You are here

Home Blogs Nicholas Winton's blogINK CIN Canadian Insider Index rallies 1%, momentum indicators remain strong

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

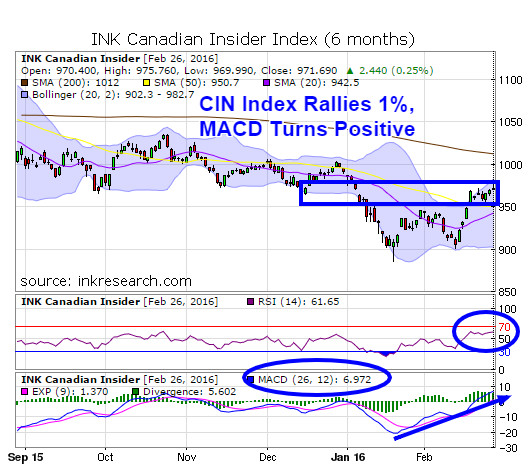

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Since our last update, the CIN Index continued its climb, rising 11 points or 1% and it even reached a high of 975.76, before closing the week at 971.69. The close on Friday was a bit negative, as it closed down over half a percent from its highs and left a reversed hammer pattern. However, we did see a similar reverse hammer pattern on Feb 22nd and it simply led to a 2-day pause before the Index made a new multi-week high.

What's good for the bull case is that the Index is now 90 points or 10% above its January lows and momentum indicators are beginning to show signs of changing character for the positive. For one thing, RSI held above the 60 level for an entire week for the first time since October. Secondly, MACD finally rose into positive territory, closing above 5 for the first time since the same October period. In order for forward momentum to continue, bulls would like to see RSI remain above 50 and ideally above 60.

With Friday's reversal candle, we may be due a pause, but the Index is now looking stronger than it has in many weeks. Looking ahead, major resistance and more areas of congestion sit overhead in the 980 area, while minor resistance is 975. Minor support is at 960 and major support is 950. If momentum softens this week, we may see the Index remain in a 960-975 range, until it can build up enough strength to make a second attempt a breakout.

Running sports | Supreme x Nike Air Force 1 Low 'Box Logo - White' — Ietp

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.