Canadians' Financials Take Hit Due to Inflation and Rising Costs: BDO Canada Affordability Index

Canadians' Financials Take Hit Due to Inflation and Rising Costs: BDO Canada Affordability Index

Canada NewsWire

TORONTO, Sept. 29, 2022

Retirement savings, discretionary spending plunge as more Canadians struggle to afford anything beyond essentials

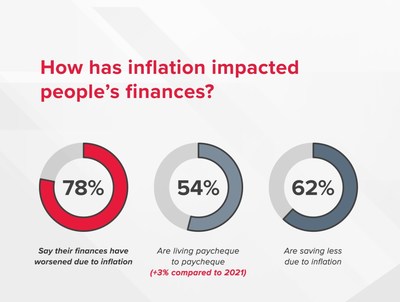

TORONTO, Sept. 29, 2022 /CNW/ - A greater number of Canadians are finding it increasingly challenging to make nearly all types of purchases, according to the fifth annual BDO Affordability Index from BDO Debt Solutions. The survey, which examines the affordability and financial health of Canadians, found more than three-quarters of Canadians (78%) say their personal finances have worsened due to inflation, while just over half (54%) say they're living pay cheque to pay cheque – an increase of three percentage points over 2021. Six in 10 Canadians are also either saving less, or not at all – especially for retirement – than they were in 2021.

"The findings from this year's Affordability Index highlight the increasing proportion of Canadians who are struggling to keep up financially," says Nancy Snedden, National Leader of the BDO Debt Solutions practice. "With inflation and rising costs, affordability challenges have returned to, and in some cases, surpassed pre-pandemic levels. It's concerning to see that Canadians are experiencing more financial difficulties today compared with the last three years."

The online survey of over 2,000 Canadians, conducted by the Angus Reid Group, found the rising cost of essential goods and services is the greatest contributing factor to increasing debt (84%), up 14 per cent from 2021. And 42 per cent say their debt has become overwhelming– almost double the levels seen in 2021.

While the majority of Canadians say they have enough money to buy the things they need, this number is lower than a year earlier (66% in 2022 vs. 70% in 2021.) Nearly one-third of Canadians (35%) say it's challenging to feed themselves and their family (an increase of 12% compared to 2021), while 52 per cent find it difficult to afford transportation (an increase of 17% compared to 2021). Discretionary spending has also taken a hit. Sixty-one per cent have cut spending on restaurants/take-out, along with travel (60%) and home electronics (53%).

Spending more on essentials means there is less money for savings and debt repayment. This is highest in Atlantic Canada where 91 per cent of respondents (78 per cent nationally) indicated spending on groceries, rent or mortgage, and other essentials was the primary reason for saving less.

More than four in 10 Canadians have also cut savings for retirement, while 71 per cent say saving for retirement is a challenge – an increase of six percentage points over 2021. As a result, 64 per cent of Canadians now say they are not on track to save enough for retirement – a jump of four percentage points in the last year – of which nearly half say they are very far behind. Among those aged 18 to 24, more than two-thirds (67%) say they have no retirement savings at all. Overall, 32 per cent of Canadians say they have no idea what their retirement plan will be, and one-third claim they will never stop working (through part-time/occasional work), despite wanting to retire.

"As Canadians continue to feel the squeeze on their financials, it's important they try to remain optimistic and not give up on looking for solutions, adds Snedden. "For those requiring support in overcoming debt challenges, there are always answers. You can speak to a Licensed Insolvency Trustee, who can help you look at the full picture and determine how to make the most impact on paying down debt."

BDO Debt Solutions has over 160 locations across Canada and over 60 Licensed Insolvency Trustees (LITs). BDO's LITs and debt professionals are committed to helping Canadians take control of their financial future and turn the page on debt. LITs are the only professionals that are licensed by the federal government to file consumer proposals or bankruptcies on behalf of individuals.

About the BDO Affordability Index

In partnership with BDO Canada, Angus Reid conducted the fifth annual online survey from August 5 to August 11, 2022, among a representative randomized sample of 2,008 Canadians age 18+ who are members of the Angus Reid Forum. For comparison purposes only, a probability sample of this size would yield a margin of error of +/- 2.2%, 19 times of out 20. Discrepancies in or between totals are due to rounding. Complete results of the 2022 BDO Affordability Index are available through the contact below.

About BDO Debt Solutions

BDO Debt Solutions is one of Canada's oldest and largest debt help firms, helping Canadians find the right solutions to their debt problems since 1958. In offices across the country, BDO's local teams of debt professionals include Licensed Insolvency Trustees (Officers of the Court and Licensed by the OSB), Proposal Administrators and Credit Counsellors who provide consumer proposals, personal bankruptcy services and credit counselling.

To learn more, please visit bdodebt.ca or follow BDO Debt Solutions on Twitter, Facebook, LinkedIn and Instagram.

About the Angus Reid Group

Angus Reid is Canada's most well-known and respected name in opinion and market research data. Offering a variety of research solutions to businesses, brands, governments, not-for-profit organizations and more, the Angus Reid Group team connects technologies and people to derive powerful insights that inform your decisions. Data is collected through a suite of tools utilizing the latest technologies. Prime among that is the Angus Reid Forum, an opinion community consisting of engaged residents across the country who answer surveys on topical issues that matter to all Canadians.

SOURCE BDO Canada Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2022/29/c5787.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2022/29/c5787.html