You are here

Home Blogs Nicholas Winton's blogINK Canadian Insider Index corrects as silver and oil surge

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

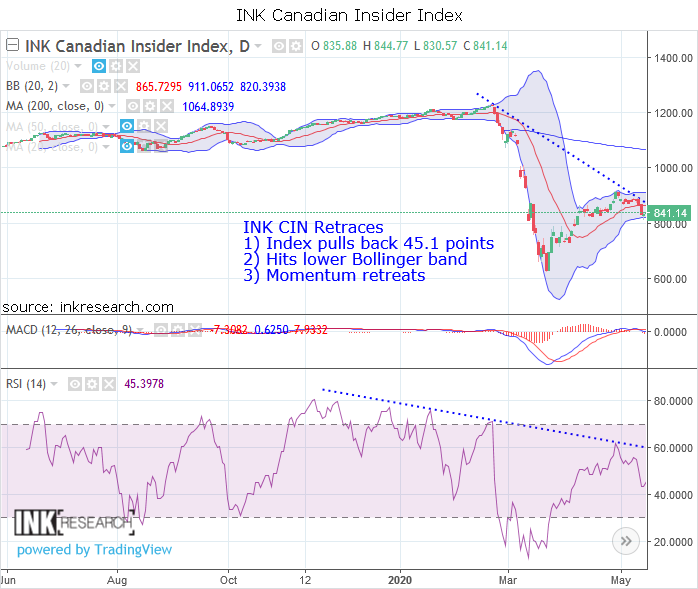

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. After some impressive weeks where it outperformed both US markets and precious metals, the Index endured a strong pullback of 45.1 points or 5% to 840.14 last week.

MACD plunged 8.9 points to -7.3. RSI slid 10.39 points or 19% to 45.4.

Support is at 820 (lower Bollinger) and 809. Resistance is at 865 (middle Bollinger) and 911 (upper Bollinger band).

As far as performance goes, the INK Canadian Insider Index lagged copper (-0.66%), the SPDR S&P 500 ETF (SPY*US) (0.45%), gold (0.88%), silver (5.66%), and crude oil (5.88%).

Precious metals began to break out last week, and we saw the miners outperforming the metals, suggesting higher highs are on the way for gold and silver. Copper had a nominal loss, but, notably, Global X Copper Miners ETF (COPX*US) rose 1.76%. And since miners lead metals, we remain bullish on copper and inflation. Oil's continued explosion also supports our case. A scenario with rising silver, oil, and copper also dovetails with my inflationary forecast that suggests markets and commodities are headed higher into mid-June or so.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).

best Running shoes brand | Air Jordan Release Dates Calendar

Category:

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.