You are here

Home Blogs Nicholas Winton's blogINK Canadian Insider Index rumbles to 1000, faces resistance

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

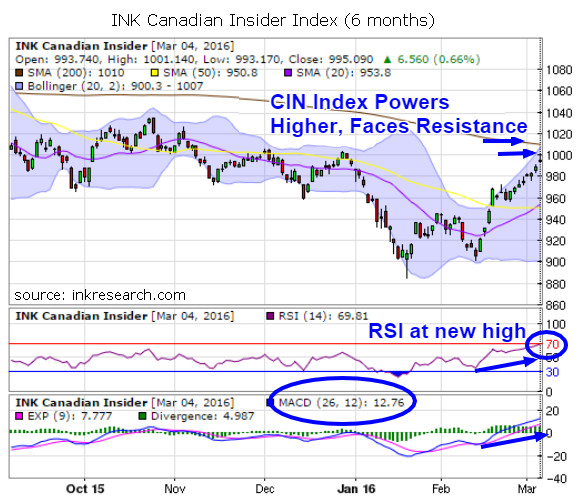

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. In our review one week ago, we suggested that the seemingly bearish candle two Fridays ago might only mean a slight pause (and not a meaningful reversal). After a mere one-day pause, the Index turned on the afterburners and surged 2.4% or 23.4 points to 995.09. Interestingly, the Index closed Friday much the way it closed the previous Friday, with a reverse hammer.

Short-term momentum indicator RSI was red hot, closing at an 11-month high of 69.81. Equally as impressively, MACD the Index's longer-term measure of momentum nearly doubled, climbing to 12.76.

Resistance now comes into play at the round number of 1000 which held the Index back for all but a few weeks of the Fall, looms as a potential hurdle, as well as at 1010, the 200-day moving average of the Index. A break above the latter would be particularly bullish, especially given the Index's snowballing momentum. Above 1010, there is little resistance until the 1100 mark, and a close above 1050 could incite a lightning fast gain of anywhere from 40-90 points (or as much as 9%).

At present, minor support is 980 and major support is 960. Minor resistance is 1000 and major resistance is 1010.

Given that reverse hammer close on Friday (similar to the previous Friday), it will be interesting to see whether the Index repeats last week's action where it takes a breather before making new highs or whether it finally corrects after this massive rally which has now lifted the Index 13% off its January lows.

That said, there are no bearish divergences in the chart and momentum appears clearly in the bulls' favour.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.