You are here

Home Blogs INK Staff's blogHas a fall floor for stocks been built?

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

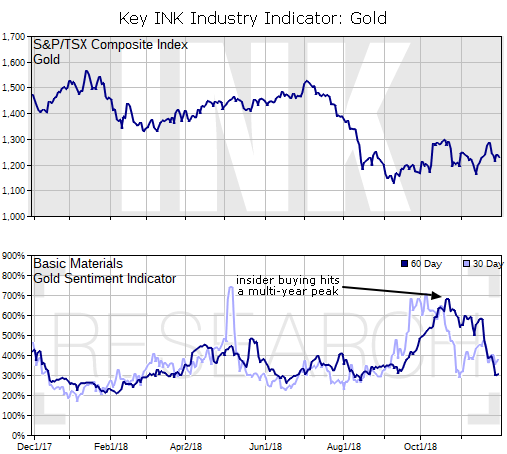

INK CEO Ted Dixon remains skeptical that a meaningful floor has been established for stocks this fall. On the other hand, a bullish set-up for gold stocks is continuing. Those were the key takeaways from his latest interview with Jim Goddard published Thursday night.

As for the broad market, INK is looking for four key signposts to confirm stocks are likely poised to move higher. At this point only is positive, that being value outperforming growth (see the November 7th post, Insiders stop short of signalling a floor is in for US stocks, for reasons why we look at this). Another key signpost that is tentatively suggesting a rally may have legs is the recent outperformance of Financials stocks. However, they stumbled on Thursday, so their continued leadership is not yet baked into the cake.

On the bright side, the situation is shaping up nicely for gold stocks:

We had heavy insider buying in October, the most we have seen since the summer of 2015

Dixon notes that the summer of 2015 coincided with major lows in gold stocks.

He also notes that recent insider buying this fall has preceded some developments which could encourage the Fed to end its interest rate hikes soon, namely rising jobless claims, a potential peak in real interest rates, and falling inflation.

As we have discussed before, gold stocks should benefit once investors start to anticipate an end to monetary tightening in the United States.

The INK CEO also believes tax loss selling will open up potential buying opportunities. Over the next few weeks, INK will be focusing on these situations in its daily morning report which is distributed to INK Research and Canadian Insider Club members.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.