Golden Dawn to Fly Airborne Survey to Test New Theory on Location of the Source to the World-Class Phoenix Copper-Gold Mine

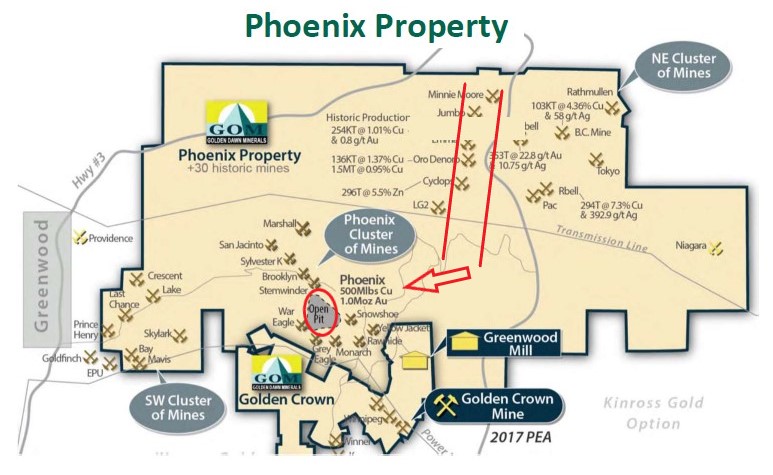

VANCOUVER, BC / ACCESSWIRE / December 15, 2020 / Golden Dawn Minerals Inc., (TSXV:GOM)(FRANKFURT:3G8C)(OTC PINK:GDMRD), ("Golden Dawn" or the "Company"), announces that it intends to fly an airborne geophysical survey in early January over its Phoenix property at its Greenwood Precious Metals project in southeastern British Columbia.

The area planned to be covered by the initial survey will include the area surrounding the historic Phoenix mine and the focus of the program is to explore for the roots of the hydrothermal system that formed the Phoenix copper-gold deposit. Golden Dawn is currently reviewing proposals for the survey and expects to sign a contract within the next few days.

The historic Phoenix copper gold mine was the largest producer in the Greenwood mining camp. Total production from Phoenix is documented as 26,956,525 tonnes of ore containing 30,715 kilograms of gold; 192,055 kilograms of silver and 930,050 tonnes of copper (BC MEMPR Paper 1986-2). The calculated grades are 3.45% copper, 1.02 grams per tonne gold and 7.12 grams per tonne silver.

Starting in 2021, Golden Dawn is planning a staged approach to search for a depth continuation of the Phoenix deposit, including:

- Airborne magnetic and electromagnetic geophysical survey

- Ground Geophysics (IP/Resistivity) in Selected Target Areas

- Compilation of Extensive Database of Exploration Data

- Drill Test High-Quality Targets

Limited exploration has been done to test the Phoenix deposit footprint at depth. One major problem for exploration of the Phoenix deposit at depth is that the Phoenix area is underlain by the Snowshoe fault, which is mapped as a listric-normal fault that truncates the host rocks and, in places, the deposit itself. This means that the Phoenix deposit has likely been offset from its roots, the location of which is unknown. The Snowshoe fault is interpreted as an extensional structure that developed on the flank of the Grand Forks metamorphic uplift during the Eocene. Offset on the Snowshoe fault is predicted to be about 1 kilometer based on regional mapping, so the roots of the Phoenix deposit could lie at least 1 km east of the open pit mine.

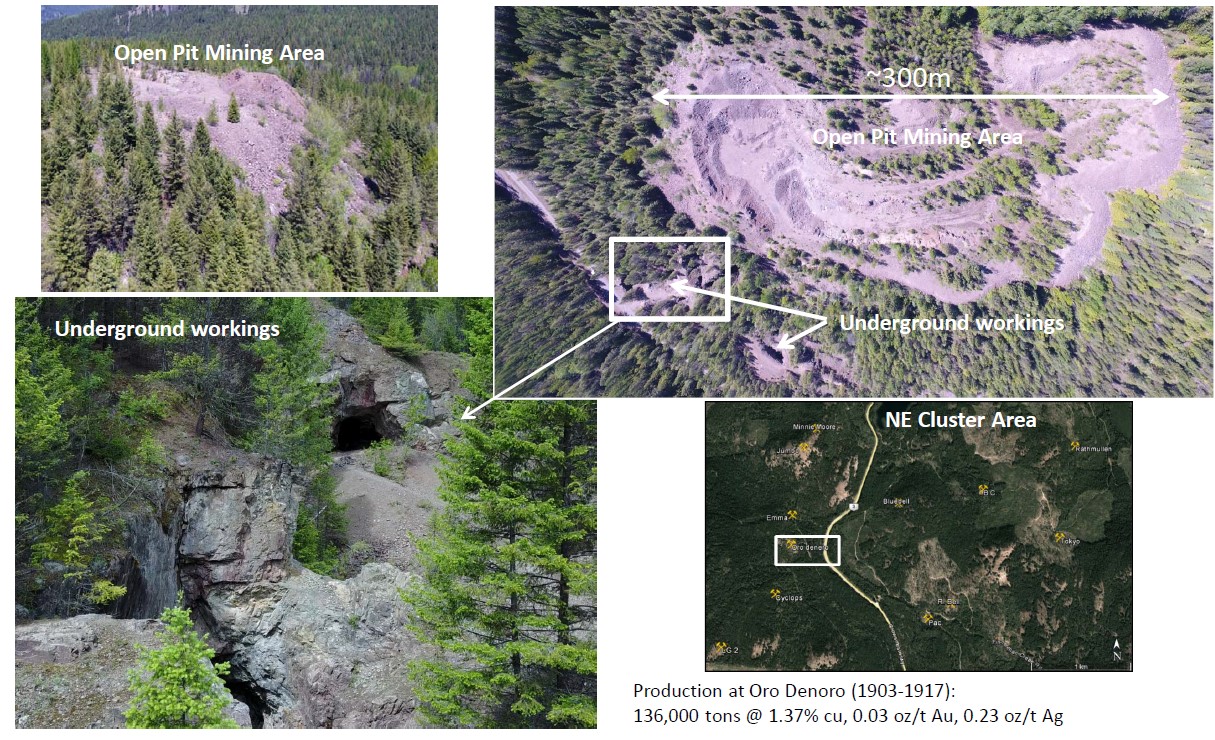

Approximately 2 kilometers east-northeast of Phoenix there is a 2.4-kilometre-long northerly trending corridor of skarn deposits that includes the Oro Denoro, Emma, Jumbo and Cyclops / Lancashire Lass, all hosted by the Brooklyn limestone. The Oro Denoro skarn is thought to be related to the Lion Creek granodiorite intrusion, and the trend of the skarn deposits in the deposit corridor coincides with a lobe of the intrusion that extends in part along the lower contact of the Brooklyn limestone. This is the same contact that is mineralized at Phoenix. As such, it is interpreted that the Phoenix deposit could be the upper part of the hydrothermal system that formed the corridor of skarn deposits, before being offset by the Snowshoe fault. The roots of the Phoenix deposit should therefore lie in the area of the northeast cluster of skarn deposits of the Phoenix mine.

Aerial photographs of the Oro Denoro historic copper-gold mine.

Production from the historic Oro Denoro mine for the period 1903 to 1917 totalled 124,001 tonnes containing 117 kilograms of gold, 954 kilograms of silver, and 1,691 tonnes of copper (BC MEMPR Paper 1986-2). Calculated grades are 1.36% copper, 0.94 grams per tonne gold and 7.7 grams per tonne silver. These grades are lower in copper but otherwise similar to those at the Phoenix deposit. In the early 1970's several thousand tonnes were extracted from the Oro Denoro and processed at the Phoenix mill.

Readers are cautioned that historical records referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

Technical disclosure in this news release has been approved by Dr. Mathew Ball, P.Geo., President of the Company and a Qualified Person as defined by National Instrument 43-101,

For more details, please see the most recent National Instrument 43-101 Technical Report on the Company's website at www.goldendawnminerals.com.

On behalf of the Board of Directors:

GOLDEN DAWN MINERALS INC.

Per: "Christopher R. Anderson"

Christopher R. Anderson

Chief Executive Officer

For further information, please contact:

Golden Dawn Minerals Inc. - Corporate Communications:

Tel: 604-488-3900

Email: [email protected]

Forward-Looking Statement Cautions: This news release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, relating to, among other things, preliminary plans for a consolidation of the Company's Shares. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange will not approve the proposed share consolidation, and that the Company may not be able to raise sufficient additional capital to continue its business. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects. This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The Company's securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL, OR THE SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY SALE OF SECURITIES OF THE COMPANY IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE: Golden Dawn Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/620909/Golden-Dawn-to-Fly-Airborne-Survey-to-Test-New-Theory-on-Location-of-the-Source-to-the-World-Class-Phoenix-Copper-Gold-Mine