You are here

Home Blogs Nicholas Winton's blogAs we review, here's looking at U

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

In this blog we're going to look back at a few stock ideas we've presented over recent months - and give our view on how they look going forward.

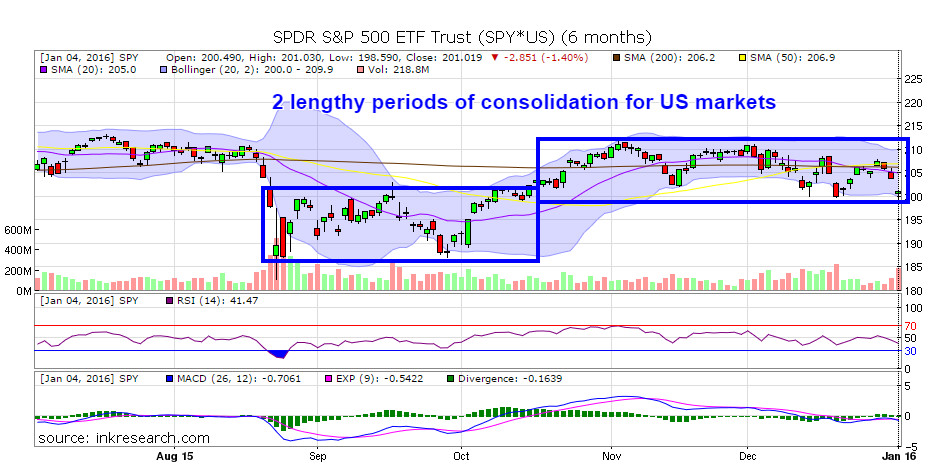

We should first start by saying that the view we shared in late summer was that the US market (a great influence on our Canadian markets) would rise during fall of last year. In reality, the US market and many world markets, after making a sharp correction in August, have rebounded and moved sideways for months. The inability of markets to make headway, along with the great amount of volatility, have fed into investor fear and dampened sentiment, creating conditions that may very well allow markets to surprise to the upside.

Backing up that view is the chart of the SPDR S&P 500 ETF Trust (SPY*US) where you can see that momentum indicators RSI and MACD gradually trending higher since the summer lows.

Back in April, we commented that microcap stocks as shown by the Russell Microcap Index (IWC*US) were outperforming- and the index went on to rise 3% higher in May but ended up breaking down subsequently. Looking back, we can see the microcaps began to correct in early to mid-May, before the US broad market began its own downturn in July and August. It's worthwhile watching the next few weeks to see if the Russell Microcap Index begins outperforming the US broad market represented here by the SPDR S&P 500 ETF Trust as small cap outperformance may give us an early indication the US market is ready to move forward.

We often trade and track stocks in the resource sector because of their volatility - and as we've written over the past 6 months, some of our favourites continue to see insider buying.

One of my favourite long-term speculations remains Fission Uranium Corp (FCU) and this view was recently re-affirmed when Fission became the first ever Canadian uranium company to receive an investment from China - a nation that is building 21 of the 64 nuclear reactors currently under construction worldwide. The buyer, CGN Mining, made an $82M investment at 85 cents per share, at a nice premium to Fission's sub-70 cent share price at the time. Given the world class nature of their assets, it's not surprising that multiple insiders have been frequent buyers over the past several years. Indeed, four different insiders have bought a total 325,000 shares in December. Shares are off their highs like most energy stocks, but shares have outperformed most energy stocks over the few weeks and are close to regaining their 200 day moving average, which was lost this summer.

Another junior speculation I like in the uranium sector is Uranium Energy Corp (UEC*US) which has seen 10 different insiders buy shares since May, including Scott Melbye who bought 20,000 shares last week. They are actually a current producer that is marginally profitable at current $35/lb uranium. The key here is their ability to scale up production to 5 million lbs/year and enjoy exponential profits if and when uranium prices begin to rise once again. Our Hedgehog Trader Newsletter opened a new long position in Uranium Energy Corp in late December in the 90 cent range. The rise and increase in both volume and relative strength (to 61) over the past week or so seems to confirm the bullish outlook suggested by our proprietary Alpha Signals.

And of course, you can't talk about uranium stocks without looking at Cameco (CCO) the world's largest producer. And what's impressive about this dividend paying uranium producer is that we continue to see insider buying and no insider sales in many months. On the buy side, officer George Assie purchased 3,300 shares in August and September. Shares looked to be under accumulation in December - which included a 2 million volume day, and more recently, shares have staged a reversal to close above its 20 day moving average. They too have been moving sideways for months, and in a tight range since mid-November.

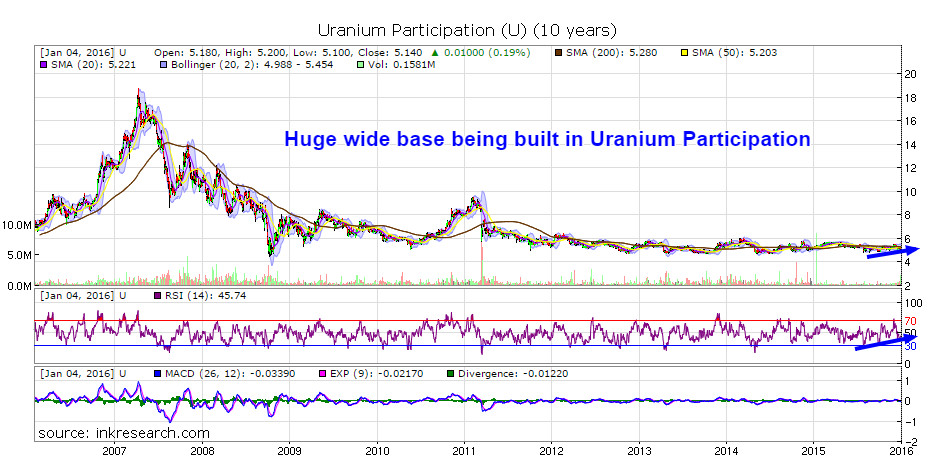

While the price of oil has been decimated over the past 2 years, sinking from over $100 per barrel to just over $30 per barrel- the price of uranium has stabilized and built a long, strong sideways base. Not surprisingly, the major, decade-long base being built in the chart of Uranium Participation (U) (which tracks the price of uranium) appears very compelling going forward.

What's also worth noting is that Uranium Participation, which is backed by physical uranium, saw its biggest volume day in in nearly a year last week, with over 2.7 million shares traded. We also like that Uranium Participation has bought back over 375,000 shares since October and that officer Thomas Hayslett bought 5,000 shares at $3.83-3.85 in November.

The uranium patch is a sector worth watching, due to the relative strength of the underlying commodity and positive insider activity- as well as the fact China has begun taking a greater interest in North American uranium assets. And it's worth remembering that typically the longer the base of a stock or commoditiy, the more powerful its breakout, once it does finally break free.

This article originally appeared on INK Research before the market open on January 7, 2016.

Sports Shoes | adidas Campus 80s South Park Towelie - GZ9177

Tags:

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.