Two thirds of Canadian business owners negatively impacted by COVID-19, most say area businesses are in crisis mode: CIBC Poll

Two thirds of Canadian business owners negatively impacted by COVID-19, most say area businesses are in crisis mode: CIBC Poll

Canada NewsWire

TORONTO, Nov. 24, 2020

Despite pressures, business owners' optimistic they will rebound as the pandemic eases

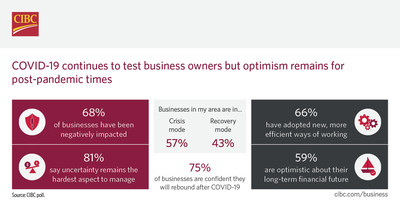

TORONTO, Nov. 24, 2020 /CNW/ - A new CIBC study finds that two-thirds (68 per cent) of Canadian business owners continue to feel the negative impacts of COVID-19, with more than half (57 per cent) believing businesses in their area are in crisis mode and 43 per cent believing businesses are in recovery mode. Top concerns are a reduced demand for their products and services (37 per cent) and worries about the overall viability of operations (23 per cent). Despite this, the majority (75 per cent) of business owners remain optimistic they will rebound once the pandemic subsides.

"During these challenging times, Canadian business owners have shown incredible resilience by staying focused on fundamentals and being very nimble and creative," said Laura Dottori-Attanasio, Group Head, Personal and Business Banking, CIBC. "Our team is engaged with business owners across the country every day. With so many feeling immediate pressures on revenues, we encourage owners to get advice about their overall financial situation including cash flow management and help managing debt levels. Whether business owners are facing challenges, or have an opportunity to capitalize on, we have the tools, advice and the team to help provide a path forward."

Business Owners Going Virtual, Slashing Costs

Business owners have employed several strategies to continue operating. A third (30 per cent) have increased their virtual presence while a further 16 per cent pivoted their business to operate completely online.

To support cash flow, 56 per cent have used at least one government program this year, and to limit costs, 35 per cent are reducing operating expenses while 28 per cent have cut employee hours. Half (52 per cent) say they are counting on government support to survive.

Close to a third (29 per cent) expect it will take between a year or two for things to get back to normal, with the majority (81 per cent) agreeing the uncertainty of the current environment remains the hardest aspect to manage.

"Canadians have the opportunity to support their local businesses in the coming weeks as we head into the holiday season and I hope we see friends and neighbours rally around their local communities to help make a difference," added Ms. Dottori-Attanasio.

Other poll findings:

- 72 per cent of business owners say their present stress level is much higher than it was prior to the pandemic

- 57 per cent are looking to build the digital capabilities of their business

- 45 per cent are looking to reduce their debt levels, while 41 per cent are seeking more credit to help with operating capital and 40 per cent are seeking advice to better manage cash flow

To help business owners manage through this challenging environment, CIBC has launched Biz Hub, a new online resource dedicated to key topics including cash flow management, taxes, business recovery, how to build and expand digital capabilities and more.

Disclaimer

From November 4th to November 9th 2020 an online survey of 1,020 Canadian Small Business Owners who are Maru Voice Business Canada panelists was executed by Maru/Blue. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 3.1%, 19 times out of 20. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading North American financial institution with 10 million personal banking, business, public sector and institutional clients. Across Personal and Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada with offices in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/en/about-cibc/media-centre.html.

SOURCE CIBC

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2020/24/c1507.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2020/24/c1507.html