Ximen Acquires Royalties for Key Properties in Greenwood Camp

VANCOUVER, BC / ACCESSWIRE / June 24, 2020 / Ximen Mining Corp. (TSXV:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") is pleased to announce that it has acquired 3% net smelter royalties covering the Golden Crown property and May Mac Property, and a royalty on material processed in the May Mac (Boundary Falls mill). All the properties are located in the Greenwood mining camp, southern British Columbia.

Photograph of locomotive and mine car at May Mac mine

Golden Crown Royalties

Ximen recently purchased two net smelter royalties (NSR's) from arm's length parties on the Golden Crown property owned by Golden Dawn Minerals Inc. The first is a 3% NSR that was split between two parties on a group of 11 mineral tenures that make up part of the property. The second is a separate 3% NSR on two other mineral claims in the property.

The Golden Crown property to which these royalties apply includes a mineral resource that was disclosed by Golden Dawn in 2017 as follows (see note 1):

- Indicted: 163,000 Tonnes, 11.09 grams per tonne gold, 0.56 percent copper,

- Inferred: 42,000 Tonnes, 9.04 grams per tonne gold, 0.43 percent copper.

Note 1: Updated Preliminary Economic Assessment on The Greenwood Precious Metals Project, Greenwood, British Columbia, Canada, Effective Date: May 5, 2017, Prepared for Golden Dawn Minerals Inc. By P&E Mining Consultants Inc., filed on SEDAR June 19, 2017.

Photograph of visible gold in Golden Crown drill core, hole 03-CDH-01.

The Golden Crown mineral resources were included in a Preliminary Economic Assessment for mine development and processing at the Greenwood mill, which is also located on the Golden Crown property.

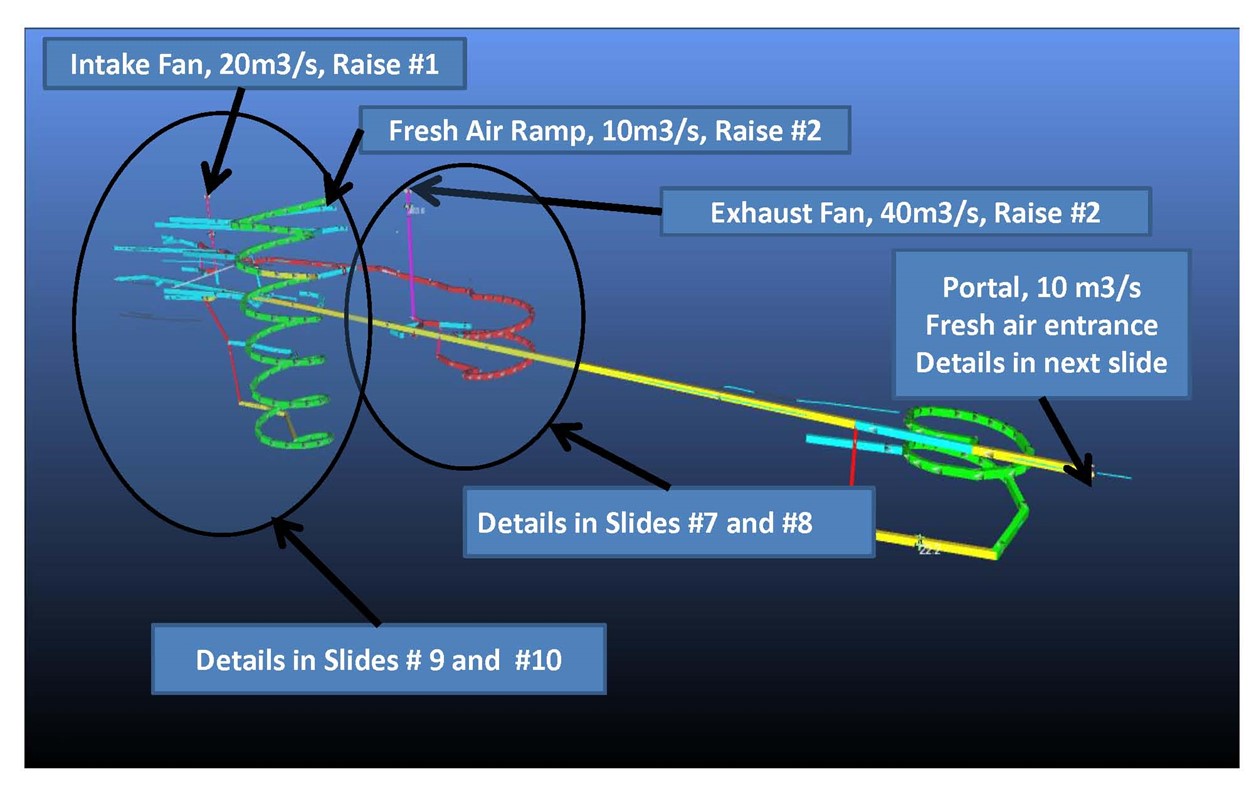

Perspective view of the conceptual mine at the Golden Crown property (see note 1).

May Mac Royalties

Ximen recently purchased a net smelter royalty of 3% that was split between two parties on the May Mac mine property (one mineral claim and two mining leases), as well as an existing royalty consisting of $5 per ton on material processed in the May Mac mill (Boundary Falls mill) from a private entity. This mill was constructed in 1980 as a 100 ton per day (90.7 tonne) gravity-flotation mill to process material from the May Mac (Skomac) mine. Both the mine and the mill have existing permits that can be amended for future use.

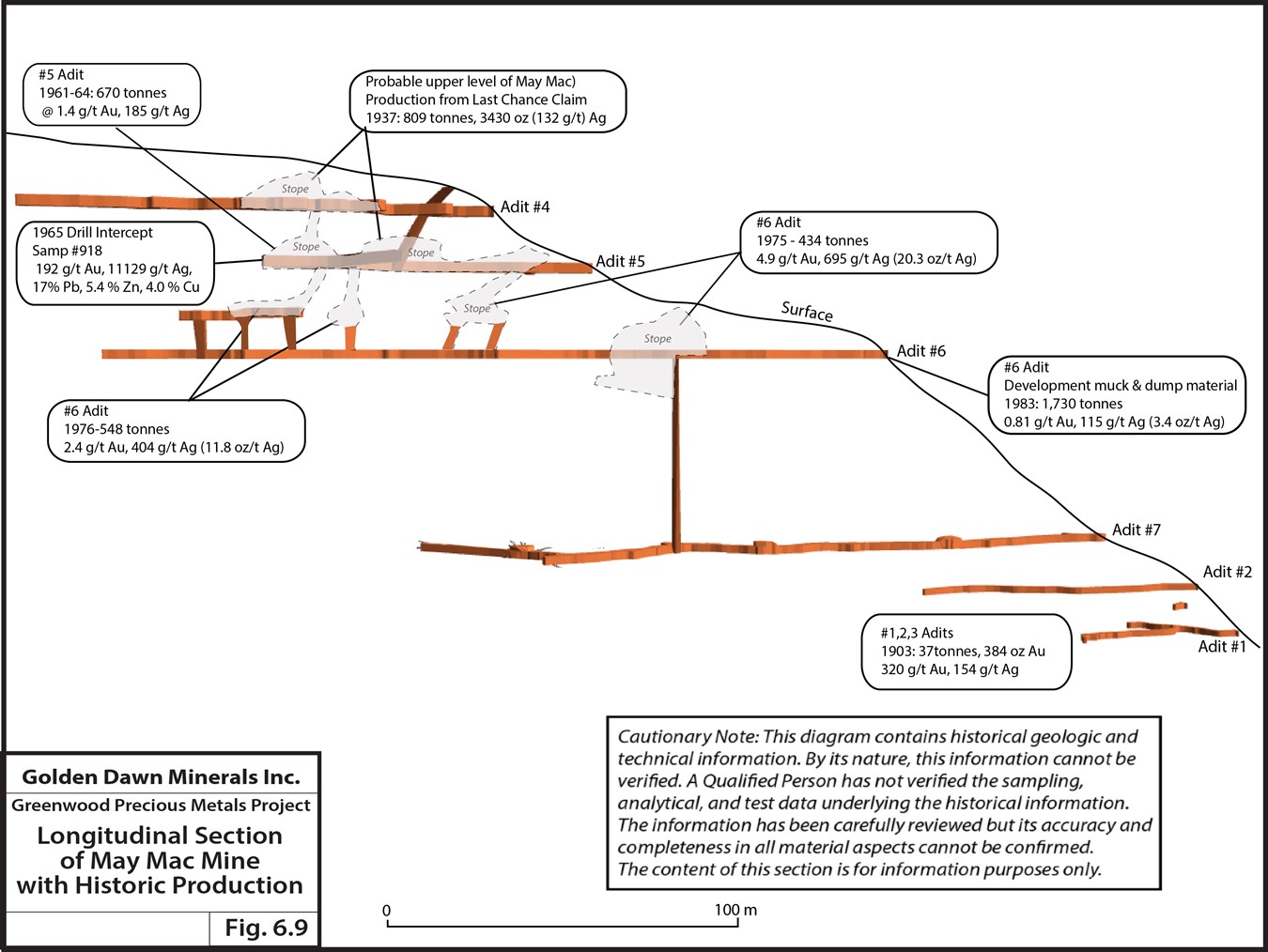

The May Mac (Skomac) mine has been worked intermittently since the original Crown Grant (Nonsuch) was staked in 1887. Initially, two tunnels separated by 23 m vertically (No. 1 lower and No. 2 upper) were driven and a small tonnage was produced from a sub-meter wide quartz vein carrying gold. In 1905 the No. 3 level was driven between the No. 1 and 2 adits for a short distance. Between 1962 and 1983, the 4, 5, 6 and 7 levels were developed at successively lower elevations above the first three levels on the Upper Skomac vein, and mining and milling took place. The figure below is a longitudinal section showing the mine levels and an interpretation of where the production was sourced.

Total production from the mine is estimated at 4,228 tonnes, grading 5.35 grams per tonne gold (0.16 ounce per ton Au), 908 g/t silver (26.5 ounce per ton). The initial production (37.3 tonnes) was from the first two mine levels and records indicate a relatively high grade in gold (9.37 ounce per ton). Production thereafter was from the Upper Skomac vein, which contains polymetallic silver, gold, lead zinc and copper mineralization. Data for lead and zinc are incomplete but 49,462 kg lead and 26,243 kg zinc were reportedly produced up to 1977, giving average calculated grades of 2.0% lead and 1.1% zinc. Production of 894 kg copper in 1983 is also recorded (see note 1).

The No. 7 level followed a weakly mineralized vein initially and then drifted off the vein. In 1987, Empire Gold drilled below the No. 6 Level to test the downward extension of the Upper Skomac vein. Fifteen underground holes totaling 450 m were drilled that showed that the Upper Skomac vein dipped more shallowly than previously interpreted. The resulting interpretation was that the No. 7 level had been driven some 45 m into the footwall of the Upper Skomac vein. In 1994, it was recommended that the No. 7 level be extended to test for the vein at this level.

Golden Dawn Minerals Inc. optioned the property and between 2010 and 2012 compiled data, conducted surface geochemical and geophysical surveys and drilled nine holes. In 2015, a second campaign of surface drilling was done that confirmed the known vein structures in the mine and discovered a lower zone of polymetallic silver-gold mineralization. In 2016 and 2017, a total of 3,833 metres was drilled from underground in 31 holes that confirmed the presence of polymetallic silver-gold mineralization in the upper Skomac and parallel veins above and below the end of the No. 7 Level. Additional surface drilling was done in 2016 (1,300 metres in 12 holes) and 2017 (1,886 m in 8 holes) which showed that the vein system extends at least 215 m beyond the termination of the No. 7 drift.

Based on all the information available, Golden Dawn proposed an exploration target for the May Mac consisting of between 150,000 and 250,000 tonnes with a grade range of 100-200 g/t Ag, 1-2 g/t Au, 1-2% Pb and 1-2% Zn.

The reader is cautioned that the potential quantity and grade of this exploration targets is conceptual in nature; there has been insufficient exploration to define a Mineral Resource and that it is uncertain if further exploration will result in the targets being delineated as a Mineral Resource (see note 1).

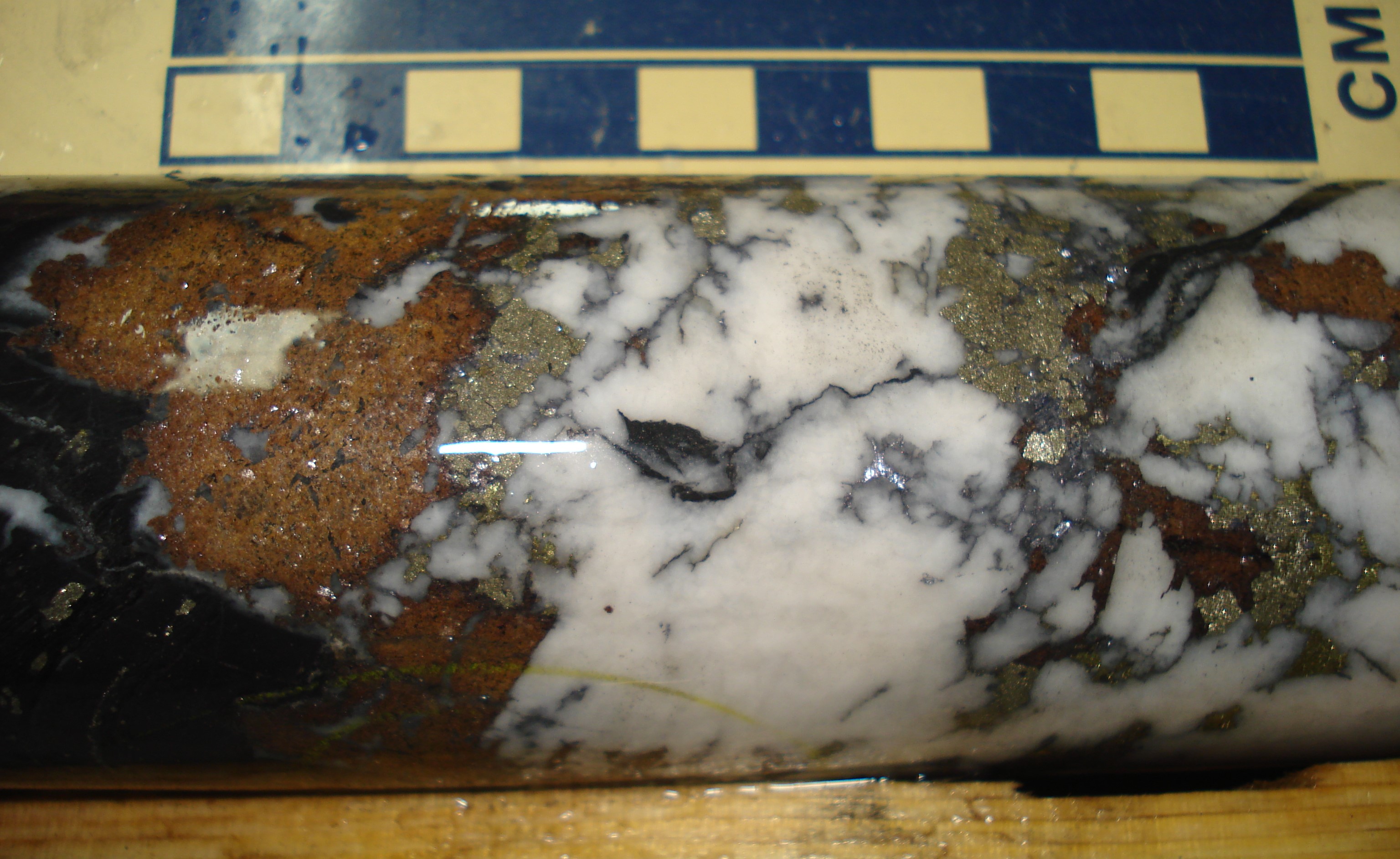

Photo of drill core from May Mac property showing polymetallic silver-gold-lead-zinc mineralization.

Readers are cautioned that historical records referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

Key points of the transaction include:

- 1,000,000 Ximen shares paid to two arm's-length vendors;

- The transaction is subject to TSX Venture Exchange approval.

- The vendors have entered into a voting trust agreement whereby the shares will be voted in favour of management.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar,

604-488-3900,

[email protected]

About Ximen Mining Corp.

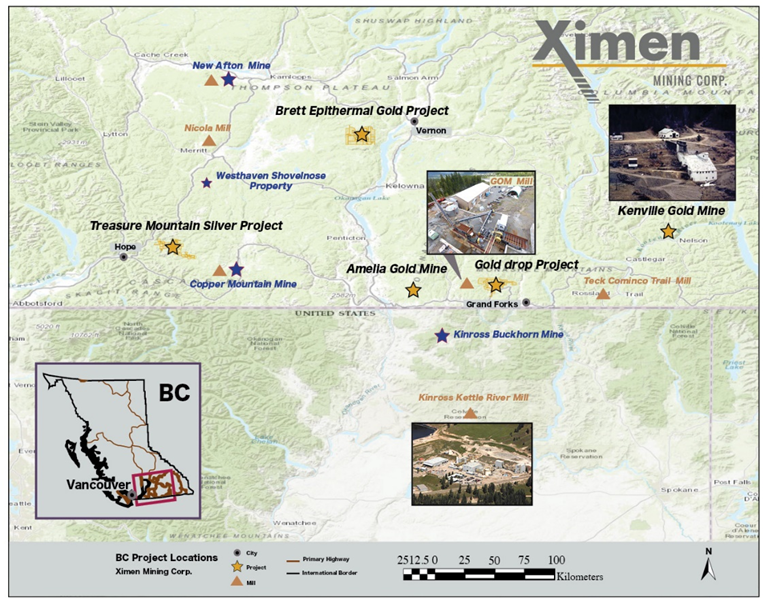

Ximen Mining Corp. owns 100% interest in three of its precious metal projects located in southern BC. Ximen`s two Gold projects The Amelia Gold Mine and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past producing Huldra Silver Mine. Currently, the Treasure Mountain Silver Project is under a option agreement. The option partner is making annual staged cash and stocks payments as well as funding the development of the project. The company has recently acquired control of the Kenville Gold mine near Nelson British Columbia which comes with surface and underground rights, buildings and equipment.

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/595016/Ximen-Acquires-Royalties-for-Key-Properties-in-Greenwood-Camp