north-gold-delivers-mcfinley-zone-mineral-resource-estimate-outlining-potential-for-incremental-mill-feed-for-the-bateman-gold-project-301191931.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/battle-north-gold-delivers-mcfinley-zone-mineral-resource-estimate-outlining-potential-for-incremental-mill-feed-for-the-bateman-gold-project-301191931.html

SOURCE Battle North Gold Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/14/c7074.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/14/c7074.html