View valuations (existing members please log in)

Subscription

Critical tools and insight from INK Research

Canadian Insider is distinct place that provides you with the tools you need to monitor your investments and find new opportunities.

Join the Canadian Insider Ultra Club for unlimited access to CanadianInsider.com charts and filings tables. Club members also receive unparalleled insight from core INK Research reports which are designed to build and protect your wealth during this period of uncertainty and shifting opportunity. A Canadian Insider Ultra Club membership* is only C$432 per year or C$39.99 per month, plus tax. Regular memberships paid by credit card are auto-renewing until cancelled which is easy to do in your account settings Membership Status tab.

One of the most popular features with our members is our intraday alert watchlist notification service (up to 50 stocks). These include email alerts for Canadian and US insider filings emailed to you intraday:

It can be a positive sign when insiders are buying a stock that has relatively cheap valuations and a warning sign if they are heavily and consistently selling an expensive name. Put this insight to work by monitoring the Canadian Insider valuations tab for every company you follow.

It is rare to see insiders buy a stock outperforming the market. When they do, it can be a positive sign. Likewise, if they are selling a name that is losing momentum, this can be a warning sign. It is more usual to see insiders buying a beaten down stock, which is a positive contrarian sign. However, it is usually a bad sign to see insiders selling a losing name. Use the Canadian Insider company chart to see if insiders are buying in relation to recent price action and use custom charts to put insider activity into the context of a stock’s technical trend.

Green icons on the chart indicate insider buying while red indicates. Scroll over any icon on the company page chart for transaction prices.

Harnessing the power of the INK Research data warehouse with its decades of information, every night the INK Edge outlook ranks over 6,000 US and Canadian stocks for you based on our V.I.P. criteria:

- Valuations

- Insider commitment

- Price momentum

We assign a Sunny outlook to the strongest stocks while weakest end up in the Rainy category. Those with promising outlooks are assigned a Mostly Sunny outlook while those with above average risk get a Cloudy reading. Stocks in the middle are of neutral interest but any one of them could surprise to the up or downside. Note, outlooks are not stock recommendations but seek to categorize opportunity and risk based on our V.I.P. metrics

Look for the INK Edge outlook in our core INK Research morning, company, and monthly Top 40, Energy Top 30, and Mining Top 20 reports.

Get the latest INK Edge outlook for a stock by downloading an INK Company Report. Reports also include the latest insider transactions which include share buybacks, key value ratios and relative performance metrics. Your membership includes 30 free reports every month. Click here for a sample.

Stay on top on what corporate executives are doing with shares in their own companies and identify potentially underpriced or overpriced situations in our daily morning report.

Every trading day, INK Research highlights one or two stocks with strong short-term or contrarian insider trading signals. These morning reports cover broad opportunity from large blue-chip names to riskier micro-cap ones.

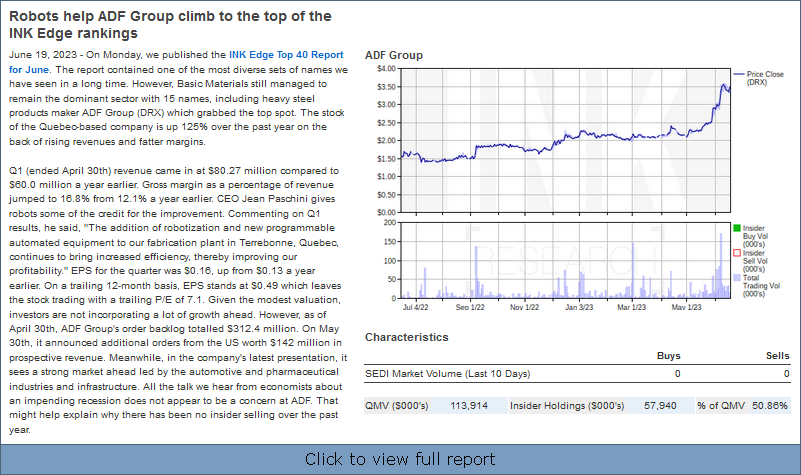

Below are some recent examples of how the INK Research morning reported added value for our members in the tough Canadian market year 2023:

The INK morning report can be a valuable resource when the market environment is primed for mergers and acquisitions. The oil patch in 2022 provides an example:

- Full access to all company pages

- Full access to Top Filers tables

- Recent Filings page screening

- Press release alerts (optional)

- No Google ads

- INK Chat community forum eligibility (weekly INK Edge workbook, service alerts and more)

Join the community based on independent, non-sponsored research that follows the smart money to help manage risk and build wealth:

Join us

To compare the features of our different subscription plans, click here.