Kindur Introduces SmartDraw, New Subscription Service to Help Baby Boomers Keep More of Their Money in Retirement

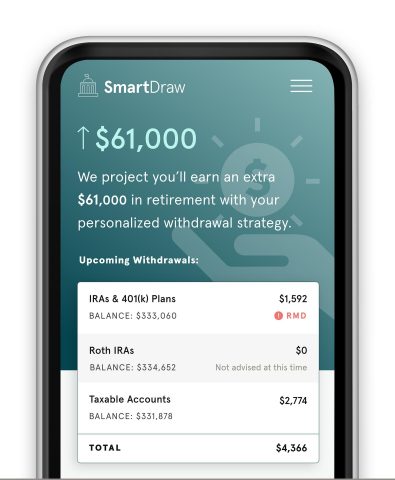

Today, Kindur has officially launched SmartDraw, a subscription service designed to empower baby boomers to retire fearlessly. With Kindur’s intuitive technology and the option to connect directly with a licensed financial advisor, SmartDraw enables customers to extend the life of their retirement nest egg. SmartDraw helps clients avoid unexpected fees and penalties, tax-efficiently withdraw funds from multiple retirement accounts and navigate the maze of everchanging retirement regulations. Kindur customers can use this tool to create a monthly retirement paycheck, so that managing finances in retirement is as simple as when one was working.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191018005308/en/

(Photo: Business Wire)

“When the stakes are this high, we’re excited to help our customers move past rules of thumb and make sure they are creating a retirement income plan that specifically addresses their fact pattern,” said Rhian Horgan, Kindur founder and CEO. “Millions of Americans transitioning out of the workforce face a web of new tax codes, regulations and deadlines with high-consequence penalties. Even for individuals who’ve done well managing their finances throughout their working lives, today’s retirement is completely different than any other generation has faced and requires a new approach.”

With this new subscription service, retirees can access expert advice and guidance starting at less than a hundred dollars a year. For a portfolio with one million dollars, this financial expertise can add up to $61,000 in additional lifetime value over the course of retirement.

Recent research from the World Economic Forum found that in the U.S., the average retiree has enough savings to cover just under ten years of expenses in retirement. Factors like increased longevity, particularly for women who have longer life expectancy, along with a structural move away from pensions, has required individuals to more strategically manage their entire financial picture in retirement.

By selecting between three strategically designed packages, customers can utilize Kindur’s proprietary SmartDraw technology for a personalized experience that matches their specific needs. Each package includes key services that provide tax efficiency, clarity and peace of mind, for less than the cost of a single hour with an advisor. Customers can choose between the Select ($99/year), Premium ($149.99/year), and Concierge ($299.99/year) packages that include services such as:

● Automated Withdrawal Recommendations help customers minimize taxes by analyzing their retirement accounts and spending needs and delivers recommendations on which account to make withdrawals from first.

● Automated RMD Calculations highlights customers’ annual “Required Distributions” to avoid the 50% tax penalty starting at the age of 70 ½ years old from each retirement account.

● Medicare Surcharge Concierge Service handles the filing of customers’ Medicare surcharge to decrease the amount of premium they pay each year if they experience a “Life Changing Event.” This could result in $1,500 or more per couple.

● Federal and State IRA Withholding Strategy helps customers avoid tax penalties and high year-end tax bills by recommending the right monthly withholding strategy for state and federal taxes when one makes withdrawals from their IRA accounts.

● Access to a licensed Financial Advisor who will create a custom plan for reach retiree

To start managing your retirement income with SmartDraw, please visit www.kindur.com/smartdraw

About Kindur

Kindur is a new-kind of retirement company that empowers baby boomers to embrace modern retirement. Grounded in decades of experience leading financial and tech initiatives at major banks and start-ups, Kindur provides straightforward digital advice and retirement tools to a rapidly growing population of retirees. By making sense of savings, insurance, Social Security and healthcare costs, users can focus on enjoying a hard-earned retirement with confidence. Kindur is headquartered in New York City. For additional information, please visit www.kindur.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20191018005308/en/

Cat Crandall, 917-838-3195

[email protected]