You are here

Home Blogs Nicholas Winton's blogWill copper score a TKO in the new year?

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

One of my favourite metals this year has been copper. In large part, investors should embrace the base metal due to the election of Donald Trump. The US president-elect himself promised to implement a huge infrastructure spending program across the country to fortify America's "roads, bridges, airports, transit systems and ports."

Of course, we also have seen other base metals, like nickel and zinc soar, long before the US election took place. And with other natural resources like oil also on similar upward trajectories, I believe we are seeing clear signs of inflation, one that will lead investors into a powerful commodities rally.

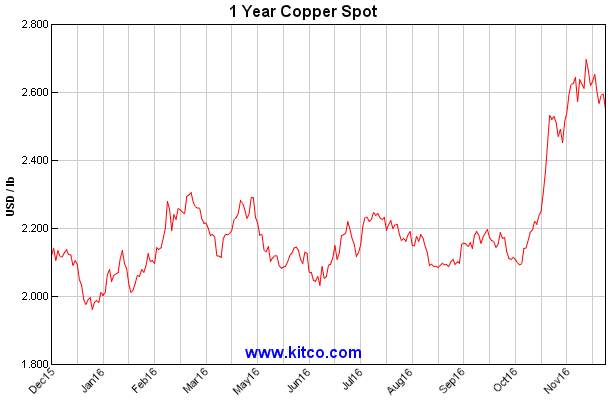

Copper has risen from $2 per pound in early 2016 to $2.55 for a 27% gain. That includes a massive 9% rise during a wild 3-day period in November. What's interesting is that it has made a move this large on 17 occasions since 2000. Furthermore, history is on the side of copper going forward- even after such a momentous rise. 15 out of 17 of these '9% in 3 day' moves resulted in a higher copper price one year later. What's more, after 3 months, copper averaged 14.3% gains. After 6 months, the base metal averaged 24.8% gains. And after a year, the metal averaged 41.9% gains. Impressive stuff.

I am forecasting a bullish move in the New Year, so these historical averages support my outlook for copper.

While copper is undergoing a correction and copper warehouse stocks are on the rise, a lower entry would be welcome as the seasonal trend for copper is very bullish starting from late December into the first quarter.

How to profit? One can certainly buy a copper ETF. But why buy a metal ETF when you can buy copper miners that are likely to outpace the aforementioned if copper price gain projections come to fruition.

My top pick is Taseko Mines (TKO) and I do hope to score a Technical Knockout (TKO) with this copper pick, as my signals are very bullish on the stock's prospects over the next few months. They are a low-cost copper producer that has survived some of the worst market conditions over the past 10 years. However, in addition to copper, they produce silver and have reopened a molybdenum mine. Between July and November, three insiders bought 225,000 shares between 71-75 cents. Robert Dickinson sold 37,500 shares on Nov 24, though he was one of those three insiders buying 180,000 shares back in July. On Dec 8, CEO Russ Hallbauer sold 81,000 shares - though this was makes up just 3% of his holdings. One day earlier, officer Brian Battison added 10,000 shares at $1.10, increasing his holdings by 5.3%. With all that said, what's important to note is that insiders own 21%, a good healthy percentage. (Our Hedgehog Trader Newsletter subscribers added shares at 55 cents.)

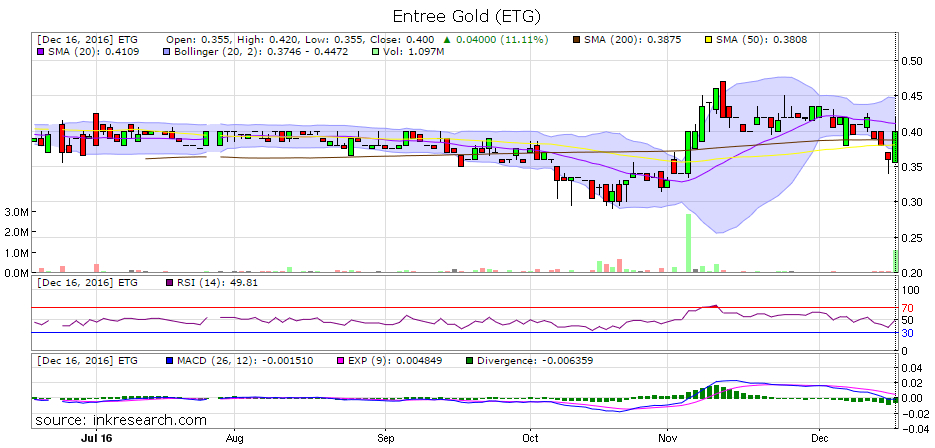

Another copper junior that has been around for many years and is drawing attention is Entree Gold (ETG). Insiders own an impressive 36% of the company's shares. Insiders picked up over $360,000 worth of equities this year and have sold none. 6 different insiders have bought shares since September, including the CEO and CFO. They own a 20% stake in a large copper project in Mongolia and some believe their stake might be subject to buyout by the majority owners. As well they also own a 100% interest in a Nevada copper project.

Nevada Copper (NCU) is a junior that has also perked up of late. What's striking is that insiders own 53.9% of the company's shares. The company is a near-term producer at its Pumpkin Hollow project in Nevada. There have been no insider sales this year, though had just one 5,000 share buy.

And since we are at that time of the season when many Venture stocks begin to rally into the New Year, a third and more speculative copper idea is Gold Reach Resources (GRV). They have a reasonable share structure at 40 million shares, and the company is exploring an intriguing copper-gold-moly-silver project in BC. Insiders own 28%. What's interesting is that 7 different insiders have bought shares over the past year, buying $267,000 worth of shares in this period.

If a bubble continues to grow in the financial markets as I am projecting next quarter - then copper and copper stocks will perform very well going forward.

I invite you to tune into my Twitter stream at http://www.twitter.com/hedgehogtrader for comments, predictions and updates on copper as well as stocks in a variety of different sectors.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.