Jaguar announces 2015 year end Mineral Reserves and Resources

Jaguar announces 2015 year end Mineral Reserves and Resources

Canada NewsWire

TORONTO, April 7, 2016

TSX-V: JAG

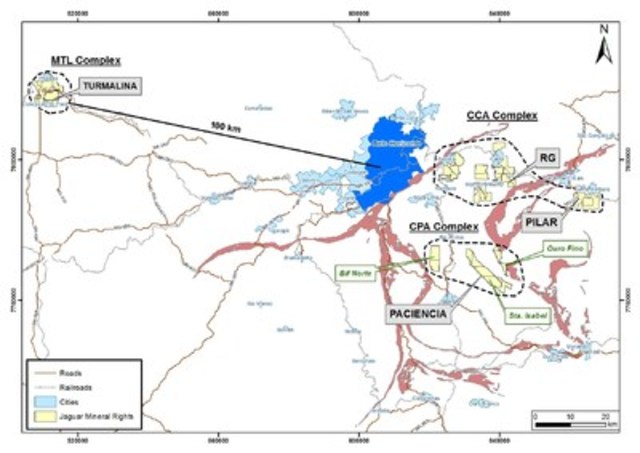

TORONTO, April 7, 2016 /CNW/ - Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX-V: JAG) today announced updated Mineral Reserves and Mineral Resources estimates as of December 31, 2015 prepared in accordance with National Instrument 43-101 ("NI 43-101"). Southern Brazil operating assets include the Turmalina Gold Complex, consisting of the Turmalina Gold Mine ("Turmalina") and a process mill, and the Caeté Gold Complex, consisting of the Pilar Gold Mine ("Pilar" or "Pilar Mine"), the Roça Grande Gold Mine ("RG" or "RG Mine"), and a process mill. Both Complexes are located within 100 kilometres of Belo Horizonte, the capital city of the state of Minas Gerais (see Figure 1). Northern Brazil development assets include the Gurupi Development Project ("Gurupi" or "Gurupi Project") located in the northern state of Maranhão, Brazil.

2015 Mineral Reserves and Mineral Resources Highlights (As at December 31, 2015)

Southern Brazil, Operating Mines

- Pilar Mineral Reserves increased 310% to 172,000 ounces of gold after depletion, while also exceeding reserve replacement targets, as a result of the increased gold presence encountered on the BF and BFII Ore Bodies which comprise 91% of Pilar's underground Mineral Reserves.

- Pilar Measured and Indicated ("M&I") Mineral Resources increased 56% to 514,000 ounces of gold grading 4.59 g/t Au. Recent drilling results from the BF and BFII zones confirm the open down-plunge potential to expand Mineral Resources and also confirm increasing grade and widths below the current mining fronts.

- Turmalina Mineral Reserves average grade remained unchanged at 5.31 g/t Au, while ounces declined 15% to 185,000 ounces of gold due to depletion during the year.

- RG M&I Mineral Resources declined to 111,000 ounces grading 2.81 g/t Au as a result of a large reclassification of resources, compared to 940,000 ounces grading 3.47 g/t Au in 2014. Exploration and development commenced during Q1 2016 aims to rebuild the existing Mineral Resource base and also convert the Mineral Resources to Reserves.

- Consolidated Mineral Reserves, representing Southern Brazil operating mines, increased 34% to 357,000 ounces with a 9% increase in grade to 4.82 g/t Au as a result of a significant increase in Mineral Reserves at the Pilar Mine.

- Consolidated M&I Mineral Resources for the Company's Southern Brazil operating mines remain strong at 1.1 million ounces grading 4.45 g/t Au.

Northern Brazil, Gurupi Development Project (Open-Pit)

- Northern Brazil Mineral Reserves and Mineral Resources, comprised of the open-pit Gurupi Development Project, remain unchanged from 2014 with Proven and Probable ("2P") Mineral Reserves of 2.3 million ounces of gold (63,757,000 tonnes grading 1.14 g/t Au), included in Mineral Resources, and M&I Mineral Resources of 3.5 million ounces of gold (142,636,000 tonnes grading 0.77 g/t Au).

Rodney Lamond, President and CEO of Jaguar Mining stated, "We have made excellent progress with the geological modeling at our core operating assets in Southern Brazil. Relative to our current production profile we have a solid base of Mineral Reserves comprised of 320,000 ounces from which we continue to build from. Our new models have provided the Company with a dart board of where to focus our exploration programs in order to build on the current life of mine plans. In particular, at Pilar, recent drilling results from the BF and BFII zones confirm the open down-plunge potential to expand Mineral Resources and also confirm increasing grade and widths below the current mining fronts. We are also focused on limiting our capital expenditures to only exploration and development of high priority targets at our operating assets. These high priority targets are those that will support finding, replacing and adding to our Mineral Reserves inventory, thereby extending mine life at all of our operating mines."

Southern Brazil Operating Mines Mineral Reserves and Mineral Resources Review

Pilar Mine Mineral Reserves and Mineral Resources Summary

|

December 31, 2015 |

December 31, 2014(1) |

2015 vs. 2014 % Change | ||||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | ||

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

|||||

|

2P Mineral Reserves | ||||||||||

|

Ore Body BA |

69 |

3.20 |

7 |

|||||||

|

Ore Body BF |

407 |

4.20 |

55 | |||||||

|

Ore Body BFII |

707 |

4.66 |

106 | |||||||

|

Ore Body LFW |

30 |

3.44 |

3 | |||||||

|

Ore Body LPA |

7 |

4.00 |

1 | |||||||

|

Total 2P Reserves |

1,220 |

4.39 |

172 |

488 |

2.70 |

42 |

150% |

63% |

310% | |

|

M&I Mineral Resources | ||||||||||

|

Ore Body BA |

467 |

4.66 |

70 |

|||||||

|

Ore Body BF |

1,035 |

4.69 |

156 | |||||||

|

Ore Body BFII |

878 |

5.11 |

145 | |||||||

|

Ore Body C |

451 |

4.62 |

67 | |||||||

|

Ore Body LFW |

243 |

4.10 |

32 | |||||||

|

Ore Body LHW |

12 |

3.61 |

1 | |||||||

|

Ore Body LPA |

56 |

3.99 |

7 | |||||||

|

Ore Body SW |

338 |

3.28 |

36 | |||||||

|

Total M&I Resources |

3,479 |

4.59 |

514 |

1,817 |

5.64 |

329 |

91% |

-19% |

56% | |

|

Inferred Mineral Resources |

1,208 |

5.45 |

212 |

1,011 |

5.65 |

184 |

19% |

-4% |

15% | |

|

1) |

Pilar Mineral Resources as at December 31, 2014 reported were calculated using the historical technical reports, depleting ounces mined until 2014. The new model developed in 2015 has reserves and resources by Ore Bodies as listed above. 2014 analysis by similar Ore Bodies was not carried out due to the new modelling techniques; hence the information for 2014 is presented on a consolidated basis only. | ||||||||||

- Pilar Mineral Reserves increased 310% to 172,000 ounces of gold after 2015 depletion, while also exceeding reserve replacement targets as a result of the increased gold presence encountered on the BF and BFII Ore Bodies which comprise 91% of Pilar's underground Mineral Reserves. Pilar Mineral Reserves average grade increased 63% to 4.39 g/t Au. In 2014, Mineral Reserves included 42,000 ounces (488,000 tonnes at an average grade of 2.70 g/t Au). (See Press Release dated March 4, 2015)

- The large increase in Mineral Reserves at Pilar supports a significant increase in mine life with sufficient Mineral Reserves for four years based on the current production profile at Pilar.

- Recent drill programs at Pilar have encountered wider mineralized structures at depth, particularly on the BF and BFII formations, resulting in a significant increase in the number of ounces per vertical metre.

- A drill program consisting of 10,725 metres is planned for 2016 to explore and infill drill the down-plunge extensions of the BA, BF, and BFII zones to build and strengthen our mine model for future development.

- M&I Mineral Resources increased 56% to 514,000 ounces of gold grading 4.59 g/t Au. Pilar's current mining front, the BA, BF, and BFII Ore Bodies, host M&I Mineral Resources containing 371,000 ounces of gold grading 4.85 g/t Au. Recent drilling results from the BF and BFII zones confirm the down-plunge potential to expand defined Mineral Resources. The BF and BFII zone drilling results also confirm increasing grade at depth, while also remaining open at depth below current active mining fronts.

- For the December 31, 2015 Pilar estimates, a new geological and block model was built under the supervision of Roscoe Postle Associates Inc. ("RPA"). Previous annual Mineral Resource estimates were internally reviewed. The previous technical report was filed in 2010. The 2015 Mineral Resources estimates for Pilar will be filed on SEDAR 45 days from the press release distributed on March 4, 2015.

- Estimates were prepared based on a cut-off date of August 31, 2015, including 984 drill holes and 16,445 channel samples. Estimates were generated from a block model constrained by three dimensional (3D) wireframe models. A capping value varying from 10 to 60 g/t Au was applied for all eight "Ore Bodies". The wireframe models of the mineralization and excavated material for Pilar were constructed by Jaguar and reviewed by RPA. A separate wireframe was built for each "Ore Body" and was used to constrain the grade estimates into the block model.

Turmalina Gold Complex Mineral Reserves and Mineral Resources Summary

|

December 31, 2015 |

December 31, 2014 |

2015 vs. 2014 % Change | |||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | |

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

||||

|

2P Mineral Reserves | |||||||||

|

Ore Body A |

827 |

5.82 |

155 |

899 |

6.23 |

180 |

-8% |

-7% |

-14% |

|

Ore Body C |

253 |

3.66 |

30 |

367 |

3.14 |

37 |

-31% |

17% |

-19% |

|

Total 2P Reserves |

1,080 |

5.31 |

185 |

1,266 |

5.33 |

217 |

-15% |

0% |

-15% |

|

M&I Mineral Resources | |||||||||

|

Ore Body A |

855 |

7.01 |

193 |

904 |

7.70 |

224 |

-5% |

-9% |

-14% |

|

Ore Body B |

511 |

3.56 |

58 |

581 |

3.11 |

58 |

-12% |

14% |

0% |

|

Ore Body C |

702 |

3.14 |

71 |

697 |

2.86 |

64 |

1% |

10% |

11% |

|

Faina |

261 |

6.87 |

58 |

261 |

6.87 |

58 |

0% |

0% |

0% |

|

Pontal |

410 |

4.72 |

62 |

410 |

4.72 |

62 |

0% |

0% |

0% |

|

Total M&I Resources |

2,739 |

5.01 |

442 |

2,853 |

5.08 |

466 |

-4% |

-1% |

-5% |

|

Inferred Mineral Resources |

3,057 |

6.30 |

619 |

3,268 |

6.40 |

673 |

-6% |

-2% |

-8% |

- Turmalina Mine Mineral Reserves declined 15% to 185,000 ounces of gold, due to depletion, while average grade remained consistent at 5.31 g/t Au. Ore Body C Mineral Reserves grade achieved a 17% increase to 3.66 g/t Au compared to the prior year, following a decision to selectively mine higher-grade ore, having the net effect of lower tonnes.

- M&I Mineral Resources of 442,000 ounces of gold (2,739,000 tonnes grading 5.01 g/t Au) decreased 5% compared to 466,000 ounces of gold (2,853,000 tonnes grading 5.08 g/t Au) in 2014 mainly due to depletion.

- 2016 drilling programs of the Ore Body A and Ore Body C down-dip continuities will focus on replacing ounces mined during the year.

- The 2015 Mineral Resources estimates for Turmalina will be filed on SEDAR 45 days from the date of this press release.

Roça Grande Mineral Resources Summary

|

December 31, 2015 |

December 31, 2014(1) |

2015 vs. 2014 % Change | |||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | |

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

||||

|

M&I Mineral Resources |

1,231 |

2.81 |

111 |

8,421 |

3.47 |

940 |

-85% |

-19% |

-88% |

|

Inferred |

1,759 |

3.48 |

197 |

2,335 |

3.90 |

293 |

-25% |

-11% |

-33% |

|

Mineral Resources | |||||||||

|

1) RG Mineral Resources as at December 31, 2014 reported were calculated using the historical technical reports, depleting ounces mined until 2014. |

|||||||||

- Exploration and development commenced during Q1 2016 at RG to rebuild the Mineral Resources as 2015 M&I Minerals Resources declined to 111,000 ounces grading 2.81 g/t Au compared to 940,000 ounces grading 3.47 g/t Au in 2014.

- Compared to the prior year, 2015 M&I Mineral Resources of 111,000 ounces declined 88% due to 829,000 ounces from RG that were not included in the 2015 Mineral Resources due to the revision of estimation parameters and geological modeling assessment.

Southern Brazil, Operating Mines Proven & Probable Mineral Reserves at December 31, 2015

|

Proven Reserves |

Probable Reserves |

Proven and Probable Reserves | |||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | |

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) | |

|

Turmalina |

460 |

5.19 |

77 |

620 |

5.40 |

108 |

1,080 |

5.31 |

185 |

|

Pilar |

164 |

3.15 |

17 |

1,056 |

4.58 |

156 |

1,220 |

4.39 |

172 |

|

Total Mineral Reserves |

624 |

4.65 |

94 |

1,676 |

4.89 |

264 |

2,300 |

4.82 |

357 |

- Consolidated Proven and Probable Mineral Reserves increased 34% to 357,000 ounces based on a 23% increase in tonnes to 2,300,000 tonnes and a 9% increase in average grade to 4.82 g/t Au, mainly due to a significant increase in Mineral Reserves at the Pilar Mine.

- Total Mineral Reserves at Pilar increased by 310% to 172,000 ounces in 2015 at a cost of $6/ounce.

Southern Brazil, Operating Mines Measured & Indicated Mineral Resources at December 31, 2015

|

Measured Resources |

Indicated Resources |

Total M&I Mineral Resources | |||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | |

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) | |

|

Turmalina |

1,235 |

5.21 |

207 |

1,505 |

4.88 |

236 |

2,739 |

5.01 |

442 |

|

Pilar |

709 |

4.25 |

97 |

2,770 |

4.68 |

417 |

3,479 |

4.59 |

514 |

|

Roça Grande |

217 |

2.17 |

15 |

1,014 |

2.95 |

96 |

1,231 |

2.81 |

111 |

|

Total M&I Mineral |

2,161 |

4.59 |

319 |

5,289 |

4.40 |

749 |

7,449 |

4.45 |

1,067 |

- Consolidated M&I Mineral Resources for the operating mines remain strong at 1.1 million ounces (7,449,000 tonnes grading 4.45 g/t Au). An improving average grade profile, due to a higher tonnage contribution from Pilar and lower tonnes from Roça Grande, drove a 3% increase in M&I Mineral Resource grade to 4.45 g/t Au from 4.30 g/t Au in 2014.

- Compared to the prior year, 2015 M&I Mineral Resources of 1.1 million ounces declined 49% due to 829,000 ounces from RG that were not included in the 2015 Mineral Resources due to the revision of estimation parameters and geological modeling assessment. Total tonnes decreased 51% to 7,449,000 compared to the prior year, also due to lower tonnes at RG.

Northern Brazil Mineral Reserves and Mineral Resources Review

Northern Brazil, Mineral Reserves at December 31, 2015

|

Proven Reserves |

Probable Reserves |

Proven and Probable Reserves | |||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | |

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) | |

|

Gurupi Project (Open-Pit) | |||||||||

|

Cipoeiro |

- |

- |

- |

45,044 |

1.20 |

1,735 |

45,044 |

1.20 |

1,735 |

|

Chega Tudo |

- |

- |

- |

18,713 |

0.99 |

593 |

18,713 |

0.99 |

593 |

|

Total Mineral Reserves - |

- |

- |

- |

63,757 |

1.14 |

2,328 |

63,757 |

1.14 |

2,328 |

Northern Brazil, Mineral Resources at December 31, 2015

|

Measured Resources |

Indicated Resources |

M&I Mineral Resources |

Inferred Resources | ||||||||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | ||||

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) | ||||

|

Gurupi Project (Open-Pit) | |||||||||||||||

|

Cipoeiro |

25,734 |

0.78 |

640 |

58,494 |

0.87 |

1,633 |

84,229 |

0.84 |

2,273 |

7,041 |

0.67 |

152 | |||

|

Chega Tudo |

20,923 |

0.66 |

440 |

37,484 |

0.67 |

805 |

58,408 |

0.66 |

1,246 |

678 |

0.62 |

13 | |||

|

Total Mineral |

46,657 |

0.72 |

1,080 |

95,979 |

0.79 |

2,438 |

142,636 |

0.77 |

3,519 |

7,719 |

0.66 |

165 | |||

|

Resources - | |||||||||||||||

|

Northern Brazil | |||||||||||||||

- Northern Brazil Mineral Reserves and Mineral Resources, comprised of the Gurupi Development Project remain unchanged from 2014 with Proven and Probable Mineral Reserves of 2.3 million ounces of gold (63,757,000 tonnes grading 1.14 g/t Au) included in M&I Mineral Resources of 3.5 million ounces of gold (142,636,000 tonnes grading 0.77 g/t Au).

- The open-pit Gurupi Project is comprised of two deposits: Cipoeiro and Chega Tudo, which are approximately eight kilometres from each other. Both deposits are located 500 kilometres southwest of the city of São Luis, the capital city of the state of Maranhão, and 350 kilometres southeast of the city of Belém, the capital city of the state of Pará, in northeastern Brazil.

- Gurupi Project estimates as at December 31, 2015 are based on the Technomine Feasibility Study Technical Report filed on SEDAR on January 31, 2011 and have not been re-estimated for this press release.

Table 1 - Summary of Mineral Reserves as at December 31, 2015

|

Proven Reserves |

Probable Reserves |

Proven and Probable Reserves | |||||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | |||

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) | |||

|

Southern Brazil | |||||||||||

|

Turmalina Gold Complex2 | |||||||||||

|

Ore Body A |

387 |

5.70 |

71 |

440 |

5.92 |

84 |

827 |

5.82 |

155 | ||

|

Ore Body C |

73 |

2.51 |

6 |

180 |

4.13 |

24 |

253 |

3.66 |

30 | ||

|

Total - Turmalina |

460 |

5.19 |

77 |

620 |

5.40 |

108 |

1,080 |

5.31 |

185 | ||

|

Caeté Gold Complex | |||||||||||

|

Pilar3 | |||||||||||

|

Ore Body BA |

69 |

3.20 |

7 |

- |

- |

- |

69 |

3.20 |

7 | ||

|

Ore Body BF |

64 |

2.95 |

6 |

343 |

4.44 |

49 |

407 |

4.20 |

55 | ||

|

Ore Body BFII |

- |

- |

- |

707 |

4.66 |

106 |

707 |

4.66 |

106 | ||

|

Ore Body LFW |

30 |

3.44 |

3 |

- |

- |

- |

30 |

3.44 |

3 | ||

|

Ore Body LPA |

1 |

3.19 |

0 |

6 |

4.15 |

1 |

7 |

4.00 |

1 | ||

|

Total - Pilar |

164 |

3.15 |

17 |

1,056 |

4.58 |

156 |

1,220 |

4.39 |

172 | ||

|

Roça Grande |

- |

- |

- |

- |

- |

- |

- |

- |

- | ||

|

Total - Caeté |

164 |

3.15 |

17 |

1,056 |

4.58 |

156 |

1,220 |

4.39 |

172 | ||

|

Total - Southern Brazil |

624 |

4.65 |

94 |

1,676 |

4.89 |

264 |

2,300 |

4.82 |

357 | ||

|

Northern Brazil | |||||||||||

|

Gurupi Project4 | |||||||||||

|

Cipoeiro |

- |

- |

- |

45,044 |

1.20 |

1,735 |

45,044 |

1.20 |

1,735 | ||

|

Chega Tudo |

- |

- |

- |

18,713 |

0.99 |

593 |

18,713 |

0.99 |

593 | ||

|

Total - Northern Brazil |

- |

- |

- |

63,757 |

1.14 |

2,328 |

63,757 |

1.14 |

2,328 | ||

|

Total - 2P Mineral |

624 |

4.65 |

94 |

65,433 |

1.23 |

2,592 |

66,057 |

1.26 |

2,685 | ||

|

Reserves | |||||||||||

|

Notes to Table 1: | ||||||||||||||

|

1. |

CIM definitions are followed for Mineral Reserves; | |||||||||||||

|

2. |

Turmalina | |||||||||||||

|

(a) |

Mineral Reserves are estimated using a break-even cut-off grade of 2.57 g/t Au. Some stopes were included using an incremental cut-off grade of 1.38 g/t Au; | |||||||||||||

|

(b) |

Bulk densities used were 2.76 t/m3 for Ore Body A and B, and 2.95 t/m3 for Ore Body C; | |||||||||||||

|

(c) |

Mineral Reserves are estimated using an average long-term foreign exchange rate of 3.8 Brazilian Reais: 1 US Dollar; | |||||||||||||

|

(d) |

Mineral Reserves are estimated using a gold price of US$1,150 per ounce for the year of 2016 and US$1,250 per ounce for the year of 2017 and beyond; | |||||||||||||

|

(e) |

A minimum mining width of approximately 2 m was used. | |||||||||||||

|

3. |

Caeté - Pilar | |||||||||||||

|

(a) |

Mineral Reserves were estimated using a break-even cut-off grade of 2.5 g/t Au; | |||||||||||||

|

(b) |

Bulk densities used were 2.89 t/m3 for iron-formation poor domains or 3.05 t/m3 for iron-formation rich domains; | |||||||||||||

|

(c) |

Mineral Reserves are estimated using an average gold price of US$1,150 per ounce; | |||||||||||||

|

(d) |

Mineral Reserves are estimated using an average long-term foreign exchange rate of 3.8 Brazilian Reais: 1 US Dollar; | |||||||||||||

|

(e) |

A minimum mining width of approximately 2 m was used. | |||||||||||||

|

4. |

Gurupi Reserves are based on the Technomine Feasibility Study Technical Report filed on SEDAR on January 31, 2011; | |||||||||||||

|

5. |

Numbers may not add due to rounding. | |||||||||||||

Table 2 - Summary of Mineral Resources as at December 31, 2015

|

Measured Resources |

Indicated Resources |

Total Measured & |

Inferred Resources | ||||||||||

|

Indicated Resources | |||||||||||||

|

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz |

Tonnes |

Grade |

Gold oz | ||

|

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) |

(000's) |

(g/t) |

(000's) | ||

|

Southern Brazil | |||||||||||||

|

Turmalina Gold Complex2 | |||||||||||||

|

Ore Body A |

478 |

6.75 |

104 |

378 |

7.33 |

89 |

855 |

7.01 |

193 |

564 |

6.50 |

118 | |

|

Ore Body B |

352 |

3.38 |

38 |

158 |

3.95 |

20 |

511 |

3.56 |

58 |

46 |

5.45 |

8 | |

|

Ore Body C |

82 |

2.88 |

8 |

621 |

3.17 |

63 |

702 |

3.14 |

71 |

775 |

4.51 |

112 | |

|

Faina |

72 |

7.39 |

17 |

189 |

6.66 |

42 |

261 |

6.87 |

58 |

1,542 |

7.26 |

360 | |

|

Pontal |

251 |

5.00 |

40 |

159 |

4.28 |

22 |

410 |

4.72 |

62 |

130 |

5.03 |

21 | |

|

Total - Turmalina |

1,235 |

5.21 |

207 |

1,505 |

4.88 |

236 |

2,739 |

5.01 |

442 |

3,057 |

6.30 |

619 | |

|

Caeté Gold Complex | |||||||||||||

|

Pilar3 | |||||||||||||

|

Ore Body BA |

293 |

4.09 |

39 |

174 |

5.58 |

31 |

467 |

4.66 |

70 |

65 |

5.13 |

11 | |

|

Ore Body BF |

259 |

4.57 |

38 |

776 |

4.74 |

118 |

1,035 |

4.69 |

156 |

293 |

6.77 |

64 | |

|

Ore Body BFII |

4 |

4.46 |

1 |

874 |

5.11 |

144 |

878 |

5.11 |

145 |

198 |

7.89 |

50 | |

|

Ore Body C |

80 |

4.24 |

11 |

371 |

4.73 |

56 |

451 |

4.62 |

67 |

140 |

5.10 |

23 | |

|

Ore Body LFW |

68 |

3.82 |

8 |

175 |

4.22 |

24 |

243 |

4.10 |

32 |

117 |

4.87 |

18 | |

|

Ore Body LHW |

- |

- |

- |

12 |

3.61 |

1 |

12 |

3.61 |

1 |

5 |

3.11 |

1 | |

|

Ore Body LPA |

6 |

2.72 |

1 |

50 |

3.99 |

6 |

56 |

3.99 |

7 |

- |

- |

- | |

|

Ore Body SW |

- |

- |

- |

338 |

3.28 |

36 |

338 |

3.28 |

36 |

389 |

3.60 |

45 | |

|

Total - Pilar |

709 |

4.25 |

97 |

2,770 |

4.68 |

417 |

3,479 |

4.59 |

514 |

1,208 |

5.45 |

212 | |

|

Roça Grande4 |

217 |

2.17 |

15 |

1,014 |

2.95 |

96 |

1,231 |

2.81 |

111 |

1,759 |

3.48 |

197 | |

|

Total - Caeté |

926 |

3.76 |

112 |

3,784 |

4.22 |

513 |

4,710 |

4.13 |

625 |

2,967 |

4.29 |

409 | |

|

Total - Southern Brazil |

2,161 |

4.59 |

319 |

5,289 |

4.40 |

749 |

7,449 |

4.45 |

1,067 |

6,024 |

5.31 |

1,028 | |

|

Northern Brazil | |||||||||||||

|

Gurupi Project5 | |||||||||||||

|

Cipoeiro |

25,734 |

0.78 |

640 |

58,494 |

0.87 |

1,633 |

84,229 |

0.84 |

2,273 |

7,041 |

0.67 |

152 | |

|

Chega Tudo |

20,923 |

0.66 |

440 |

37,484 |

0.67 |

805 |

58,408 |

0.66 |

1,246 |

678 |

0.62 |

13 | |

|

Total - Northern Brazil |

46,657 |

0.72 |

1,080 |

95,979 |

0.79 |

2,438 |

142,636 |

0.77 |

3,519 |

7,719 |

0.66 |

165 | |

|

Total - Mineral Resources |

48,818 |

0.89 |

1,399 |

101,268 |

0.98 |

3,187 |

150,085 |

0.95 |

4,586 |

13,743 |

2.70 |

1,193 | |

|

Notes to Table 1: | ||||||||||||||

|

1. |

CIM definitions are followed for Mineral Reserves; | |||||||||||||

|

2. |

Turmalina | |||||||||||||

|

(a) |

Mineral Resources were estimated using a cut-off grade of 2.11 g/t Au (Turmalina); 3.8 g/t Au (Faina); and 2.9 g/t Au (Pontal); | |||||||||||||

|

(b) |

Bulk densities used were 2.89 t/m3 for iron-formation poor domains or 3.05 t/m3 for iron-formation rich domains; | |||||||||||||

|

3. |

Caeté - Pilar | |||||||||||||

|

(a) |

Mineral Reserves were estimated using a break-even cut-off grade of 2.5 g/t Au;

| |||||||||||||

|

(b) |

Bulk densities used were 2.89 t/m3 for iron-formation poor domains or 3.05 t/m3 for iron-formation rich domains; | |||||||||||||

|

4. |

Caeté - Roça Grande | |||||||||||||

|

(a) |

Mineral Resources are estimated using a cut-off grade of 1.46 g/t Au.; | |||||||||||||

|

(b) |

Bulk densities used were 2.87 t/m3 for RG1, RG2, RG3, and RG6, and 2.75 t/m3 for RG7; | |||||||||||||

|

5. |

Gurupi Reserves are based on the Technomine Feasibility Study Technical Report filed on SEDAR on January 31, 2011; | |||||||||||||

|

6. |

Numbers may not add due to rounding. | |||||||||||||

|

7. |

Mineral Resources for Turmalina, Pilar, and Roça Grande are estimated using an average long-term foreign exchange rate of 2.5 Brazilian Reais: 1 US Dollar and average long term gold price of $1,400 per ounce; | |||||||||||||

|

8. |

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability; | |||||||||||||

|

9. |

Numbers may not add due to rounding. | |||||||||||||

Qualified Persons

Mineral Reserves and Mineral Resources 2015 estimates for Southern Brazil were prepared by Jaguar Mining under the supervision of Jason Cox, P.Eng., and Reno Pressacco, P.Geo. of Roscoe Postle Associates Inc. ("RPA"). RPA is an independent mining consultant and each of Messrs. Cox and Pressacco are Qualified Persons within the meaning of NI 43-101. The effective date of these estimates is December 31, 2015. An independent technical report documenting the Mineral Resource estimates prepared in accordance with NI 43-101 will be filed on SEDAR.

In respect of Mineral Reserves and Mineral Resources 2015 estimates for Northern Brazil i.e. the Gurupi Project, (i) information up to January 31, 2011 is derived from the technical report titled "Gurupi Gold Project Cipoeiro e Chega Tudo Properties Feasibility Study", filed on Sedar on January 31, 2011 (with an effective date of January 31, 2011), (the "Gurupi Feasibility Study"). The Gurupi Feasibility Study was prepared by Ivan C. Machado, MSc. P.E., P.Eng. of TechnoMine; (ii) information on updated Measured & Indicated Resources dated July 30, 2012 for the Gurupi Project has been prepared by or under the supervision of Leah Mach. Gurupi Mineral Reserves and Mineral Resources 2015 estimated were reviewed by Marcos Dias Alvim, BSc Geo., MAusIMM (CP) as the Qualified Person.

Quality Control

Jaguar Mining has implemented a quality-control program that includes insertion of blanks, commercial standards and duplicate core samples in order to ensure best practice in sampling and analysis. NQ and BQ size drill core is sawn in half with a diamond saw. Samples are selected for analysis in standard intervals according to geological characteristics such as lithology and hydrothermal alteration contents. Half of the sawed sample is forwarded to the analytical laboratory for analysis while the remaining half of the core is stored in a secure location. Rock channel sampling of the underground development follows the same standard intervals of the drill core. The drill core samples are transported in securely sealed bags to the Jaguar in-house laboratory located at the Roça Grande Mine, Caeté, Minas Gerais. Some samples are also sent for check assaying to the independent SGS Geosol laboratory located in Vespasiano, Minas Gerais. The rock chip samples are transported in securely sealed bags to the Roça Grande Mine Laboratory, Caeté, Minas Gerais. The preparation and analysis are all conducted at the respective facilities, either at the Roça Grande Mine Laboratory in Caeté, Minas Gerais or at the SGS Geosol Laboratory in Vespasiano, Minas Gerais. The Roça Grande Mine Laboratory does not carry an ISO certification. The SGS Geosol Laboratory is ISO 9001 accredited. As part of in-house QA/QC, the Roça Grande Mine Laboratory inserts certified gold standards, blanks and pulp duplicate samples.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes, and a large land package with significant upside exploration potential from mineral claims covering an area of approximate 191,000 hectares. The Company's principle operating assets are located in a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex ("Mineração Turmalina Ltda" or "MTL") and the Caeté Gold Mine Complex ("Mineracao Serras do Oeste Ltda" or "MSOL") which combined produce more than 90,000 ounces of gold annually. The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. Additional information is available on the Company's website at www.jaguarmining.com.

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected", "is forecast", "is targeted", "approximately", "plans", "anticipates" "projects", "anticipates", "continue", "estimate", "believe" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved. This news release contains forward-looking information regarding the development of the Pilar Gold Mine, the reserve and resource estimates for the Pilar Gold Mine and the assumptions and parameters related thereto, the expected mine life and anticipated gold production. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the availability of financing for exploration and development activities; the estimated timeline for the development of the Pilar Gold Mine; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; and general business and economic conditions. Forward-looking information involve a number of known and unknown risks and uncertainties, including among others the uncertainties with respect to the price of gold, labor disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, procurement and delivery of parts and supplies to the operations, uncertainties inherent to capital markets in general and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent annual information form and management's discussion and analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Jaguar Mining Inc.

Image with caption: "Figure 1 – Location Map of Operating Assets in Southern Brazil (CNW Group/Jaguar Mining Inc.)". Image available at: http://photos.newswire.ca/images/download/20160407_C6491_PHOTO_EN_659741.jpg