You are here

Home The Newswire News ReleasesSouth Star Mining Files Positive Pre-Feasibility Study Results and Maiden Reserve Estimate for Santa Cruz Graphite Project

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

(TheNewswire)

Toronto, ON – TheNewswire - March 18, 2020 – South Star Mining Corp. (‘South Star’ or ‘the Company’) (TSXV:STS) (OTC:STSBF), further to its February 5, 2020 News Release, has filed a National Instrument 43-101 technical report dated March 18, 2020 and entitled "Updated Resources and Reserves Estimate and Pre-feasibility Study on the Santa Cruz Graphite Project, Bahia, Brazil" (the "Report" or "PFS"). There are no material differences between the mineral resources, mineral reserves or results disclosed in the Report and those disclosed in the Company's February 5th, 2020 news release. The Report can be found under the Company's SEDAR profile at www.sedar.com.

The PFS presents a two-phased approach to production with an after tax NPV5% of US$81.2M, an IRR of 35% and a 4-year payback. The study used the current average basket price of US$1,287 per tonne which was held constant for the life of the project.

Phase 1 consists of a pilot plant with the capacity to produce 5,000t of concentrate per year, and the simple layout includes a small open-pit processing plant with filtered tails technology, waste storage facility for co-disposal of waste-rock and filtered tails and civil infrastructure. The goal of the Phase 1 operations is to test and optimize the flowsheet, develop the key commercial relationships and optimize the production of products demanded in the marketplace, given the inherent, high-quality nature of the concentrates produced to date. Detailed engineering of the pilot plant was completed as part of the PFS.

Phase 2 is a larger plant with similar layout and technology, but with a capacity of 25,000t of concentrate per year. It’s important to highlight that both Phases include the use of filtered tails technology and co-disposal of tailings with waste-rock to avoid the requirement of a Tailings Storage Facility. This is essential in facilitating the permitting process and decreasing the environmental footprint of the facility.

PFS Highlights

- Combined Maiden Proven & Probable (P+P) Reserve Estimate of 12.3M tonnes with strong conversion of resource to reserves.

- The Mineral Reserve Estimate is listed below:

----------------------------------------------------------- |Mineral Reserve Estimate|Tonnage |Cg |In-situ Graphite| | |--------------------------------| | |(t) |(%) |(t) | |---------------------------------------------------------| |Proven |3,989,635 |2.49|99,340 | |---------------------------------------------------------| |Probable |8,318,795 |2.35|195,490 | |---------------------------------------------------------| |Total P&P |12,308,500|2.40|295,400 | -----------------------------------------------------------Notes:

-

1)Mineral Reserves are as defined by the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves.

-

2)Mineral Reserves are based on Mineral Resources (Published on July 8th, 2019) estimated using ordinary kriging method and a three-dimensional block model using a cut-off grade of 0.75% and 1% Cg, depending on the modeled zones.

-

3)Numbers have been rounded.

-

4)Mineral Reserves have incorporated cut-off, pricing, costs, recovery & FX.

- Phase 1 Average Production of 5,000 tpy of 95% Cg Concentrate in Years 1 & 2

- Phase 2 Ramping up from 13,500 tpy of 95% Cg Concentrate in Year 3 to an average production of 25,000 tpy in years 4-11

- Average Basket Price of Products of US$1,287/t

- Open-pit mining with strip ratio of 1.6 Life of Mine (LOM)

- 12-Year LOM

- Exchange Rate of R$3.95 to US$1.00

- Post-Tax NPV5% of US$81.2M and internal rate of return of 35%

- US$129M Post-tax Cash Flow LOM

- Payback Period of 4 years

- CAPEX & OPEX Parameters for Each Phase are listed below:

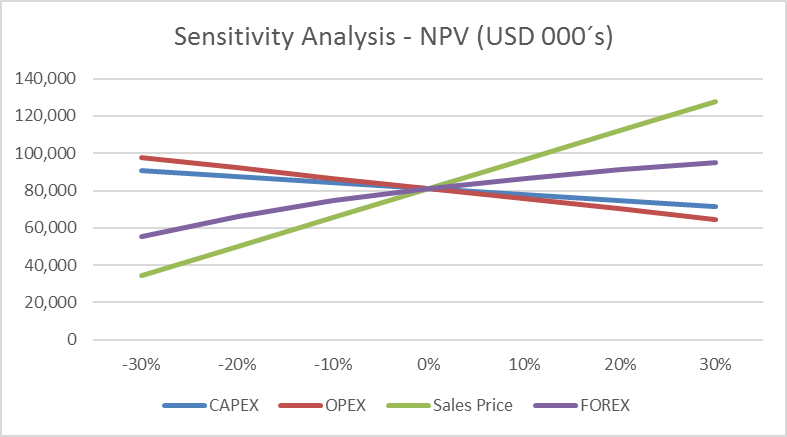

-------------------------------------------------- | |Phase 1|Phase 2|Phase 1&2| |Parameter |(US$) |(US$) |(US$) | |------------------------------------------------| |CAPEX |7.3M |27.2M |34.5 | |------------------------------------------------| |OPEX ($/t Concentrate)|604 |386 |396 | --------------------------------------------------- Sensitivity Analysis for NPV using CAPEX, OPEX, Sales Price and FX as follows:

The technical information contained in this news release pertaining to the Santa Cruz Graphite Project has been prepared, reviewed and approved by Luiz Eduardo Pignatari, an independent qualified person under National Instrument 43-101–Standards of Disclosure for Mineral Projects ("NI43-101"). The qualified person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

About South Star Mining Corp.

South Star Mining Corp. is focused on the selective acquisition and development of near-term mine production projects in Brazil to maximize shareholder value. STS has an experienced executive team with a strong history of discovering, developing, building and operating profitable mines in Brazil.

The Santa Cruz Graphite Project is located in Southern Bahia in the third largest graphite producing region in the world with over 70 years of continuous mining. The Project has at surface mineralization in friable materials, and successful large-scale pilot plant testing (>30t) has been completed. The results of the testing show approximately 65% of Cg concentrate is +80 mesh with good recoveries and 95-99% Cg. With excellent infrastructure and logistics, South Star is carrying its development plan towards production projected at the end of 2020.

To learn more, please visit the Company website at http://www.southstarmining.ca.

On behalf of the Board,

Mr. Richard Pearce

Chief Executive Officer

For additional information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x231

Email: [email protected]

Mr. Dave McMillan

Chairman

Email: [email protected]

Mr. Eric Allison

Director

Email: [email protected]

CAUTIONARY STATEMENT

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Information

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

Copyright (c) 2020 TheNewswire - All rights reserved.

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.