You are here

Home Blogs James Kwantes's blogEx-politician rings the Bell for Dominion Diamond

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

Brendan Bell, the acting CEO of Dominion Diamond (DDC), took an unconventional route to the C-suite.

Neither a geologist nor an investment banker, Bell was a cabinet minister in the Northwest Territories before joining the northern diamond producer in July 2013.

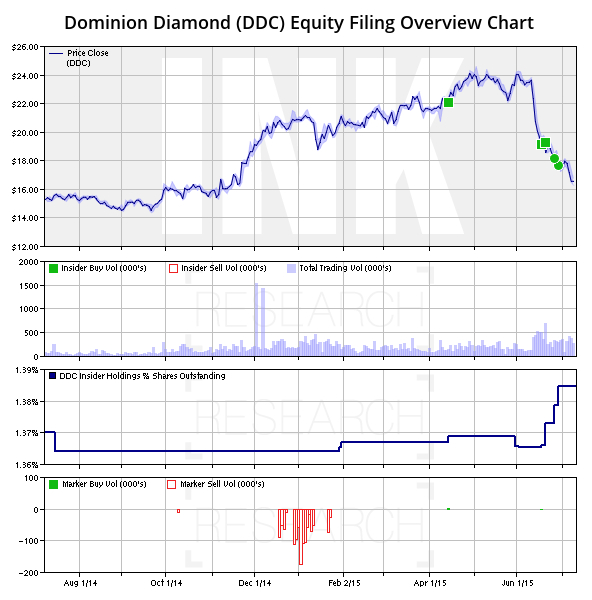

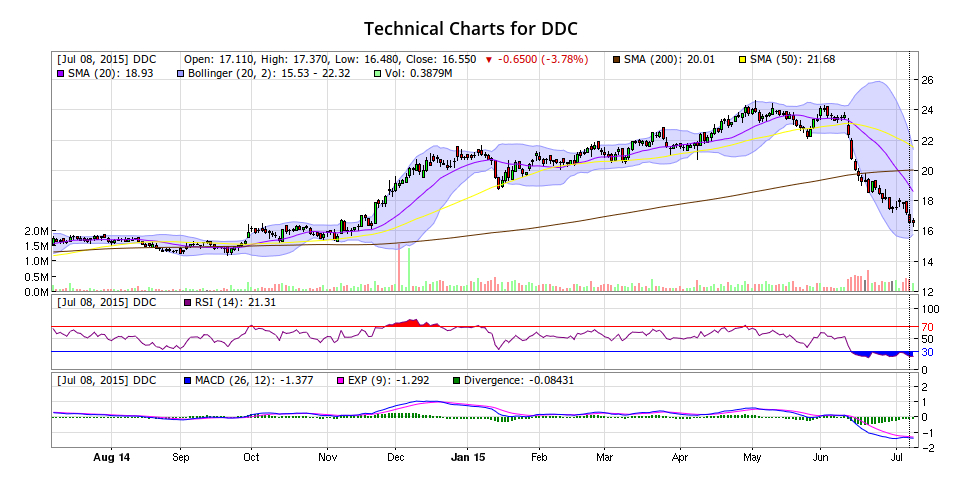

As the company's stock has plummeted recently, Bell has been buying. He purchased 5,000 shares at $18.14 on June 25, following that up with another 5,000-share buy four days later at $17.65.

Dominion Diamond is a successor company to Aber Resources, which discovered the Diavik diamond mine, Canada's second. It owns 40% of Diavik (Rio Tinto owns 60% and is the operator) as well as 88.9% of Ekati, following the purchase last year of discoverer Chuck Fipke's 10% stake. Both mines are in the Northwest Territories.

Despite positive longterm supply/demand dynamics, these are tough times to be a diamond producer. China's economic slowdown has put a damper on investor demand for the shares of companies providing luxury goods. Global rough diamond prices have also slid about 10% on average in the past year, according to an index at PaulZimnisky.com. In Dominion's case, some company-specific news announced along with the most recent financials didn't help either.

On June 10, Dominion announced sales of $187.7 million for the first quarter of fiscal 2016 ending April 30, up from $175.5 million a year earlier. But EBITDA, earnings per share and gross margins dropped, and Dominion also lowered 2016 full-year production guidance at Ekati. The mine is now expected to yield 3 million carats, down from 3.3 million carats, as the company prepares to mine the higher-grade Misery open-pit expansion. The stock has since fallen about 30%. It is currently the worst performing stock in the INK Canadian Insider Index since the semi-annual rebalancing on May 15.

Bell, 43, took over the top job in November 2014 on an acting basis, when Dominion announced that longtime chairman and CEO Bob Gannicott would take a medical leave of absence "to undergo important treatment." Monday, the company announced that Gannicott is returning from medical leave to resume duties as chairman of the board immediately on a non-executive basis while Bell will be appointed CEO as of July 31st.

When tapped for the top job, Bell was Dominion's executive vice-president, community affairs - a post he continues to hold. Prior to that, Bell ran a northern consultancy group specializing in the non-renewable resource industry after exiting politics in 2008.

As a politician, Bell served 8 years in the NWT legislature - holding cabinet portfolios including energy and mines, environment and justice/attorney general - before running as a federal Conservative candidate in the 2008 election and narrowly losing to the NDP incumbent. Bell was also chairman of the NWT Power Corporation from 2010 until he resigned on March 1 of this year.

Bell, a University of Calgary grad (Commerce), is not the only former politician with a Dominion diamond sparkle in his eye. Former Conservative cabinet minister Chuck Strahl has been a Dominion director since November 2012 and he recently picked up some shares as well. On June 17, Strahl purchased 498 shares at $19.16, a $9,500 transaction.

On June 19, director Manuel "Ollie" Oliveira, a former De Beers executive and an Antofagasta director, bought 6,000 shares at $15.72 US.

Dominion shares retain a mostly sunny INK Edge outlook on the strength of insider ownership levels and valuations. Dominion recently instituted a 40-cent annual dividend, with the stock's drop pushing its yield up to 3%.

Gannicott remains a large shareholder - he owns 1,114,050 shares, a 1.3% stake worth more than $18 million, as well as 2.2 million options.

Brendan Bell's Insider Holdings Allocation - July 10, 2015

This blog post was originally published on INKResearch.com for paying subscribers on Friday July 10, 2015.

Tags:

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.