You are here

Home Blogs Nicholas Winton's blogSilver and silver stocks prepare for their next leg higher

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

In my Jan 27th technical review on silver and Silver Standard (SSO), I stated I was very bullish on silver and silver equities in part due to the strong relative strength of silver during the steep January stock market correction. Since that post, Silver Standard has risen about 50% and the price of silver has risen as much as 10%. Indeed, both gold and silver stocks alike have performed very well. Another junior miner Claude Resources (CRJ) which we covered in a Dec 11th technical review has also gained 50% since our review highlighting its relative strength.

In my view, we are indeed seeing the start of the next bull market in gold and silver and the tremendous gains in mining stocks are simply the beginning of a reflation of the sector, which has seen valuations smashed over the past 4 years.

For this reason, I am not looking for major price corrections in mining stocks in the near term - instead, I believe the 'corrections' to watch for are actually the pauses or sideways movement we are seeing in many precious metal stock charts. This is precisely the behaviour we saw from mining stocks as they emerged from the 2009 market crash. Back then they rallied and then moved sideways before resuming their rally. This gave mining stock short-sellers no mercy, as they rallied for weeks on end.

Below, I highlight several intriguing plays for a continued rally in the silver sector.

One miner not many people know about which I like a lot is Avino Silver (ASM) and the reason is that the small $40 million market cap silver producer has plans to double and triple production over the next 3-4 years, potentially generating 4-5 million ounces of silver production annually. But surprisingly, there's even more value here, as the miner is also looking to begin gold production in 2017. It's likely to begin small, in the range of 30-50k ounces that first year, but their plan is to ramp production up to 100-200k or more over the following 3 years. So, if we're headed into a new bull market for gold and silver, an aggressively growing Avino, a company whose silver costs are in the lowest quartile, should be highlighted on investors' watch lists. The company, guided by its experienced CEO in David Wolfin, has flown under the radar for some time - but I feel a major valuation re-rating is coming. Over the past year, net buying of shares by insiders, largely by the CEO and 3 directors has reached $841,783.

Another way to play silver is on the pure exploration front in the form of Levon Resources (LVN). Levon is no newcomer, for it has already accumulated a significant resource of close to 500 million ounces of silver, plus 1.5 billion pounds of zinc. At a modest $100M market cap, Levon is being valued at 20 cents per ounce of silver. And lest you think this is an exploration-only play, investors should also know Levon also owns 10% of Pershing Gold Corp (PGLC*US) which is rapidly moving toward gold production in Nevada and backed by billionaire Philip Frost. According to a preliminary economic assessment published in 2012, Levon needs silver to trade at $20 for its deposit to be economic and I think we're going to see shares respond very strongly as this silver rally intensifies. Insiders have been buyers from November through as recently as February 3rd. Director Ron Tremblay has been a big buyer scooping up about 1.5 million shares since July.

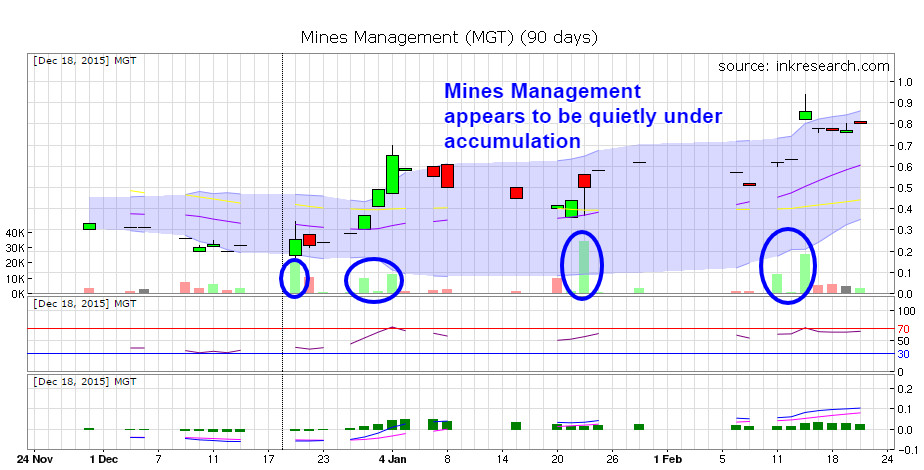

On Feb 12th, another of my favourite silver plays, Mines Management (MGT) received the go-ahead to build their Montanore silver mine after waiting an entire decade. Their resource boasts 230 million ounces of silver and over a billion pounds of copper. Their PEA suggests their mine can produce 8 million ounces of silver and 60 million pounds of copper per year for 15 years. It's worth noting that a silver production figure of 8 million ounces per year would place it among the top 10 producing silver mines in the world. Its market cap is also small and leveraged, with just under 30 million shares outstanding. It will require $500 million to build the mine, but it has very robust economics. And the company which has already waited 10 years, can afford to wait for even higher silver prices before securing those funds at the best of terms. Also notable is that 16% of the company is held by insiders. Shares on the Canadian side are traded thinly as you can see by the chart, but are far more liquid on their US listing under the symbol MGN*US.

Incidentally, the aforementioned Silver Standard Resources remains a favourite of mine and shares are right back at their 200 day moving average. Shares appear to be carving out a bullish saucer pattern that could see it embark on its next bullish leg higher.

At present, the price of silver is dancing near its 200 day moving average. In the chart we've drawn, we are looking for the next up-leg in silver and the miners to take place once silver breaks and closes above $15.50. I do think silver has a shot at reaching $16 an ounce over the next month. In fact, our forecasts suggest we could see silver's uptrend last until mid to late March.

Disclosure: This article first appeared for INK Research subscribers on February 25, 2016. The author owns shares of Levon Resources and Mines Management. Avino Silver is a recommendation in the author's Hedgehog Trader Newsletter

Tags:

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.