You are here

Home Blogs Nicholas Winton's blogThe INK Canadian Insider Index bounces back 5.7%, along with markets, metals

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

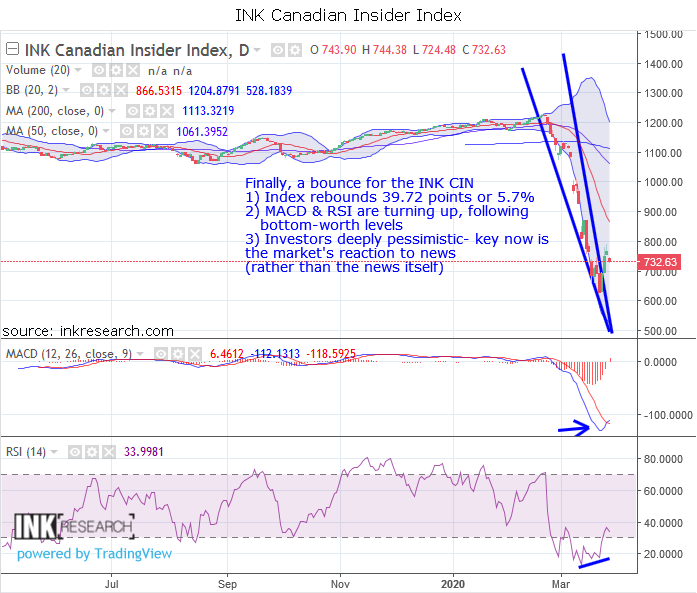

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, after a two-week 40% panic washout, the INK Canadian Insider Index bounced back 39.72 points or 5.7% to close at 732.63.

MACD shot up over 46 points to close in the black at 6.46. RSI rose 14.22 points or 72% to 34. Our note that the positive divergence in RSI which began to slope higher even as price fell, proved prescient.

Support moves up to 685 and 690. Resistance moves to 760 and 800.

As far as performance goes, the Index beat copper (0.02%) as well as outpacing crude oil (-4.95%) for the fourth week in a row. However, the INK CIN did underperform the SPDR S&P 500 ETF (SPY*US) (10.76%), gold (11.42%), and soaring silver (17.35%).

Markets and metals began to bounce back last week, providing investors with some relief. Of course, we will need to see crude oil join that rebound if markets are to enjoy any kind of sustained rebound, especially since oil has been on a nasty non-stop plunge since it topped in early January. So, one key is to watch and see if oil can start to carve out a bottom and a second key is to see how markets react to news, especially bad news. Sentiment is very poor as we mentioned last week and, going forward, should we see markets rally on bad news or on 'less bad news' then we might deduce markets have made an important turn for the better.

Category:

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.