Anaconda acquires another gold deposit and project; Expands its reach in Newfoundland

Anaconda acquires another gold deposit and project; Expands its reach in Newfoundland

Canada NewsWire

TORONTO, Feb. 10, 2016

TORONTO, Feb. 10, 2016 /CNW/ - Anaconda Mining Inc. ("Anaconda" or the "Company") – (TSX: ANX) is pleased to report that on February 5, 2016 (the "Effective Date") it entered into an option agreement (the "Viking Agreement") with Spruce Ridge Resources Ltd. ("Spruce Ridge"), to acquire a 100% undivided interest in the Viking property ("Viking"), which contains the Thor-Trend Gold Deposit ("Thor Deposit"). The Thor Deposit contains a Historical Mineral Resource Estimate as summarized below:

|

Resource Category |

Cut-off (g/t)* |

Tonnes |

Grade (g/t) |

Ounces of gold (Au) |

|

Indicated |

1.0 |

937,000 |

2.09 |

63,000 |

|

Inferred |

1.0 |

350,000 |

1.79 |

20,000 |

|

*grams per tonne |

The Thor Deposit remains open for potential expansion along strike near surface and at depth.

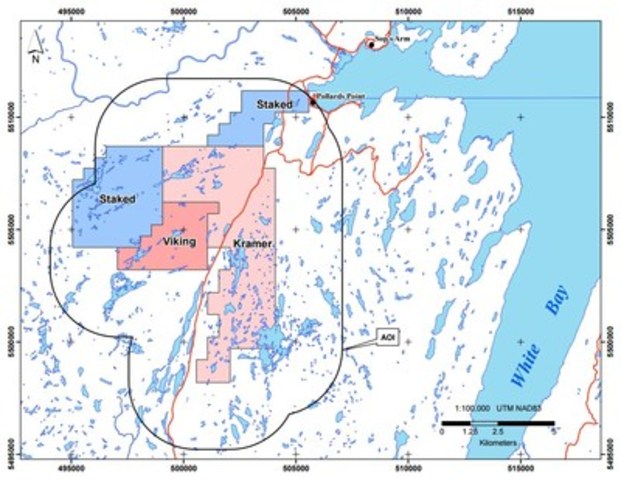

The Company also entered into a second option agreement (the "Kramer Agreement") with Spruce Ridge to acquire a 100% undivided interest in the Kramer Property ("Kramer"), which is contiguous to Viking and contains numerous gold prospects and showings similar in geological character and setting to the Thor Deposit.

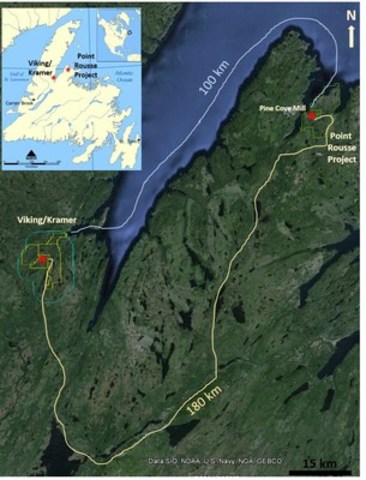

Viking and Kramer are located near the communities of Pollards Point and Sop's Arm in White Bay, Newfoundland and Labrador, approximately 180 km by road (100 km by barge) from the Company's Pine Cove mill, and are accessible via a 2.5 km forest road from provincially maintained paved road networks (Exhibits A and B). The combined Viking and Kramer properties encompass 4,025 hectares of highly prospective mineral lands.

On January 29, 2016, Anaconda also staked an additional 2,200 hectares of prospective mineral lands contiguous to Viking and Kramer (Exhibit B). In total, the Company now controls approximately 6,225 hectares of property in White Bay, Newfoundland, similar in size to the Point Rousse Project on the Ming's Bight Peninsula.

President and CEO, Dustin Angelo, stated, "Our option of Spruce Ridge's gold properties is an exciting transaction for Anaconda as it is the first step out from the Point Rousse Project and will add significant resources to our portfolio within striking distance of the Pine Cove mill. Our intent is to process any ore mined from this property at the Pine Cove mill so as to leverage our existing infrastructure. Beyond the historical Indicated and Inferred Mineral Resources at Viking, we are encouraged by the overall gold bearing potential of the entire land package, including Kramer and the property staked by Anaconda. Ultimately, we foresee simultaneously operating two large gold mining projects at Point Rousse and Viking while processing their ore at the Pine Cove mill."

John Ryan, President and CEO of Spruce Ridge stated that, "we are pleased to have an agreement with Anaconda that will advance the Viking and Kramer properties to the benefit of shareholders of both companies. Anaconda has an active mining operation within reasonable trucking or shipping distance from Viking/Kramer and has demonstrated their ability to operate successfully as evidenced from their track record at the Point Rousse Project. This agreement will allow the potential fast tracking of Viking towards production utilizing Anaconda's existing infrastructure."

Near term exploration and evaluation plans

The Company plans to verify all available historical data, fully integrate the data into its database, and complete an assessment of the Thor Deposit and the exploration potential of the entire project area. It will refine the Thor Deposit geological model to incorporate the new geological model and ultimately generate a new Mineral Resource Estimate. Contemporaneous with data and resource model assessment, Anaconda will create a preliminary development plan to evaluate the project viability based on leveraging the Pine Cove mill.

Anaconda is planning a field program, based on the aforementioned work, for early summer of 2016 to advance the project. Additionally, metallurgical testing will be completed on mineralized intervals from the Thor Deposit drill core to further assess compatibility with the Pine Cove mill flowsheet.

Terms of the option and royalty agreements

The Viking Agreement: To earn a 100% interest in Viking, the Company is required to make aggregate payments to Spruce Ridge of $300,000 over a five-year period based on milestones to production including a final payment of $175,000 upon commencement of commercial production. The Company can pay all option payments at any time during the option period to earn its 100% interest. In addition, the Company granted warrants to Spruce Ridge to purchase 350,000 common shares of Anaconda at an exercise price of $0.10 per share, expiring three years from the Effective Date. Further, the Viking Agreement provides for one-half of one percent (0.5%) Net Smelter Returns royalty ("NSR") to Spruce Ridge on the sale of gold from Viking.

The Kramer Agreement: To earn a 100% interest in Kramer, the Company is required to make aggregate payments to Spruce Ridge of $132,500 over the five-year period, beginning with an initial payment of $12,500 on closing with increasing payments on the anniversary of the Effective Date of the agreement. The Company also issued 250,000 common shares of Anaconda. The Kramer Agreement provides for a two percent (2%) NSR to Spruce Ridge on the sale of gold from Kramer. The NSR is capped at two and one-half million dollars ($2,500,000), after which, the NSR will be reduced to one percent (1%). Anaconda is required to spend a total of $750,000 in qualified exploration expenditures on Kramer during the option period.

Other agreements: Two previous NSR agreements held by Altius Resources Inc. ("Altius") and a prospector, Paul Crocker, in relation to Viking will be terminated upon Anaconda earning its 100% interest in Viking and/or Kramer. These agreements will be replaced by new NSR agreements that stipulate that the Company will pay Altius a 2.5% NSR granted on Viking, a 1% NSR granted on Kramer and a 1.5% NSR granted on an area of interest within 3 km of the combined Viking and Kramer properties.

The Thor Deposit

The Thor Deposit hosts a Historical Mineral Resource Estimate as defined by the National Instrument 43-101 Standards for Disclosure for Mineral Projects and is not considered by the Company to be a Current Mineral Resource, since Anaconda Qualified Persons have not completed sufficient work to classify it as a Current Mineral Resource. The Indicated and Inferred Resources referenced above are taken from a technical report filed on SEDAR titled "MINERAL RESOURCE ESTIMATE UPDATE FOR THE THOR TREND GOLD DEPOSIT, NORTHERN ABITIBI MINING CORP., White Bay Area, Newfoundland and Labrador, Canada, Latitude 49o 42' N Longitude 57o 00' W." prepared for Northern Abitibi Mining Corp. by Dr. Shane Ebert, P. Geo. and Gary Giroux, P. Eng. MASc., December 30, 2011.

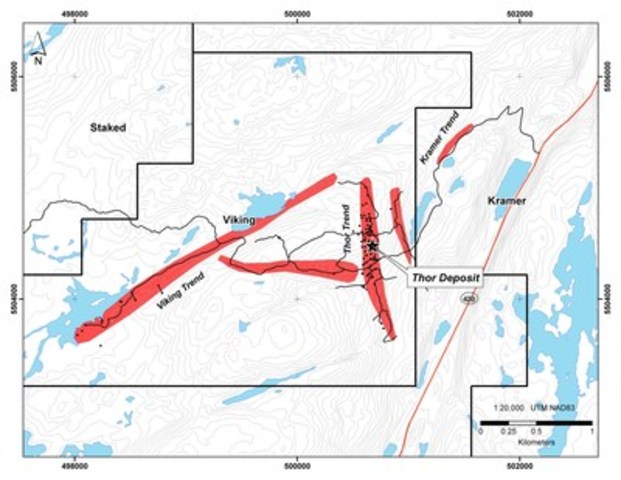

The Historical Mineral Resource Estimate of the Thor Deposit is based on 109 diamond drill holes totaling 15,574 m and 74 lines of surface channel samples cut from trenches using a diamond saw (Exhibit C). Gold mineralization was constrained within a 3-dimensional geological solid built using Gemcom software. Gold assays within the mineralized solid were capped at 66.0 g/t Au while those outside the solid were capped at 4.0 g/t Au. Drill hole assay samples were composited into 2.5 m intervals and a block model with 5m x 5m x 5m block size was created. Gold grades were interpolated into all blocks, by a combination of ordinary and indicator kriging.

The Company considers the NI 43-101 report to be relevant and reliable given that the report was published recently and that no additional work of significance has been completed since the issuance of the Historical Mineral Resource Estimate.

In addition to the Historical Mineral Resource Estimate, other historical exploration efforts on the Viking and Kramer properties include: 128 holes of diamond drilling totaling 18,620.6 m on Viking and 28 holes totaling 3,650.3 m on Kramer; excavation of 62 trenches on Viking and 5 trenches on Kramer and associated channel sampling; high-resolution airborne magnetic and electromagnetic geophysical surveying; ground induced polarization, magnetic and VLF surveys, rock and soil sampling and geological mapping.

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

ABOUT ANACONDA

Headquartered in Toronto, Canada, Anaconda is a growth oriented, gold mining and exploration company with a producing project, called the Point Rousse Project, and approximately 6,300 hectares of exploration property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula. It is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include three deposits and numerous prospects and showings, all within 8 kilometres of the Pine Cove mill. The Company's plan is to discover and develop more resources within the project area and double annual production from its current rate of approximately 15,000 ounces to 30,000 ounces. Anaconda also controls approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 180 km via road (100 km by barge) from the Pine Cove mill. The White Bay property contains the Thor-Trend gold deposit and other gold prospects and showings.

FORWARD LOOKING STATEMENTS

This document contains or refers to forward-looking information. Such forward-looking information includes, among other things, statements regarding growth and is based on current expectations and assumptions of management that involve a number of business risks and uncertainties. Factors that could cause actual results to differ materially from any forward-looking statements include, but are not limited to: the expectations of the Company in expanding mineral resources and project mine life and the timing thereof, current and future market trends and growth opportunities and whether the Company will be able to capitalize upon them. Forward-looking statements may include words such as "plans," "may," "estimates," "expects," "indicates," "targeting," "potential" and similar expressions. These forward-looking statements are based on current expectations and are subject to significant risks and uncertainties, including the risks factors outlined in the Company's latest annual information form and other continuous disclosure documents filed at www.sedar.com, and other factors that could cause actual results to differ materially from expected results. Readers should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances, except as required by law.

Company website: www.anacondamining.com

SOURCE Anaconda Mining Inc.

Image with caption: "Exhibit A: A satellite image of northwest central Newfoundland showing the location of the Point Rousse Project and the Pine Cove Mill in relation to the Viking and Kramer properties. (CNW Group/Anaconda Mining Inc.)". Image available at: http://photos.newswire.ca/images/download/20160210_C3156_PHOTO_EN_617557.jpg

Image with caption: "Exhibit B: A map showing the location of the Viking, Kramer and staked licenses in relation to White Bay and the communities of Pollards Point and Sop's Arm. (CNW Group/Anaconda Mining Inc.)". Image available at: http://photos.newswire.ca/images/download/20160210_C3156_PHOTO_EN_617559.jpg

Image with caption: "Exhibit C: A map of the Viking and Kramer licenses showing the location of the Thor Deposit and associated gold trends. (CNW Group/Anaconda Mining Inc.)". Image available at: http://photos.newswire.ca/images/download/20160210_C3156_PHOTO_EN_617561.jpg