You are here

Home Blogs Nicholas Winton's blogINK Canadian Insider Index slips to 1300.67 ahead of Canada Day

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

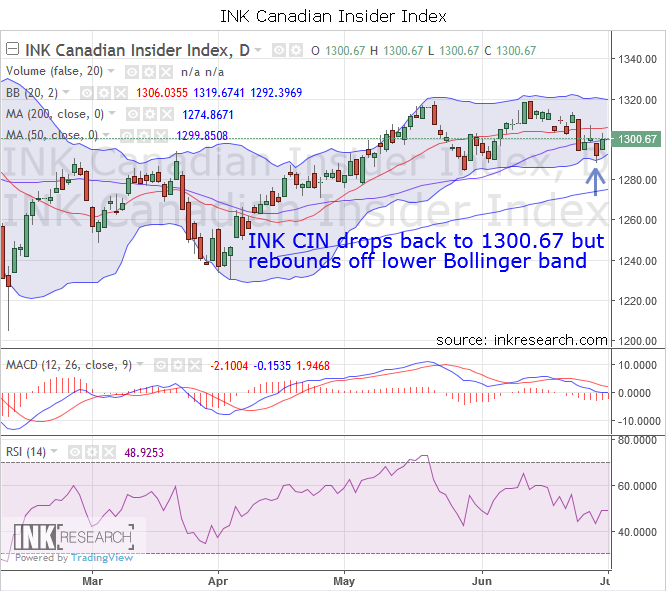

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Despite appearing ripe for an advance based on the Index hugging the 1300 area for a couple of weeks in a row, the Index slipped last week. The INK CIN fell as much as 22 points to 1288.60 on an intraday basis (a shade below its lower Bollinger band), before scrambling to finish the week at 1300.67 for a loss of 12 points or nearly 1%.

MACD fell 2.21 points to -2.1. RSI fell 2.4 to 48.93.

Support is at 1294 and 1300. Resistance is at 1310 and 1315. While the INK Canadian Insider Index looks fairly neutral at present, its bounce off its lower Bollinger band (briefly piercing it) may be a bullish sign. While this is no guarantee of a repeat, the reversals the INK CIN enjoyed in early February and early April began after the Index initially plunged below the lower Bollinger band and embarked upon a multi-week move higher.

While the US Dollar chart appears vulnerable to a decline in the near-term, it has not yet broken down. Until that happens, The INK Canadian Insider Index and even oversold commodities like silver and copper will need to bide their time. Whether the dollar enjoys one final sprint or not remains to be seen. What is for sure is that the next couple of weeks should prove very interesting.

Sports Shoes | Nike Wmns Air Force 1 07 Essential White Silver Gold Women Casual , Cellmicrocosmos Marketplace

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.