You are here

Home Blogs Nicholas Winton's blogINK Canadian Insider Index surges 1.7% to new all-time highs!

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

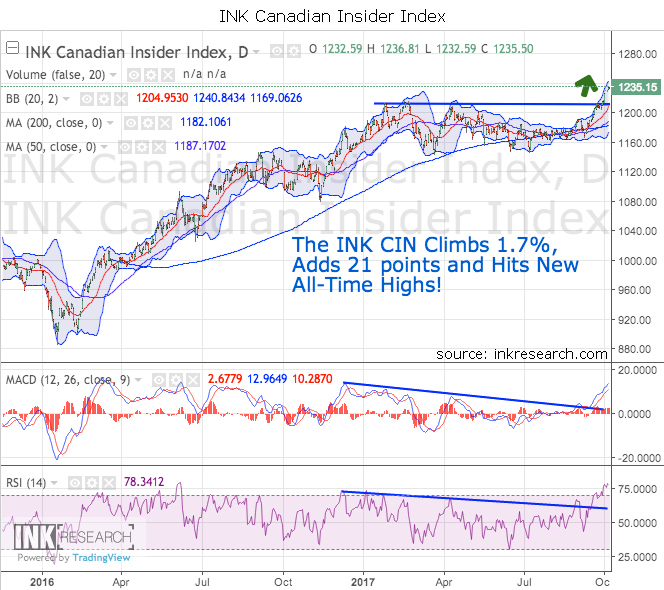

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the Index continued to bubble higher still, rising 21 points or 1.7% to close at 1235.14, a mere 0.36 points below its all-time closing high achieved on Thursday.

Our short-term momentum indicator, RSI, remains in the hot zone and rose almost 8 points to 77.85. Our long-term momentum indicator, MACD, rose 45% from 1.75 to 2.53. Importantly, the MACD slow and fast lines continue their bullish, higher trending action and have now moved above the key 10 level with the fast line closing at 13.38.

Strong support sits in the 1210-1215 region and 1200 below. Resistance is at 1235 and 1240 above. The Index is performing very bullishly, and the technicals are now reflecting this. Given that RSI is in overbought territory and at its highest level in nearly 18 months, we could see the Index resting and consolidating some of its recent gains before continuing to move higher. However, it's worth noting that in bull markets, commodities, stocks, and ETFs can remain heavily overbought for long periods.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.