You are here

Home Blogs INK Staff's blogEnergy will be key for Canadian investors and politicians in 2019

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

In his latest Howe Street interview with Jim Goddard, INK Research CEO Ted Dixon sees the Energy sector as being key to the fortunes of both Canadian investors and politicians in 2019. Based on INK's indicators he also sees a period of consolidation ahead for Canadian stocks. Meanwhile, in the United States investors seem inclined to favour high-priced growth stocks again. We are seeing some of that in Canada too, as cannabis stocks enjoy renewed investor interest despite the risks.

INK Energy Report: Turnaround time in the Canadian oil patch?

Building on INK's key theme outlined in the January Top 30 Energy Report (Turnaround time?) that we appear close to confirming a turnaround in Canadian oil & gas stocks, Dixon suggests there is probably more risk to the upside than down side in the sector right now.

The market has discounted a lot of bad news, and there is always a possibility that politicians may change in Ottawa, or their attitudes may change, and we get some constructive work in the oil patch. So, there is an upside risk and I think investors have been getting a little too gloomy. I can understand why they are gloomy about the Canadian oil patch, but all that gloom for the most part is baked into the prices. What's not baked in is any upside surprise.

According to Dixon, despite forces in the Liberal Party of Canada that appear to have an agenda to stop the Trans Mountain pipeline, the project probably will eventually get built.

However, it will not get built in time to boost the Canadian economy this year and that will have repercussions politically. Dixon believes Justin Trudeau's Liberal Party is miscalculating when it believes it can drag its feet on Trans Mountain and score political points outside of Alberta. Moreover, he suggests Mr. Trudeau's leadership could come under threat within the Liberal Party in light of friction with China:

Maybe there will even be a shake-up in the Liberal Party leadership because Mr. Trudeau's performance over the past few months has not been impressive when you look at how he has handled the China situation.

Dixon suggests that Justin Trudeau has not provided an effective response to China who is being a tough customer on the Meng Wanzhou arrest issue. That is likely leading to questions within the Liberal Party about Mr. Trudeau's abilities.

With respect to U.S. stocks, INK indicators suggest there is only a 50/50 chance that the S&P 500 Index can remain over 2,600. One discouraging development for value investors is the re-emergence of growth stocks.

We are seeing a shift back to growth stocks which is like the bad old days for value investors. We had a dip in December when all of a sudden we saw value emerging in the US market. But with the Fed saying we are probably not going to raise interest rates, you have investors probing growth stocks again and seeing how high they can push share prices

Growth stocks lead the rebound in the US (click for larger)

Seeing investors scrambling for growth stories implies they believe sustainable broad American economic growth will be in short supply:

If investors believed there was growth everywhere around the corner, you wouldn't need to go scrambling for high-priced growth stocks. You could buy the cheapest stocks in the market because you would assume they are going to benefit from a growing economy. But that is not what is happening.

The rebound in Canadian cannabis stocks is mirroring the growth stock trend in the United States. However, based on insider trends, the opportunities in the cannabis group are specialized (See January Top 40 Finally some stocks on sale).

Ones that are more internationally focused. That seems to be where most of the positive insider activity is taking place. Not so much those servicing the Canadian market. That peak was around legalization day in October.

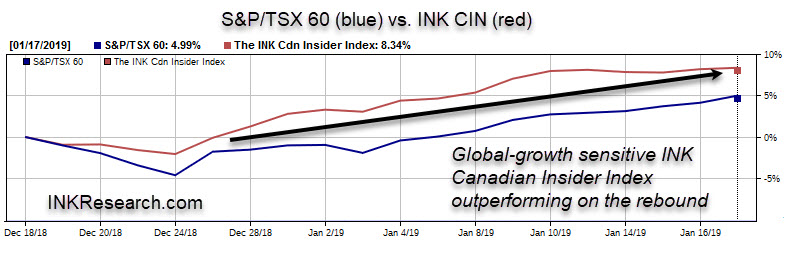

Beyond marijuana stocks, there is a positive note in Canada. The INK Canadian Insider (CIN) Index has been outperforming the S&P/TSX 60 Index. The INK CIN Index would tend to benefit from expected stronger global growth because it has companies in it exposed to the global economy. In contrast the S&P/TSX 60 is dominated by large cap stocks such as big banks which investors often prefer on a relative basis during times of trouble.

You want to see stocks that are more sensitive to global growth outperform. We have seen it now for over a month, but we want to see more.

It is a positive sign to see the INK Canadian Insider Index outperforming

Right now, INK's indicators suggest that the base case for the Canadian market is a period of consolidation. That could provide investors an opportunity to put their shopping lists together and consider getting some Energy sector exposure if they do not have it already.

Generally, Dixon suggests that markets are in for a period of volatile times. Investors should not assume that a trend which develops in one month to persist in the next month due in part to Fed headline risk and shifts in the Chinese growth story.

jordan release date | Air Jordan Release Dates 2021 + 2022 Updated , Ietp

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.