You are here

Home Blogs Nicholas Winton's blogIs the INK Canadian Insider Index finding a higher range?

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

Technical Overview by Nicholas Winton, Hedgehog Trader and @HedgehogTrader on Twitter

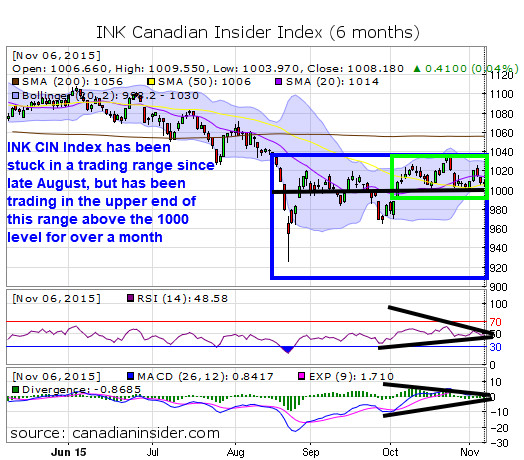

Thank you for joining us for our weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Since our last update, the CIN Index has been fairly quiet, initiating only a small rally to its 1020 resistance level before retreating back to its 1000 support. Its technical indicators MACD and RSI read neutral - seemingly waiting for the next market catalyst to drive their direction.

While the Index has been locked in a tight trading range for virtually the entire fall, one positive sign is that it has traded exclusively above the 1000 point level at the top right quadrant (marked by a green box) of its box pattern over the last month. We'll soon see if this new higher range can last. What we know is that the longer this critical 1000 level support remains intact, the stronger this line of support becomes. Of course, since major resistance at 1020 and 1040 have stone-walled rallies 6 or 7 times, this tight range of consolidation could continue even longer, perhaps even into year end.

If momentum doesn't pick up for the Index over the next week we can't rule out a flush back down to 960 as we saw in late September. However, given the resilience and persistence shown during its nearly 10-week journey since the late summer sell-off, the Index's behaviour suggests it is likely to be able to overcome weakness. That's because the chart's sideways pattern suggests to me it is biding its time until it can successfully break through resistance and escape its 'box.'

Impatient investors should take note that long bases and consolidations are considered very bullish. The longer the base moves sideways, the larger and more significant the ensuing rally tends to be.

Authentic Sneakers | Nike Air Force 1 , Sneakers , Ietp STORE

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.