You are here

Home Blogs David Chong's blogUpbeat Canadian insiders

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

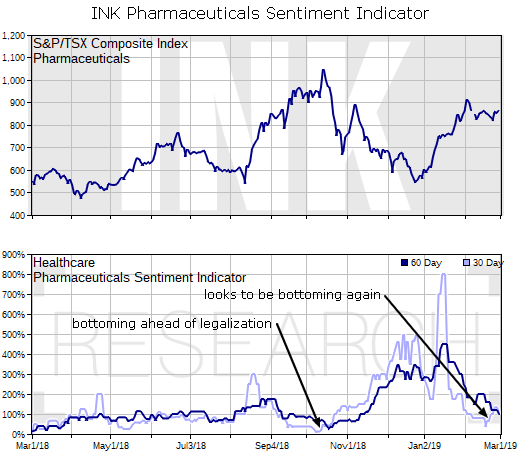

Starting in the second segment of his latest interview with Jim Goddard, INK CEO Ted Dixon gives an overview of the outlook for Canadian stocks drawing on the most recent Insights weekly newsletter. Broadly speaking, insiders remain upbeat about their prospects going forward, particularly in the oil patch where stocks have undergone a correction to reflect commodity pricing troubles.

He does, however, highlight a warning sign.

The cannabis-stock heavy Pharmaceuticals sector may be in store for some headwinds as the INK 30-day sentiment indicator is showing bearish signs. It recently approached the levels seen when it bottomed just prior to legalization back in October. He advises taking some profits and trimming exposure to the group, particularly for those companies with weaker fundamentals and poor INK Edge outlook rankings, including some of the bigger pot growers where potential risks may not have been fully priced in.

In the final segment, he notes that the case for speculators to return to the junior gold space is slowly building. Based on insider trends, he is optimistic for the group's prospects over the next year or two, helped along the way by expanding US government debt issuance.

trace affiliate link | Nike Air Max 270 - Deine Größe bis zu 70% günstiger

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.