Superior Gold Inc. Announces Five Year Guidance for Plutonic Underground Gold Mine and Third Quarter Production Results for Plutonic Gold Operations

Superior Gold Inc. Announces Five Year Guidance for Plutonic Underground Gold Mine and Third Quarter Production Results for Plutonic Gold Operations

Canada NewsWire

TORONTO, Oct. 23, 2019

(In US Dollars unless otherwise stated)

TORONTO, Oct. 23, 2019 /CNW/ - Superior Gold Inc. ("Superior Gold" or the "Company") (TSXV:SGI) today announced its five year guidance for the Company's 100%-owned Plutonic underground gold mine, located in Western Australia, together with the third quarter production results for the Plutonic Gold Operations. Superior Gold remains focused on establishing the Plutonic Gold Operations as a producer capable of delivering at least 100,000 ounces of gold annually. This five year guidance provides the platform to deliver on this goal.

Highlights of the Five Year Underground Guidance:

- Annual underground gold production of 70,000 – 85,000 ounces

- All-in Sustaining Cash Cost ("AISC") averaging less than $1,100/oz over the five year plan which demonstrates robust margins in excess of $375/oz at current gold prices

- Does not include open pit production from Hermes, Hermes South or other potential Plutonic open pit operations which represent potential upside to the annual production rate

Chris Bradbrook, President and CEO of Superior Gold stated: "We are pleased to provide this five year guidance for the underground operations at our Plutonic Gold Mine. The plan is the result of detailed analysis and work completed since we appointed our Chief Operating Officer, Keith Boyle, on April 1, 2019. The goals of this work have been as follows:

- Deliver a realistic and sustainable plan

- Return to the operating performance previously demonstrated which generated significant free cash flow

- Maximize the benefits of the record high Australian dollar gold price"

Keith Boyle, stated: "In developing this plan, we focused on reaching a number of key goals as highlighted above which are aimed at optimizing performance from the Plutonic underground gold mine.

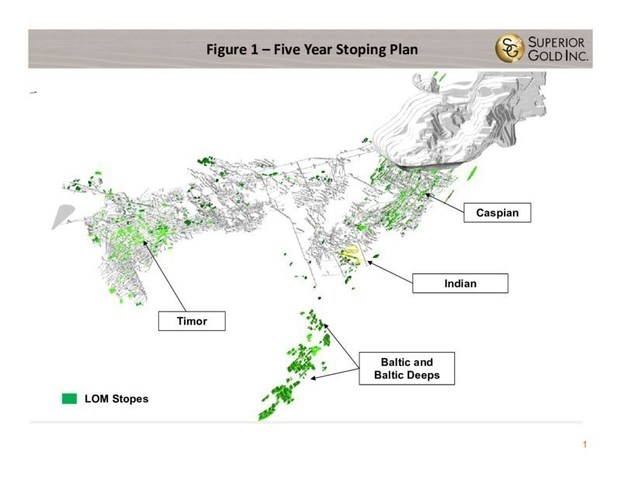

As indicated in Figure 1, we have moved towards increasing efficiencies by focusing on a smaller number of mining fronts. For the next five years, our primary focus will be on mining the Timor, Indian, Caspian and Baltic areas; this contrasts with the previous mode of operation where mining activities took place across eight fronts. In order to execute on this plan, we will be ensuring development rates increase substantially from 600 metres per month to more than 800 metres per month which the mine has now achieved for two consecutive months. We have achieved this through improved maintenance practices which have increased equipment availabilities and therefore supported improved operating efficiencies. This will also result in an increase in sustaining capital costs offset partially by a decrease in operating costs as a result of the increased efficiencies.

We will maintain an ongoing commitment to exploration and development in order to ensure that we not only outline sufficient reserves to replace those being mined, but increase reserves and resources beyond current levels. At the core of this philosophy is that grade is the key driver of profitability. Whilst we have taken a conservative approach, and our plan shows a profitable outcome at below reserve grade, we will focus on improving that towards reserve grade. Clearly, any success on this front will lead to a better financial outcome for the Company and our shareholders.

The five year guidance is based on current reserves and a portion of resources. It is important to highlight that the Plutonic underground mine has a much larger resource than that included in this plan. The historic conversion rate of resources into reserves is 40-50%. As a result, we anticipate that with our ongoing underground diamond drilling, the current five year guidance can be extended for a number of years beyond the time frame that has been presented. Our primary focus will be to establish new mining fronts which will allow us to continue to maintain operational efficiencies. One of our main areas of interest will be the area between the Indian and Baltic zones which has received limited development and exploration to date.

Additionally, we are undertaking a calculation of a new global resource for the Plutonic Gold Mine, the results of which we will ultimately incorporate into a longer term plan. With excess mill capacity, as a result of our second mill which is not currently being utilized, we are well positioned to benefit from any reserve and resource expansion. These are exciting times for the Plutonic Gold Operations.

The five year plan outlined does not include potential improvements from operational efficiencies which are currently being implemented. In addition, the plan was developed assuming a gold price of A$1,750 per ounce, which is substantially below the current gold price of more than A$2,150 per ounce. An A$:US$ exchange rate of 0.7 was used.

Finally, we are also working on a plan for the open pit operations which we anticipate will incrementally add production over the next five years to achieve an overall total of at least 100,000 ounces of gold annually. Details for the open pit portion of the five year guidance are expected in the fourth quarter of 2019."

Five Year Guidance

Operating Parameters1 | 2020-2024 |

Gold produced (ounces/year) | 70-85,000 |

Stope grade (g Au/t)2 | 3.5-4.5 |

Total cash costs ($/ounce)3 | 925-1,050 |

AISC ($/ounce)3 | 1,025-1,150 |

Capital ($ Million/year)4 | 7.0 |

Exploration ($ Million/year)5 | 6.5 |

Notes: |

1 Based on an A$:US$ exchange rate of 0.7. |

2 Development ore milled has an estimated grade of 1.8 g/t gold. |

3 Refer to Non-IFRS Performance Measures section of the Company's MD&A for a description and calculation of these measures. |

4 The majority of the capital spending is related to sustaining capital expenditures. |

5 Exploration expenditures may increase with positive results. |

Third Quarter Production Results

Third quarter production was negatively impacted by the necessary decision to focus on the long term plan and the need to establish sufficient development to enable execution of the plan. Production details are summarized in the table below:

Operating Parameters1 | Three month period September 30, 2019 | YTD Nine month period September 30, 2019 |

Stope material mined (Tonnes) | 118,725 | 393,114 |

Stope grade mined (g Au/t) | 2.96 | 3.06 |

Development material mined (Tonnes) | 58,157 | 201,399 |

Development grade mined (g Au/t) | 1.61 | 1.71 |

Surface material mined (g Au/t/)2 | 244,671 | 689,364 |

Surface material grade (Tonnes)2 | 0.73 | 1.08 |

Total material milled | 415,018 | 1,262,944 |

Grade milled (g Au/t) | 1.46 | 1.78 |

Gold recovery (%) | 85 | 87 |

Gold Produced (ounces) | 16,627 | 62,951 |

Gold Sold (ounces) | 17,900 | 64,342 |

Cash Balance ($ Million) | 14.1 | 14.1 |

Notes: |

1 Numbers may not add due to rounding. |

2 Surface material milled in Q3 consists of primarily low grade stockpile from Hermes. |

Revised 2019 Guidance

As stated in our news release on August 14, 2019, the Company has made the strategic decision to sacrifice short term results to ensure the long term success of the operations, as outlined in this five year guidance. Consequently, our operating and financial results for the second half of the year will be impacted as we focus on the development necessary to access the areas needed to execute on the long term plan for the underground portion of the Plutonic Gold Mine. This factor, along with our commitment to upgrading the underground mining fleet are expected to contribute to lower production and increased costs for 2019. Accordingly, we have adjusted our 2019 guidance as indicated in the table below.

Operating Parameters | Low | High |

Production (oz of Gold) | 80,000 | 85,000 |

Cash Costs ($/oz)1 | $1,250 | $1,350 |

All In Sustaining Costs ($/oz)1 | $1,350 | $1,450 |

Notes: |

1 This is a Non-IFRS measure. Refer to Non-IFRS measures section of the Company's prior MD&A's for a description of these measures. |

Conference Call

Management will host a conference call and webcast on Wednesday October 23, 2019 at 10:00AM ET to discuss the new five year plan.

Conference Call and Webcast | |

Date: | Wednesday October 23, 2019 10:00AM ET |

Toll-free North America: | (888) 231-8191 |

Local or International: | (647) 427-7450 |

Webcast: https://event.on24.com/wcc/r/2111509/CD108E1F0C379140827766022F08B69A | |

Conference Call Replay | |

Toll-free North America: | (855) 859-2056 |

Local or International: | (416) 849-0833 |

Passcode: | 9494838 |

The conference call replay will be available from 1:00PM ET on October 23, 2019 until 23:59PM ET on November 6, 2019 | |

The presentation will be available on the Company's website at www.superior-gold.com.

Qualified Person

Scientific and technical information in this news release has been reviewed and approved by Pascal Blampain, who is a member of the AusIMM and the Australian Institute of Geoscientists (AIG) and a "qualified person" within the meaning of NI 43-101. Mr. Blampain is an employee of the Company and serves as Chief Geologist.

About Superior Gold

Superior Gold is a Canadian based gold producer that owns 100% of the Plutonic Gold operations located in Western Australia. The Plutonic Gold operations include the Plutonic underground gold mine and central mill, the Hermes open pit projects and an interest in the Bryah Basin joint venture. Superior Gold is focused on expanding production at the Plutonic Gold operations and building an intermediate gold producer with superior returns for shareholders.

Forward Looking Information

This press release contains "forward-looking information" within the meaning of applicable securities laws that is intended to be covered by the safe harbours created by those laws. "Forward-looking information" includes statements that use forward-looking terminology such as "may", "will", "expect", "anticipate", "believe", "continue", "potential" or the negative thereof or other variations thereof or comparable terminology. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, and statements regarding exploration results and exploration plans.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made. Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. See "Risk Factors" in the Company's prospectus dated February 15, 2017 filed on SEDAR at www.sedar.com for a discussion of these risks.

The Company cautions that there can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information. Except as required by law, the Company does not assume any obligation to release publicly any revisions to forward-looking information contained in this press release to reflect events or circumstances after the date hereof.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/superior-gold-inc-announces-five-year-guidance-for-plutonic-underground-gold-mine-and-third-quarter-production-results-for-plutonic-gold-operations-300943565.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/superior-gold-inc-announces-five-year-guidance-for-plutonic-underground-gold-mine-and-third-quarter-production-results-for-plutonic-gold-operations-300943565.html

SOURCE Superior Gold

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2019/23/c1973.html