You are here

Home Blogs Ted Dickson's blogThe silver lining in short data

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

Insiders can help make sense of short selling data when it is released in the middle and at the end of every month. There are three general scenarios that can arise. First, if a stock is seeing both short covering and insider buying, we have two positive pieces of information leading to a bullish consensus.

1. Bullish Consensus

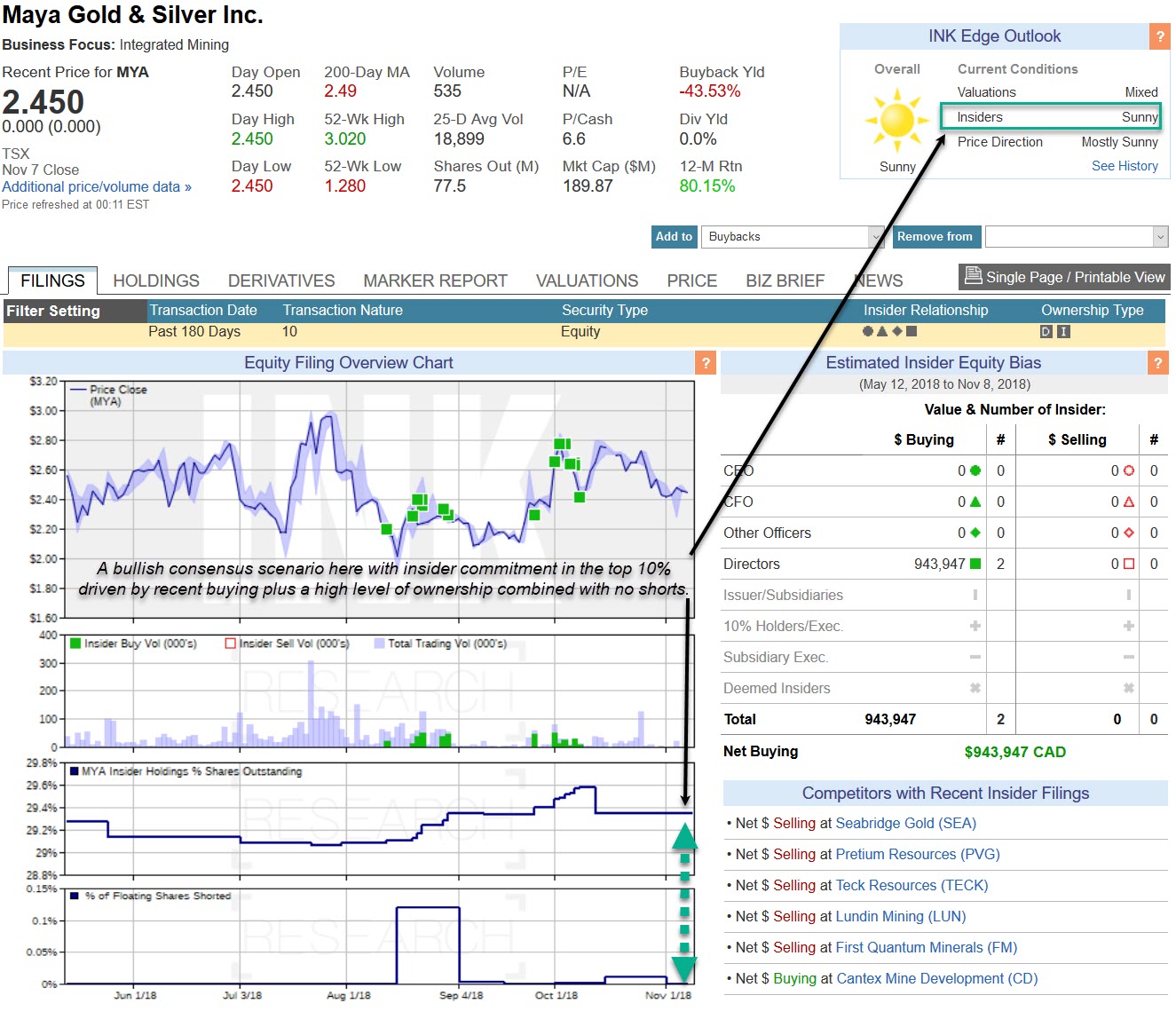

Insiders typically buy when they have a positive outlook about a stock's prospects. If insider buying is taking place as short-sellers are covering, rising insider commitment can serve as confirmation of the positive signal associated with short covering. The relative levels of insider commitment and short selling can also work together. For example, a bullish consensus can take place when insiders are eager to hold onto their shares while at the same time short-sellers show little interest in the stock.

An example of a bullish consensus is found in the latest short data released by the TSX as of the end of October. As we discuss in Wednesday's morning report (available to Canadian Insider Club members), not only does Maya Gold & Silver (Sunny; MYA) have zero short interest, shorts actually threw in the towel at the end of the month. Meanwhile, insider commitment is strong thanks to a high amount of insider ownership and recent buying.

INK site users can often spot an indication of bullish consensus when the there is a divergence between the line in the Insider holdings as a percent of shares outstanding chart and the line in the percent of float shares shorted.

2. Bearish Consensus

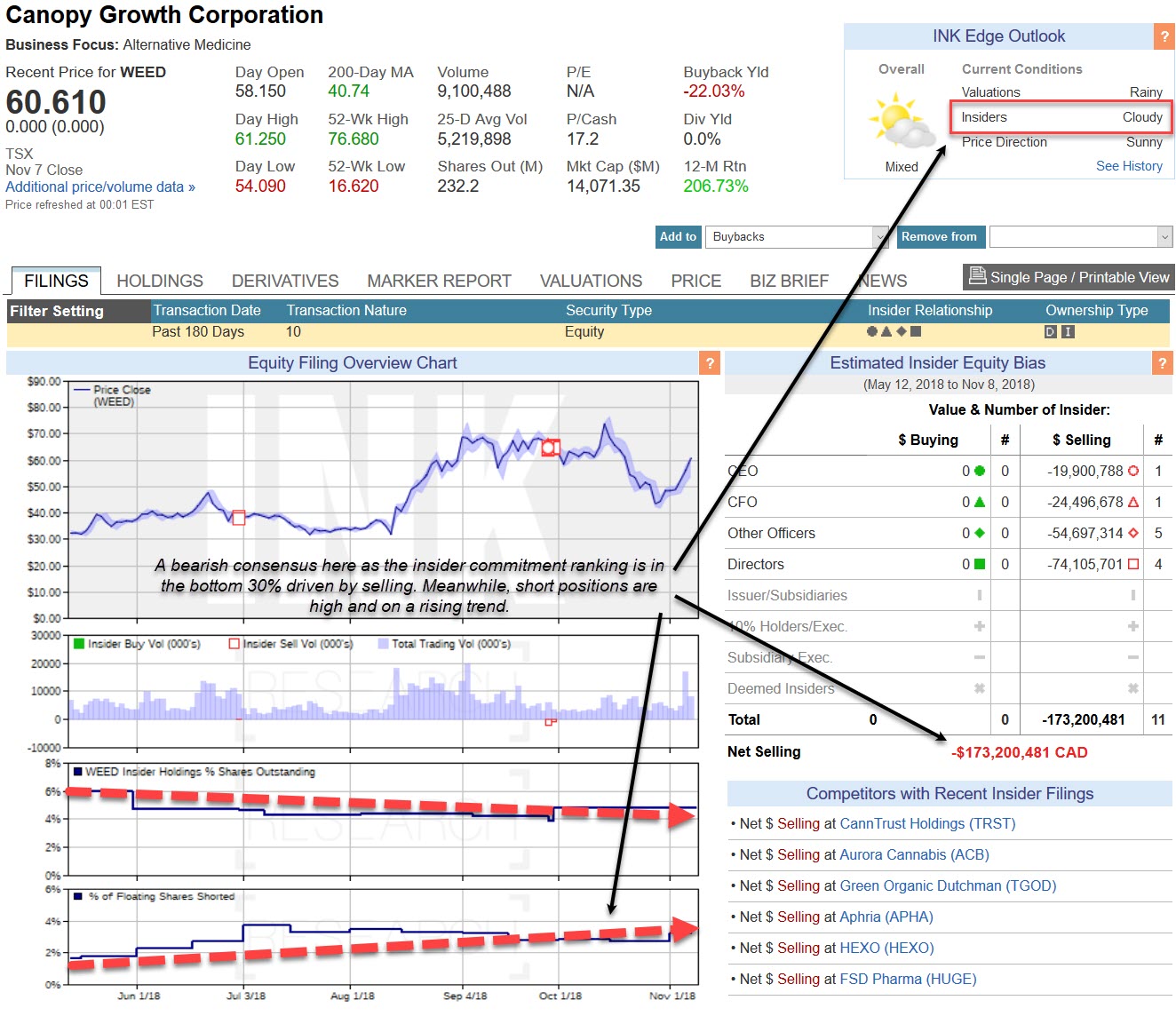

A bearish consensus occurs when short levels are relatively high and insider commitment levels are relatively low. Canopy Growth (Mixed; WEED) provides a good example of a bearish consensus. Short interest is high and growing and the relatively low level of officer and director insider commitment as measured by our INK Edge rankings system supports the bearish case. Indeed, while the overall outlook for the stock is mixed based all three V.I.P INK Edge measures of value, insider commitment and price momentum, the high level of short interest may increase the odds of the stock underperforming

INK site users can spot the bearish consensus when the there is a convergence between the line in the Insider holdings as a percent of shares outstanding chart and the line in the percent of float share shorted.

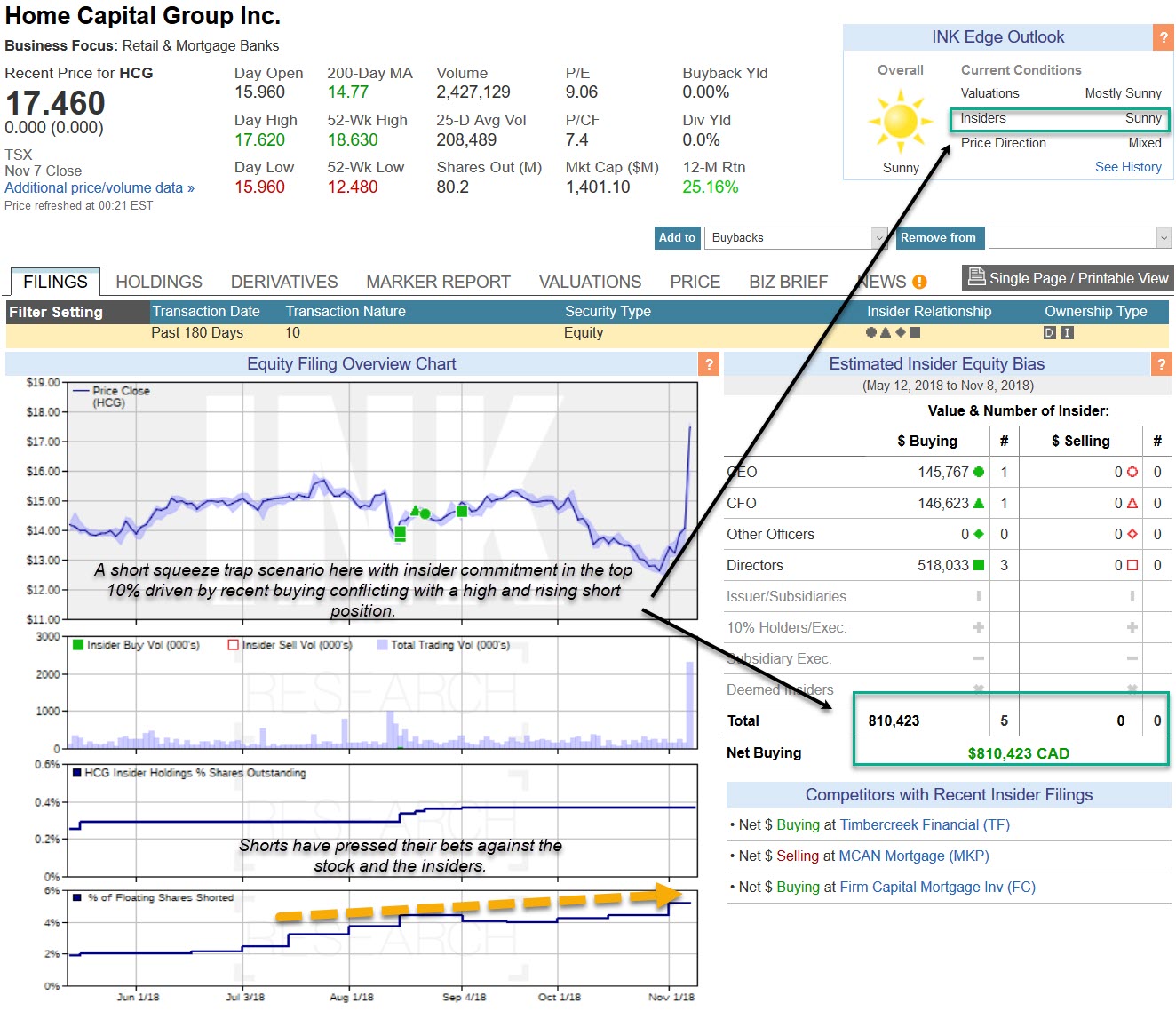

3. Short Squeeze Trap

A short squeeze trap is the third scenario we come across with short data. This happens when short levels are high or growing significantly in a stock that has high levels of insider commitment. Home Capital Group (Sunny; HCG) is a great example. The stock surged 24% on Wednesday when it released Q3 results. A high short position in the stock likely contributed to the surge as short sellers were squeezed on the positive news. As we wrote in our Morning report of August 27th, shorts were betting against the insiders at Home Capital. In fact, the company ranks in the top 10% in terms of insider commitment.

INK site users can spot a potential short trap scenario when officer and director holding levels are high and possibly rising at the same time as the short level is high and rising. Shorting a stock can be a risky proposition at the best of times and shorting one with a high level of insider commitment is even riskier. Conviction levels should be very high before entering into such a short position.

While INK outlook categories are designed to identify groups of stocks that have the potential to out- or under-perform the market, any individual stock could surprise on the up or downside. As such, this report is not meant to be a stock-specific recommendation. Disclosure: I hold a position in Maya Gold & Silver. This article first appeared on the INK Research website.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.