You are here

Home Blogs Nicholas Winton's blogCobalt's new highs and M&A: Do they point to an energy metals opportunity?

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

A brief uranium note before we start this blog: a couple of weeks ago, I pondered whether uranium was oversold enough for a big rally. Since then, we've seen some positive signs. First, Uranium Participation (U) the tracking stock for the price of uranium climbed to a 3-week high. And Cameco (CCO) the world's largest uranium producer looks to be carving a bottom and has held its ground in the $12 area for about 2 weeks. As well, Nexgen (NXE) shares have made an impressive U-turn in the past few days. But we don't have an all-clear signal just yet. That's because the uranium sector needs Cameco to take the sector lead (and cross above its 200-day average) ahead of any uranium sector rally, so it's a stock worth watching closely. Finally, junior producer Uranium Energy Corp (UEC*US) which I wrote about in that blog, received confirmation this week that they will be added to the Russell 3000 Index later this month (as well as either the Russell 2000 or Russell 1000).

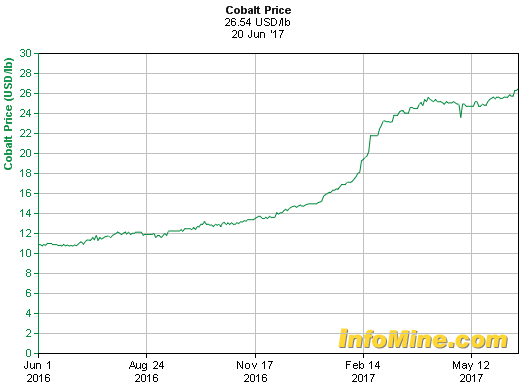

By early 2016, many of the world's largest corporations decided to stop sourcing cobalt from Congo's child mining operations- shutting the door on 50-60% of the world's cobalt supply. Since then, cobalt which is used in electric car batteries (more cobalt goes into a battery than lithium) has soared from $10 per pound to over $26 per pound as additional corporations and automakers have pledged not to use slavery-derived cobalt. What's more, we're even seeing reports of hedge funds buying up quantities of this metal which is in tight supply. Not surprisingly, a number of Canadian resource companies have turned their sights toward the rocketing metal. Cobalt stocks have recently had a sharp pullback- perhaps in sympathy with weak energy prices or even the struggling mining sector. But given that the price of cobalt has now made fresh 18 month highs, a number of these cobalt stocks offer excellent upside. Particularly as there are no cobalt or cobalt stock ETFs that investors can buy to participate in this bull market.

First Cobalt (FCC) is small enough at a market cap of just over $30 million that the company provides investors great leverage. Co-founder Robert Cross is an extremely successful executive in the resource sector and is currently chairman of B2Gold (BTG*US). Their big news is their 50% acquisition of a refinery 25 kilometres from their Keeley-Frontier silver-cobalt project in Cobalt, Ontario. The past-producer yielded over 3.3 million pounds of cobalt and 19.1 million ounces of silver from 1908 to 1965. Insiders have added 210,000 shares since May and while insiders own just 3.5% of its shares, company insiders have increased their overall holdings by 25% in the last year. Late-breaking Update: First Cobalt has just made an offer to take over CobalTech Mining (CSK), as it has found many synergies with the much smaller cobalt company (which owns a number of cobalt and silver properties) and would benefit from CobalTech's mill. Before the release of this news today, both stocks were halted and after trading resumed, both stocks shot higher.

King's Bay Gold (KBG) is another cobalt play I'm watching. Interestingly, as many mining discoveries are made by chance, their flagship Lynx Lake property in Labrador which features cobalt and high-grade copper, was discovered after highway construction revealed mineralization in the bedrock. The company notes it has three other cobalt projects in Quebec, two of which had exploration undertaken by Falconbridge Ltd in 2000-2001. King's Bay CEO Kevin Bottomley, David Hodge and Zimtu Capital have all been buyers since April between 10 and 15 cents. Insiders have been net buyers of nearly $270,000 in stock over the past year. Holdings among all insiders increased 17% in the last year, primarily from purchases by Zimtu Capital which owns 17%. It netted a double for our High Roller microcap members earlier this year when we bought shares around 8 cents.

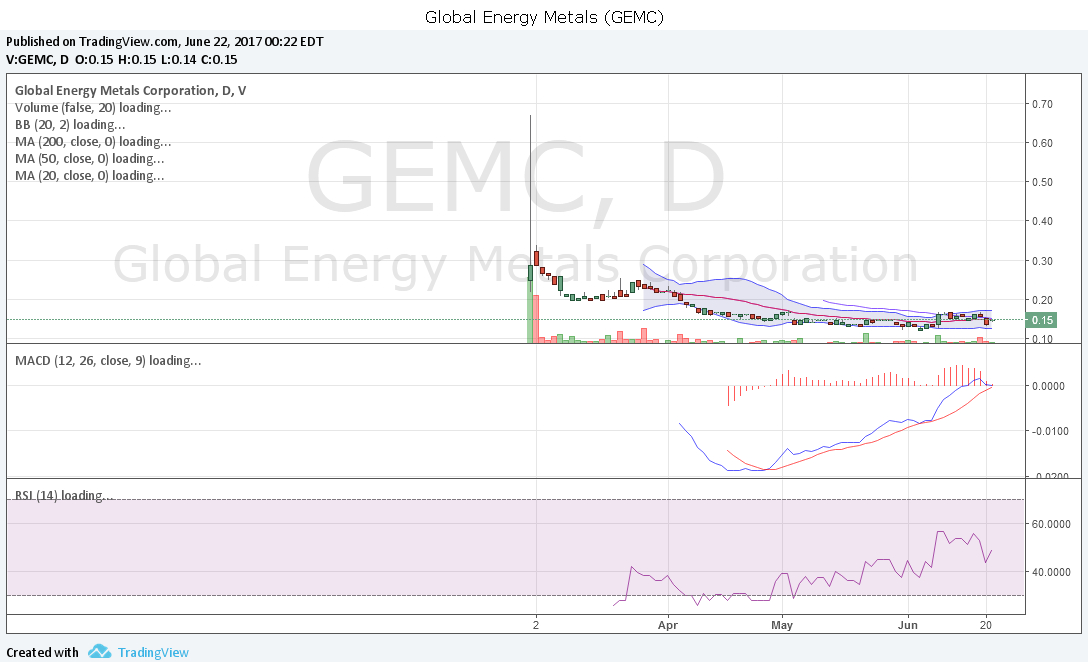

A third smaller, highly leveraged cobalt speculation that I'm following with great interest is Global Energy Metals (GEMC). With a market cap of just $5M, it is unusual to see the depth of management experience the company has assembled. CEO Mitchell Smith has held senior positions at Global Cobalt Corp, International Barytex Resources and Petaquilla Copper Ltd and importantly, has negotiated off-take agreements for cobalt and negotiated with Chinese battery manufacturer companies.

Executive Chairperson and director Erin Chutter, is the founder of Puget Ventures and a former officer of Global Cobalt. Chutter has previously consulted for Mag Silver and West Timmins Mining and also has experience negotiating off-take agreements and making deals with battery makers. Director Ray Castelli, is the CEO of Weatherhaven, a key supplier of redeployable camps and shelter systems to Canada, the US, Australia and NATO.

Mr. Castelli was also co-founder and Senior Vice President of Quadrem, a global supply chain and e-procurement company, serving 19 of the world's largest natural resource companies including Rio Tinto, BHP Billiton, Alcan and Inco. Beyond the vast experience of its insiders, the company also has in place a strategic cooperation agreement with Beijing Easpring Material Technology Co., a leading battery manufacturing company, to jointly invest in and develop cobalt projects. Global Energy Metals owns and is advancing the Werner Lake Cobalt Mine in Ontario and has an earn-in agreement on the Milennium Cobalt Project in Mt. Isa, Australia. Insiders own 25% of the stock and have bought over $2 million worth of shares in the last year, mostly at higher prices. In fact, Chutter bought over 5.3 million shares on August 26th alone at a price of 25 cents and is the top holder with a 21.55% share or 7.6 million shares. Insiders have increased their holdings 41% overall in the last year. One very interesting and potentially bullish technical observation is that both RSI and MACD are climbing even as price bases in the 15-16 cent range. Might these indications foreshadow a breakout? We'll soon see.

With the steep drop in energy prices this month (I was wrong about expecting an upturn) acting like a bit of a wet blanket to energy sub-sectors like lithium, uranium, and cobalt, we may need to see these cobalt stocks base a bit longer before they set out on their next big advance.

With that said, perhaps the fact the price of cobalt made a brand new two-year-high on the day we received M&A activity between CobalTech and First Cobalt is a sign cobalt miners are sufficiently undervalued and investors might begin take a look at opportunities within the sector.

Author owns shares in Global Energy Metals and Uranium Energy Corp.

Follow me on Twitter at http://www.twitter.com/HedgehogTrader for more discussion of cobalt, uranium and other individual stock ideas.

Tags:

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.