You are here

Home Blogs Nicholas Winton's blogCIN Index Stealth Rally Resumes

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

Technical Overview by Nicholas Winton, Hedgehog Trader and @HedgehogTrader on Twitter

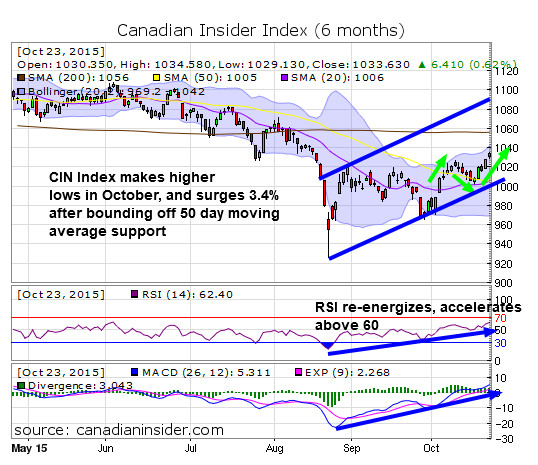

Thank you for joining us in a technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. A week ago, we saw the CIN Index seemingly sag after failing to hold the 1020 level for more than one day. Since then, we can see the Index parlayed its downward force into upside thrust as it bounded off its 50-day moving average, solidly clearing 1020 support.

While the Index itself has seemingly made little progress, having snaked along and gained a mere 1.5% since its September high, it has gained over 6% since the start of October and its chart is showing signs of a powerful acceleration phase that could surprise investors.

For one thing, its MACD oscillator is again turning higher, but even more importantly, its near-term momentum gauge, Relative Strength, which briefly dipped under 50 has impressively surged back above 60 to 62.4, reaching its highest levels since June! What's also bullish is that the CIN Index has forged a series of higher lows in October and looks to be coiling for a big pop to end the month. In fact, Friday's action was particularly bullish, as the Index gapped up at the open and held those gains into the close.

With 1020 now overcome, that long-time resistance now becomes support. Going forward, we have a few upside targets/resistance areas to watch. The first is 1040 where the top bollinger band sits. A second important resistance level is the Index's 200 day moving average around 1056-1060. Further up is the 1080-1090 level which marks the top of its current trading channel and major resistance. The week ahead should be quite interesting.

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.