You are here

Home Blogs Nicholas Winton's blogA mining rally at last? Waiting for gold dough

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

In a previous blog, we suggested we'd see a rally for miners into the end of September. Mining stocks did rise about 10% from the end of August until about Sept 22nd. Unfortunately for the bulls, heavily piled up short positions as evidenced through commitments of traders reports took their toll on gold, and the miners themselves were pulled under their support, toppling 18% to their recent lows.

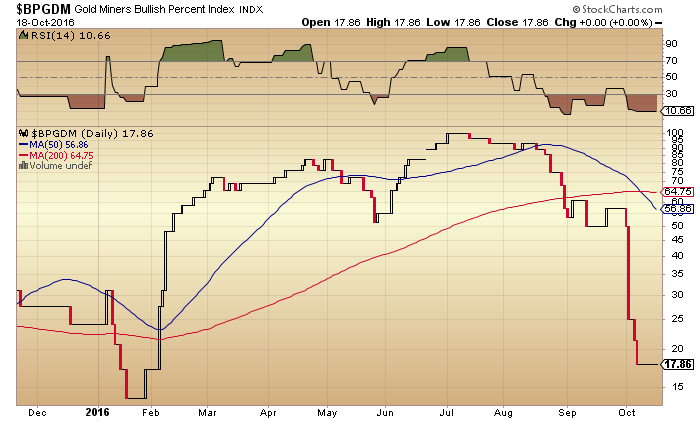

Not surprisingly, the Bullish Percent Gold Miners chart shows a huge drop off in sentiment over the past few months, as only 17% of gold miners are in an uptrend. The only lower reading in recent memory was January with a reading of just 14%.

The good news is that over the last 10 days or so mining stocks have been basing, and now, at long last, miners are showing signs of a rally that traders can profit from.

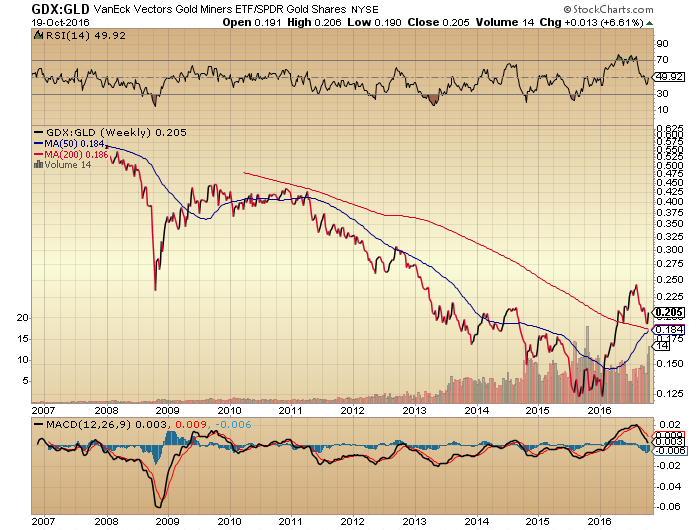

Signs of a fresh rally can be seen in our handy gold miners to price of gold ratio which has just turned up, indicating mining stocks are starting to outperform the metal.

Miners in the HUI Gold Bugs Index have about 10% upside until they run into first resistance but individual miners may offer more upside given the drubbing they've suffered.

Two silver miners we alerted our subscribers to as great buys Tuesday are Alexco Silver (AXR) and Avino Silver (ASM). Alexco is a successful silver explorer that also offers the upside of a producer should silver prices continue to firm up and allow the company to recommence production. Avino is a low cost silver producer I alerted INK readers to several months ago before it soared, and with year's end approaching, it's worth repeating that Avino will soon be doubly-attractive, because it will become a gold producer in 2017.

Some smaller miners may interest gold stock speculators, especially those that have been showing strength during recent metal price weakness.

One such microcap idea is Corex Gold (CGE). They are a near-term gold producer in Sonora, Mexico at their open pit Santana Mine which is under construction but fully permitted. They also own an interesting second project which is a joint venture with Goldcorp (G). Alamos Gold (AGI) recently participated in a financing, purchasing 25.3 million shares at 10 cents. The company's president Craig Schneider has M&A experience and founded Magnum Uranium which was later sold to Energy Fuels (EFR). A second key individual is Chester Millar who is a renowned mine builder. He built and sold Afton Mines to Teck Cominco, and founded Castle Gold and Pediment Gold and made a tidy profit when he sold both to Argonaut Gold (AR).

In the near term, we are likely to see an upswing for the out of favour miners, followed by some year end selling that allows investors to re-position for a significant rally early in the New Year.

A look at the big picture for the mining sector is helpful as well. And since the miners usually lead the metals, this long-term chart shows the new gold miners uptrend that began in January remains intact. Importantly, for the miners to continue on their bull run, gold bulls need the ratio to remain above the 0.20 level.

Follow my Twitter feed http://www.twitter.com/hedgehogtrader for updated commentary on miners and other stocks.

Nike air jordan Sneakers | Mens ASICS GEL-Kayano 28 Running Shoe at Fitforhealth

Tags:

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.