You are here

Home Blogs Nicholas Winton's blogWill uranium stocks continue their molten melt-up?

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

This week, we look back at past stock ideas from my November blog on what was a hated, unpopular and out of favour sector, uranium.

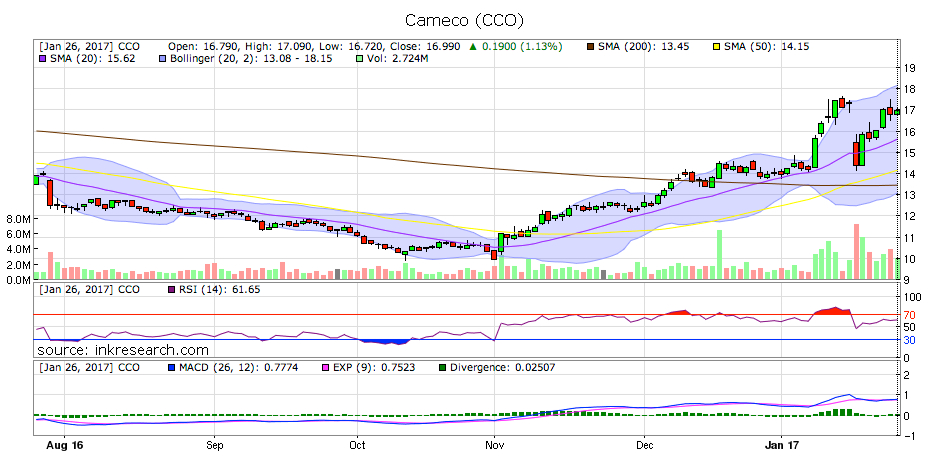

On Nov 17th, my blog noted the striking divergence between a nascent four-week uptrend in Cameco (CCO) and the rapidly plunging price of uranium. Uranium had plunged to $18.75 per pound; yet its downward spike looked unsustainable, as many uranium producers need to sell above $60 to generate profit. My inkling that Cameco's strength, coupled with bullish insider activity was a bottom signal for the energy metal proved correct. At the time, Cameco was trading at about $12 per share, since then Cameco, the world's largest uranium producer, soared $5 to $17.03 for a 42% gain.

Importantly, on January 15th, the major uranium producing nation of Kazakhstan announced uranium production cuts of 10%, reinforcing the idea that extreme low uranium prices would force producers to respond by slashing output. Once again, several days later, the industry giant Cameco itself announced both production cuts and layoffs. Each announcement sent the price of uranium higher, along with the universe of uranium stocks.

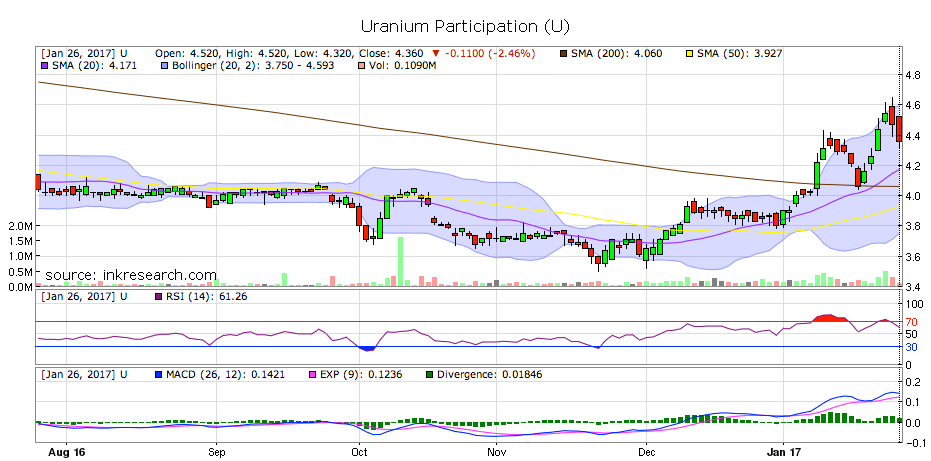

The price of uranium has now recovered to $22.50 for a 20% gain. Uranium Participation (U) serves as a uranium price tracking stock, as it holds physical uranium and has risen from $3.80 where we noted it was basing and has risen to $4.54 for a gain of 19%.

In the November blog, I also shared two other Canadian-listed uranium stock ideas, Energy Fuels (EFR) and Skyharbour Ventures (SYH).

Explorer Skyharbour, which has seen Denison Mines (DML) take a big position and become a JV partner, has been a huge winner for my HHT Newsletter subscribers, more than tripling from our entry price. But even since our November INK blog, shares have been a terrific performer, moving up from $0.315 to $0.44 for a 40% gain.

The CEO Jordan Trimble has been a regular buyer of shares since mid-August and has purchased $50,000 worth of shares this year.

And with a chart that looks ready to go parabolic, shares look ripe for further gains.

At the time of our blog, Energy Fuels was fresh off the discovery of 30% copper at its lowest cost uranium mine and we noted that copper's rapidly increasing price would help boost their profitability even more and provide a nice extra tailwind for the stock. The stock was trading at $1.90 at the time (also where our newsletter alerted subscribers to buy shares). Since then copper has continued to soar, alongside uranium's rally. Not surprisingly, Energy Fuels has gone super-nova, rising $1.29 per share to $3.29 or 69%.

As I've written before on my blogs and INK CIN chart reviews, I am forecasting the current general market and commodity melt-up to continue, so I like accumulating both these stocks.

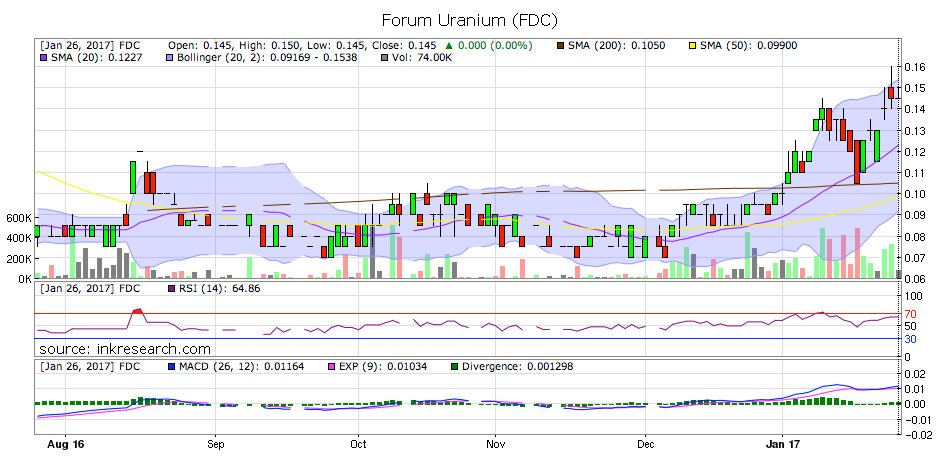

Another interesting uranium play I'd like to introduce here is Forum Uranium (FDC).

With a market cap of about $13 million, they have 5 well-located, near surface deposits in the Athabasca region of Saskatchewan.

What's more, Forum can boast several big-name JV project partners, including Areva (ARVCF), Rio Tinto (RIO*US), Nexgen (NXE), and Cameco. Projects include: Fir Island (100% Forum); Henday (60% Rio Tinto, 40% Forum); Key Lake Area Projects (100% Forum); Clearwater (51% Option to Uracan (URC)); Maurice Point (100% Forum); & Northwest Athabasca Joint Venture (39.25% Forum, 28.25% NexGen, 20% Cameco, and 12.5% Areva).

One exciting project they are working on this year, Henday, has funding to the tune of $20M by Rio Tinto (which is 60% owner). The project is in the same area as large uranium deposits held by other companies, totalling over 350 million pounds, including: Roughrider, Rabbit Lake, Dawn Lake, Eagle Point, Collins Bay, Sue A, C, and E, as well as Midwest and Midwest A.

It's also very bullish that CEO Richard Mazur and director Haughom bought a combined $92,000 worth of shares and warrants on January 13, and there have been no sales in the last year.

Our signals are very bullish on the stock and shares have already begun to break out.

Continue to watch the US broad market, such as the S&P 500 SPDR (SPY*US). As US markets continue to make new highs, I am looking for speculation in uranium and other sectors to increase.

For those who are interested, the Hedgehog Trader Newsletter and my microcap newsletter, High Roller, feature excellent speculations (including small producers) in uranium and other resources. To join either of our publications, visit http://www.gohht.com/products.php and follow me on Twitter at http://www.twitter.com/HedgehogTrader where I often post stock ideas, commentary and of course, predictions.

This article appeared on INKResearch.com before the market open on January 27, 2017.

Nike footwear | Air Jordan Release Dates 2021 + 2022 Updated , Ietp

Tags:

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.