ARC Resources Ltd. Announces 118 MMboe of Total Proved Plus Probable Reserve Additions in 2018, Replacing 245 Per Cent of Production, and Delivers Record Proved Producing Reserve Additions of 82 MMboe

ARC Resources Ltd. Announces 118 MMboe of Total Proved Plus Probable Reserve Additions in 2018, Replacing 245 Per Cent of Production, and Delivers Record Proved Producing Reserve Additions of 82 MMboe

Canada NewsWire

CALGARY, Feb. 7, 2019

CALGARY, Feb. 7, 2019 /CNW/ - (ARX - TSX) ARC Resources Ltd. ("ARC" or the "Company") is pleased to report its 2018 year-end reserves and resources information.

"ARC delivered another exceptional year of reserves results, including record proved producing reserve additions of 82 MMboe. Strong well performance from all of our Montney assets resulted in positive technical revisions and material reserves growth in 2018. These results highlight the depth of ARC's low-cost Montney portfolio, which feature finding and development costs of $5.76 per boe for proved plus probable reserves, excluding future development capital, and further validate the investments we are making in the multi-year infrastructure projects at Attachie West, Dawson, and Ante Creek," stated Myron Stadnyk, ARC's President and Chief Executive Officer. "Our best-in-class Montney oil and gas portfolio has grown to over 14.3 billion barrels of tight oil and 101.8 Tcf of shale gas initially-in-place according to our updated 2018 Independent Resources Evaluation. With a strong balance sheet and excellent capital and operating efficiencies to support our large inventory of development opportunities, ARC is in a strong position to continue creating value for our shareholders for many years to come."

HIGHLIGHTS

- Replaced 245 per cent of total 2018 production (1), adding 118 MMboe of proved plus probable ("2P") reserves through development activities. This includes positive technical revisions of 22 MMboe, predominantly in Sunrise and the greater Parkland area, reflecting the strong well performance from these Montney assets. 2018 is the eleventh consecutive year that ARC has replaced an average of 200 per cent or greater of produced reserves through development activities.

- Replaced 230 per cent of 2018 natural gas production, adding 478 Bcf of 2P natural gas reserves.

- Replaced 284 per cent of 2018 oil and natural gas liquids ("NGLs") production, adding 38 MMbbl of 2P oil and NGLs reserves.

- Total proved reserves increased by nine per cent from 506 MMboe at year-end 2017 to 551 MMboe at year-end 2018, and 2P reserves increased by five per cent from 836 MMboe at year-end 2017 to 879 MMboe at year-end 2018.

- ARC had record proved producing ("PDP") development adds of 82 MMboe in 2018, predominantly stemming from development activities and positive technical revisions in ARC's core Montney properties. This reflects ARC's increased confidence in its assets and strong performance from its 2018 development program. Net of 2018 acquisitions and dispositions, PDP reserves increased by six per cent, from 230 MMboe at year-end 2017 to 244 MMboe at year-end 2018.

- ARC maintained competitive finding and development ("F&D") costs (1) of $5.76 per boe for 2P reserves and $6.02 per boe for total proved reserves, excluding future development capital ("FDC"), resulting in recycle ratios (1) of 3.0 times and 2.8 times for 2P reserves and total proved reserves, respectively. Recycle ratios are based on ARC's 2018 operating netback(2) of $17.12 per boe.

- Table 1 provides a summary of ARC's 2018 and three-year average F&D costs, including and excluding FDC, as well as ARC's 2018 and three-year average finding, development and acquisition ("FD&A") costs (1), including and excluding FDC.

Table 1

Proved plus Probable Reserves | F&D, excluding FDC | F&D, including FDC | FD&A, excluding FDC | FD&A, including FDC | |||

2018 | 5.76 | 9.93 | 5.32 | 10.33 | |||

Three-year Average | 5.49 | 8.65 | 4.08 | 6.94 |

- Before-tax net present value ("NPV") for 2P reserves, discounted at 10 per cent, is $6.3 billion at year-end 2018, evaluated on GLJ Petroleum Consultants ("GLJ") forecast pricing and foreign exchange rates at January 1, 2019. The before-tax NPV increased 11 per cent from year-end 2017.

- High-value oil, condensate, and pentanes plus volumes significantly contributed to the value of ARC's reserves, accounting for 162 MMbbl or 18 per cent of ARC's 2P reserves.

- Year-end 2018 NPV includes the value attributed by GLJ to ARC's physical marketing natural gas diversification contracts to move its natural gas production to consuming markets beyond AECO. 2018 was the first year that ARC's diversification contracts were included in the NPV calculation, as ARC believes they are core to the execution of its strategy and currently provide the Company with a competitive advantage in the marketplace.

- ARC updated an Independent Resources Evaluation (the "Resources Evaluation" or "Independent Resources Evaluation") to now include all of its core Montney lands in northeast British Columbia and northern Alberta through the addition of Ante Creek in 2018. The identified resource on ARC's Montney lands includes shale gas Total Petroleum Initially-in-Place ("TPIIP") of 101.8 Tcf in 2018, and tight oil TPIIP of 14.3 billion barrels of oil in 2018 (3).

- Before-tax NPV for Risked Development Pending Contingent Resources, discounted at 10 per cent, increased to $4.0 billion at year-end 2018.

(1) | "Reserve replacement", "finding and development costs" or "F&D costs", "recycle ratio", and "finding, development and acquisition costs" or "FD&A costs" do not have standardized meanings. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

(2) | "Operating netback" is a non-GAAP measure and does not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Refer to the section entitled, "Non-GAAP Measures" contained within ARC's Management's Discussion and Analysis ("MD&A"). |

(3) | The year-end 2018 Resources Evaluation complies with current Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") guidelines. The Resources Evaluation volumes provided are the "Best Estimate" case. Year-end 2018 TPIIP estimates utilize a one per cent porosity cut-off for shale gas and tight oil based upon "Best Estimate" case. |

2018 INDEPENDENT RESERVES EVALUATION

GLJ conducted an Independent Reserves Evaluation (the "Reserves Evaluation" or "Independent Reserves Evaluation") effective December 31, 2018, which was prepared in accordance with definitions, standards, and procedures contained in the COGE Handbook and National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). The reserves evaluation was based on GLJ forecast pricing and foreign exchange rates at January 1, 2019, as outlined in Table 2 below.

Reserves included herein are stated on a company gross basis (working interest before deduction of royalties without the inclusion of any royalty interest) unless otherwise noted. In addition to the detailed information disclosed in this news release, more detailed information will be included in ARC's Annual Information Form ("AIF") for the year ended December 31, 2018, which will be available on ARC's website at www.arcresources.com and as filed on SEDAR at www.sedar.com on or before March 29, 2019.

Based on this Independent Reserves Evaluation, ARC's reserves profile as at December 31, 2018 is summarized below:

- Five per cent increase in 2018 2P reserves to 879 MMboe at year-end 2018 compared to 836 MMboe of 2P reserves at year-end 2017. 2P reserves are comprised of 4.0 Tcf of natural gas, 98 MMbbl of oil (1) and 107 MMbbl of NGLs at year-end 2018. The NGLs are comprised of 59 per cent condensate and pentanes plus (63 MMbbl), 18 per cent propane (19 MMbbl), and 23 per cent butane (24 MMbbl). Condensate and pentanes plus reserves increased to 63 MMbbl at year-end 2018 as compared to 35 MMbbl at year-end 2017.

- 2P reserve additions of 118 MMboe from development activities (including revisions), before net dispositions of 27 MMboe and 2018 production of 48 MMboe. Positive technical revisions added 22 MMboe, which more than offset the removal of 4 MMboe due to economic factor revisions resulting from the decrease in natural gas price forecasts since year-end 2017.

- Oil and NGLs comprise 29 per cent of PDP reserves and 23 per cent of 2P reserves. Natural gas comprises 71 per cent of PDP reserves and 77 per cent of 2P reserves, using the commonly accepted boe conversion ratio of six thousand cubic feet of natural gas to one barrel of oil.

- Additions from development activities resulted in increased reserves, and coupled with increased FDC for these development activities, resulted in 2018 2P F&D costs (2), including FDC, of $9.93 per boe and $8.65 per boe for the three-year average. Proved 2018 F&D costs, including FDC, were $11.00 per boe and $10.56 per boe for the three-year average.

- Strong 2P reserve life index ("RLI") (2) of 17.4 years at year-end 2018 is consistent with year-end 2017. For details pertaining to ARC's 2019 production guidance, see the November 8, 2018 news release entitled, "ARC Resources Ltd. Announces $775 Million Capital Program for 2019 That Will Advance Multi-year Infrastructure Development Projects at Attachie West, Dawson, and Ante Creek" available on ARC's website at www.arcresources.com and as filed on SEDAR at www.sedar.com.

- Recycle ratio (2) of 3.0 times and 2.8 times for 2018 and the three-year average, respectively, for 2P reserves, based on 2018 and three-year average F&D costs, excluding FDC, which are based on 2018 and three-year average operating netbacks (3) of $17.12 per boe and $15.50 per boe, respectively.

- FDC increased by $456 million compared to year-end 2017, to total $3.7 billion at year-end 2018, and was driven by the addition of the Dawson Phase IV gas processing and liquids-handling facility and the Ante Creek 10-36 facility expansion projects, including related drilling activity costs, to ARC's development plan.

- Abandonment and reclamation costs decreased from $527 million (undiscounted) at year-end 2017 to $462 million (undiscounted) at year-end 2018. These costs have been included in the 2P reserves, which account for the abandonment and reclamation of all wells to which reserves have been attributed. The reduction in abandonment and reclamation costs is a result of the non-core asset dispositions that took place in 2018.

(1) | Total oil includes light, medium, heavy, and tight oil. See Tables 3 and 4 for detailed breakdown. |

(2) | "Finding and development costs" or "F&D costs", "reserve life index" or "RLI", and "recycle ratio", do not have standardized meanings. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

(3) | "Operating netback" is a non-GAAP measure and does not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Refer to the section entitled, "Non-GAAP Measures" contained within ARC's MD&A. |

Table 2

GLJ Price Forecast (1) | WTI Crude Oil (US$/bbl) | Edmonton Light Oil (Cdn$/bbl) | NYMEX Henry Hub | AECO Natural Gas (Cdn$/MMBtu) | Foreign Exchange (US$/Cdn$) | ||||||||||||||

2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | ||||||||||

2019 | 56.25 | 59.00 | 63.33 | 70.25 | 3.00 | 3.00 | 1.85 | 2.54 | 0.750 | 0.790 | |||||||||

2020 | 63.00 | 60.00 | 75.32 | 70.31 | 3.15 | 3.25 | 2.29 | 2.88 | 0.770 | 0.800 | |||||||||

2021 | 67.00 | 63.00 | 79.75 | 72.84 | 3.35 | 3.50 | 2.67 | 3.24 | 0.790 | 0.810 | |||||||||

2022 | 70.00 | 66.00 | 81.48 | 75.61 | 3.50 | 3.70 | 2.90 | 3.47 | 0.810 | 0.820 | |||||||||

2023 | 72.50 | 69.00 | 83.54 | 78.31 | 3.63 | 3.86 | 3.14 | 3.58 | 0.820 | 0.830 | |||||||||

2024 | 75.00 | 72.00 | 86.06 | 81.93 | 3.70 | 3.94 | 3.23 | 3.66 | 0.825 | 0.830 | |||||||||

2025 | 77.50 | 75.00 | 89.09 | 85.54 | 3.77 | 4.02 | 3.34 | 3.73 | 0.825 | 0.830 | |||||||||

2026 | 80.41 | 77.33 | 92.62 | 88.35 | 3.85 | 4.10 | 3.41 | 3.80 | 0.825 | 0.830 | |||||||||

2027 | 82.02 | 78.88 | 94.57 | 90.22 | 3.93 | 4.18 | 3.48 | 3.88 | 0.825 | 0.830 | |||||||||

2028 (2) | 83.66 | 96.56 | 4.00 | 3.54 | 0.825 | 0.830 | |||||||||||||

Escalate thereafter at | +2% / year | +2% / year | +2% / year | +2% / year | +2% / year | +2% / year | +2% / year | +2% / year | 0.825 | 0.830 | |||||||||

(1) | GLJ assigns a value to ARC's existing physical diversification contracts for natural gas for consuming markets at Dawn, Chicago, Ventura, and Malin based upon GLJ's forecasted differential to NYMEX Henry Hub, contracted volumes, and transportation costs. No incremental value is assigned to potential future contracts which were not in place as of December 31, 2018. |

(2) | Escalated at two per cent per year starting in 2028 in the January 1, 2019 GLJ price forecast with the exception of foreign exchange, which remains flat. |

Table 3

Reserves Summary Company Gross (1) | Light, Medium and | Tight Oil | NGLs (Mbbl) | Total Oil and | Natural Gas (4) (MMcf) | 2018 Oil Equivalent (Mboe) | 2017 Oil Equivalent (Mboe) | ||||||

Proved Producing | 33,242 | 14,411 | 24,209 | 71,863 | 1,034,297 | 244,246 | 229,530 | ||||||

Proved Developed Non-producing | 546 | 172 | 1,725 | 2,443 | 56,622 | 11,880 | 38,726 | ||||||

Proved Undeveloped | 6,198 | 14,302 | 40,593 | 61,093 | 1,401,505 | 294,677 | 238,063 | ||||||

Total Proved | 39,987 | 28,885 | 66,528 | 135,399 | 2,492,424 | 550,803 | 506,319 | ||||||

Proved plus Probable | 50,621 | 47,856 | 107,100 | 205,576 | 4,039,794 | 878,875 | 836,103 |

(1) | Amounts may not add due to rounding. |

(2) | Light, Medium and Heavy Oil includes light, medium and heavy crude oil product types, as heavy oil makes up three per cent of total light, medium and heavy crude oil and is considered to be immaterial. |

(3) | Total Oil and NGLs represents the summation of Light, Medium, Heavy, and Tight Oil and NGLs. |

(4) | Natural Gas includes shale gas and conventional natural gas product types, as conventional natural gas makes up two per cent of total gas and is considered to be immaterial. |

Reserves Reconciliation

Table 4 reconciles reserves volumes from opening balances at December 31, 2017 to closing balances at December 31, 2018. Key highlights include:

- All technical revisions in the PDP reserves category were positive.

- Significant negative technical revisions in Tight Oil in the total proved and 2P reserves categories are associated with the reclassification of recovered liquids from oil to condensate based upon new well classification guidelines in British Columbia. These negative Tight Oil revisions are directly offset by additions of condensate in the NGLs category.

- Further growth in technical revisions to NGLs were observed due to strong performance from the lower Montney horizon across ARC's asset base.

- A minor technical revision to 2P reserves occurred in the Pembina area.

- ARC divested 27 MMboe of 2P reserves in 2018, of which 76 per cent were oil volumes.

Table 4

Reserves Reconciliation Company Gross (1) | Light, Medium and (Mbbl) | Tight Oil (Mbbl) | NGLs (Mbbl) | Total Oil and (Mbbl) | Natural Gas (4) (MMcf) | Oil Equivalent (Mboe) | |||||

Proved Producing | |||||||||||

Opening Balance, December 31, 2017 | 51,470 | 14,650 | 17,780 | 83,901 | 873,778 | 229,530 | |||||

Discoveries | — | — | — | — | — | — | |||||

Extensions and Improved Recovery (5) | 834 | 4,259 | 6,928 | 12,021 | 287,416 | 59,924 | |||||

Technical Revisions | 4 | 159 | 5,771 | 5,935 | 102,338 | 22,989 | |||||

Acquisitions | — | — | — | — | — | — | |||||

Dispositions | (15,364) | — | (1,046) | (16,410) | (15,305) | (18,960) | |||||

Economic Factors | — | — | (31) | (31) | (5,958) | (1,024) | |||||

Production | (3,701) | (4,657) | (5,193) | (13,551) | (207,973) | (48,213) | |||||

Ending Balance, December 31, 2018 | 33,242 | 14,411 | 24,209 | 71,863 | 1,034,297 | 244,246 | |||||

Total Proved | |||||||||||

Opening Balance, December 31, 2017 | 59,632 | 33,944 | 42,593 | 136,171 | 2,220,896 | 506,319 | |||||

Discoveries | — | — | — | — | — | — | |||||

Extensions and Improved Recovery (5) | — | 7,144 | 12,403 | 19,547 | 299,354 | 69,438 | |||||

Technical Revisions | 142 | (7,546) | 18,194 | 10,790 | 217,123 | 46,977 | |||||

Acquisitions | — | — | — | — | — | — | |||||

Dispositions | (16,087) | — | (1,238) | (17,325) | (18,065) | (20,335) | |||||

Economic Factors | — | — | (232) | (232) | (18,911) | (3,383) | |||||

Production | (3,701) | (4,657) | (5,193) | (13,551) | (207,973) | (48,213) | |||||

Ending Balance, December 31, 2018 | 39,987 | 28,885 | 66,528 | 135,399 | 2,492,424 | 550,803 | |||||

Proved plus Probable | |||||||||||

Opening Balance, December 31, 2017 | 79,151 | 51,489 | 72,570 | 203,210 | 3,797,360 | 836,103 | |||||

Discoveries | — | — | — | — | — | — | |||||

Extensions and Improved Recovery (5) | — | 13,373 | 21,147 | 34,520 | 395,452 | 100,428 | |||||

Technical Revisions | (4,149) | (12,349) | 20,648 | 4,151 | 105,966 | 21,811 | |||||

Acquisitions | — | — | — | — | — | — | |||||

Dispositions | (20,680) | — | (1,835) | (22,515) | (27,192) | (27,047) | |||||

Economic Factors | — | — | (238) | (238) | (23,820) | (4,208) | |||||

Production | (3,701) | (4,657) | (5,193) | (13,551) | (207,973) | (48,213) | |||||

Ending Balance, December 31, 2018 | 50,621 | 47,856 | 107,100 | 205,576 | 4,039,794 | 878,875 | |||||

(1) | Amounts may not add due to rounding. |

(2) | Light, Medium and Heavy Oil includes light, medium and heavy crude oil product types, as heavy oil makes up three per cent of total light, medium and heavy crude oil and is considered to be immaterial. |

(3) | Total Oil and NGLs represents the summation of Light, Medium, Heavy, and Tight Oil and NGLs. |

(4) | Natural Gas includes shale gas and conventional natural gas product types, as conventional natural gas makes up two per cent of total gas and is considered to be immaterial. |

(5) | Reserves additions for infill drilling, improved recovery, and extensions are combined and reported as "Extensions and Improved Recovery". |

Reserve Life Index

ARC's 2P RLI (1) was 17.4 years at year-end 2018, and the proved RLI was 10.9 years. The RLIs are determined by dividing the appropriate GLJ reserves category by ARC's 2019 production guidance midpoint of 138,500 boe per day, which is contingent upon the execution of a $775 million capital program for 2019. As a result of successful delineation activities and reserves growth of ARC's Montney assets in northeast British Columbia, the 2P RLI has been maintained at greater than 15 years since year-end 2010. ARC's annual average production has increased from 112,387 boe per day in 2014 to 132,724 boe per day in 2018. Table 5 summarizes ARC's historical RLI.

(1) | "Reserve life index" or "RLI" does not have a standardized meaning. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

Table 5

Reserve Life Index | 2018 (1) | 2017 | 2016 | 2015 | 2014 | |||||

Total Proved | 10.9 | 10.5 | 9.6 | 9.1 | 8.5 | |||||

Proved plus Probable | 17.4 | 17.4 | 16.4 | 15.9 | 15.0 |

(1) | Based on production guidance midpoint of 138,500 boe per day for 2019. |

Net Present Value Summary

ARC's oil, natural gas, and NGLs reserves were evaluated using GLJ forecast pricing and foreign exchange rates at January 1, 2019. The NPV is prior to provision for interest, debt service charges, and general and administrative expenses. It should not be assumed that the NPV of future net revenue estimated by GLJ represents the fair market value of the reserves. The NPV of ARC's reserves increased relative to year-end 2017 as a result of liquids growth and accounting for ARC's physical marketing natural gas diversification contracts. NPVs on both a before- and after-tax basis are presented in Table 6.

Table 6

NPV of Future Net Revenue (1)(2) ($ millions) | Undiscounted | Discounted at 5% | Discounted at 10% | Discounted at 15% | Discounted at 20% | |||||

Before-tax | ||||||||||

Proved Producing | 3,754 | 3,031 | 2,509 | 2,149 | 1,890 | |||||

Proved Developed Non-producing | 205 | 141 | 104 | 81 | 65 | |||||

Proved Undeveloped | 3,808 | 2,365 | 1,537 | 1,026 | 691 | |||||

Total Proved | 7,767 | 5,537 | 4,150 | 3,255 | 2,645 | |||||

Probable | 6,392 | 3,487 | 2,196 | 1,515 | 1,112 | |||||

Proved plus Probable | 14,159 | 9,024 | 6,346 | 4,771 | 3,758 | |||||

After-tax (3)(4) | ||||||||||

Proved Producing | 3,167 | 2,607 | 2,181 | 1,882 | 1,664 | |||||

Proved Developed Non-producing | 150 | 102 | 74 | 57 | 45 | |||||

Proved Undeveloped | 2,767 | 1,661 | 1,022 | 629 | 374 | |||||

Total Proved | 6,084 | 4,369 | 3,277 | 2,567 | 2,083 | |||||

Probable | 4,688 | 2,528 | 1,573 | 1,073 | 778 | |||||

Proved plus Probable | 10,772 | 6,897 | 4,850 | 3,640 | 2,861 | |||||

(1) | Amounts may not add due to rounding. |

(2) | Based on NI 51-101 company net interest reserves and GLJ price forecasts and costs at January 1, 2019. |

(3) | Based on ARC's estimated tax pools at year-end 2018. |

(4) | The after-tax NPV of the future net revenue attributed to ARC's oil and natural gas properties reflects the tax burden on the properties on a standalone basis. It does not consider the business entity tax-level situation or tax planning, nor does it provide an estimate of the value at the level of the business entity, which may be significantly different. ARC's audited consolidated financial statements and notes ("financial statements") and MD&A should be consulted for information at the business entity level. |

At a 10 per cent discount factor, and on a before-tax basis, the future net revenue attributed to the proved producing reserves constitutes 60 per cent of the future net revenue attributed to the total proved reserves ("NPV10 before-tax"). This is similar to the future net revenue attributed to the total proved reserves, which accounts for 65 per cent of the future net revenue attributed to the 2P reserves (NPV10 before-tax).

Future Development Capital

FDC reflects the independent evaluator's best estimate of what it will cost to bring the proved and probable developed and undeveloped reserves on production. Changes in forecast FDC occur annually as a result of development activities, acquisition and disposition activities, and changes in capital cost estimates based on improvements in well design and performance, as well as changes in service costs. Undiscounted FDC increased by $456 million compared to year-end 2017, to total $3.7 billion at year-end 2018. The increase in FDC was driven by the addition of the Dawson Phase IV gas processing and liquids-handling facility and the Ante Creek 10-36 facility expansion projects, including related drilling activity costs, to ARC's development plan.

Table 7 outlines GLJ's estimated FDC required to bring total proved and total 2P reserves on production.

Table 7

Future Development Capital (1)(2) ($ millions) | Total Proved | Total Proved plus Probable | ||

2019 | 555 | 634 | ||

2020 | 555 | 645 | ||

2021 | 598 | 626 | ||

2022 | 415 | 540 | ||

2023 | 317 | 480 | ||

Remainder thereafter | 258 | 746 | ||

Total FDC, Undiscounted | 2,699 | 3,671 | ||

Total FDC, Discounted at 10% | 2,123 | 2,746 |

(1) | Amounts may not add due to rounding. |

(2) | FDC as per GLJ Independent Reserves Evaluation as of December 31, 2018 and based on GLJ forecast pricing and foreign exchange rates at January 1, 2019. |

ARC's 2019 capital budget is $775 million, 22 per cent higher than the proved plus probable FDC forecast for 2019. The total proved plus probable FDC, undiscounted, is less than five times ARC's 2019 capital budget. For details pertaining to ARC's 2019 capital budget, see the November 8, 2018 news release entitled, "ARC Resources Ltd. Announces $775 Million Capital Program for 2019 That Will Advance Multi-year Infrastructure Development Projects at Attachie West, Dawson, and Ante Creek" available on ARC's website at www.arcresources.com and as filed on SEDAR at www.sedar.com.

Finding, Development and Acquisition Costs

ARC's 2018 F&D costs (1) were $5.76 per boe and $6.02 per boe for 2P and proved reserves, respectively, excluding FDC ($9.93 per boe and $11.00 per boe, respectively, for 2P and proved reserves, including FDC). ARC's three-year average F&D costs were $5.49 per boe for 2P reserves and $6.31 per boe for proved reserves, excluding FDC. The low F&D costs are attributed to the high-quality nature of ARC's portfolio of assets, the efficiency and strong results from ARC's development program, and meaningful reserves growth in 2018, notably at Dawson, Sunrise, Ante Creek, and Parkland/Tower. ARC's 2018 F&D costs include approximately $0.9 million of capital investment on Crown lands, with no significant associated reserves or production.

Including net acquisitions and dispositions, ARC's 2018 FD&A costs (1) were $5.32 per boe for 2P reserves and $5.22 per boe for proved reserves, excluding FDC ($10.33 per boe and $11.15 per boe, respectively, for 2P and proved reserves, including FDC). The three-year average FD&A costs were $4.08 per boe for 2P reserves and $4.56 per boe for proved reserves, excluding FDC. ARC's low FD&A costs reflect ARC's focus on high-quality assets, cost management, and allocation of resources and capital investment to high rate of return projects. ARC's 2018 FD&A costs include approximately $0.9 million of capital investment on Crown lands, with no significant associated reserves or production, and also incorporate the net disposition of properties with associated reserves and production of approximately $195.9 million in 2018.

(1) | "Finding and development costs" or "F&D costs" and "finding, development and acquisition costs" or "FD&A costs" do not have standardized meanings. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

Table 8 highlights ARC's reserves, F&D costs, FD&A costs, and the associated recycle ratios for 2016 to 2018.

Table 8

Reserves (Company Gross), Capital Expenditures and | 2018 | 2017 | 2016 | |||

Reserves (Mboe) | ||||||

Proved Producing | 244,246 | 229,530 | 212,341 | |||

Total Proved | 550,803 | 506,319 | 425,927 | |||

Proved plus Probable | 878,875 | 836,103 | 736,733 | |||

Capital Expenditures ($ millions) | ||||||

Exploration and Development | 680.3 | 927.3 | 456.1 | |||

Net Property Acquisitions (Dispositions) | (195.9) | 2.5 | (532.5) | |||

Total Capital Expenditures | 484.4 | 929.8 | (76.4) | |||

Operating Netback ($/boe) | ||||||

Operating Netback | 17.12 | 15.72 (4) | 13.45 | |||

Operating Netback – Three-year Average | 15.50 | 15.25 (4) | 20.83 | |||

(1) | Amounts may not add due to rounding. |

(2) | "Operating netback" is a non-GAAP measure and does not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Refer to the section entitled, "Non-GAAP Measures" contained within ARC's MD&A. |

(3) | Operating netback excludes other income. |

(4) | 2017 operating netback has been restated. Refer to Note 4 "Changes in Accounting Policies" in ARC's financial statements for details on revised presentation of certain items in the audited consolidated statement of income (the "statement of income") for the year ended December 31, 2017. |

Table 8a

Finding and Development Costs, excluding FDC (1)(2)(3)(4) Company Gross | 2018 | 2017 | 2016 | |||

Proved Producing | ||||||

Reserve Additions (MMboe) | 81.9 | 61.9 | 43.6 | |||

F&D Costs ($/boe) | 8.31 | 14.98 | 10.46 | |||

F&D Recycle Ratio | 2.1 | 1.0 | 1.3 | |||

F&D Costs – Three-year Average ($/boe) | 11.01 | 11.26 | 12.77 | |||

F&D Recycle Ratio – Three-year Average | 1.4 | 1.4 | 1.6 | |||

Total Proved | ||||||

Reserve Additions (MMboe) | 113.0 | 125.3 | 88.6 | |||

F&D Costs ($/boe) | 6.02 | 7.40 | 5.15 | |||

F&D Recycle Ratio | 2.8 | 2.1 | 2.6 | |||

F&D Costs – Three-year Average ($/boe) | 6.31 | 6.88 | 9.56 | |||

F&D Recycle Ratio – Three-year Average | 2.5 | 2.2 | 2.2 | |||

Proved plus Probable | ||||||

Reserve Additions (MMboe) | 118.0 | 144.6 | 113.5 | |||

F&D Costs ($/boe) | 5.76 | 6.41 | 4.02 | |||

F&D Recycle Ratio | 3.0 | 2.5 | 3.3 | |||

F&D Costs – Three-year Average ($/boe) | 5.49 | 5.73 | 7.19 | |||

F&D Recycle Ratio – Three-year Average | 2.8 | 2.7 | 2.9 | |||

(1) | F&D costs take into account reserves revisions during the year on a per boe basis. |

(2) | The aggregate of the exploration and development costs incurred in the financial year and the changes during that year in estimated future development costs may not reflect the total F&D costs related to reserves additions for that year. |

(3) | "Finding and development recycle ratio" or "F&D recycle ratio" does not have a standardized meaning. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

(4) | 2017 recycle ratios have been restated. Refer to Note 4 "Changes in Accounting Policies" in ARC's financial statements for details on revised presentation of certain items in the statement of income for the year ended December 31, 2017. |

Table 8b

Finding and Development Costs, including FDC (1)(2)(3)(4) Company Gross | 2018 | 2017 | 2016 | ||

Proved Producing | |||||

Change in FDC ($ millions) | 121.1 | 35.5 | 19.0 | ||

Reserve Additions (MMboe) | 81.9 | 61.9 | 43.6 | ||

F&D Costs ($/boe) | 9.79 | 15.55 | 10.90 | ||

F&D Recycle Ratio | 1.7 | 1.0 | 1.2 | ||

F&D Costs – Three-year Average ($/boe) | 11.95 | 11.27 | 12.76 | ||

F&D Recycle Ratio – Three-year Average | 1.3 | 1.4 | 1.6 | ||

Total Proved | |||||

Change in FDC ($ millions) | 563.5 | 242.9 | 581.3 | ||

Reserve Additions (MMboe) | 113.0 | 125.3 | 88.6 | ||

F&D Costs ($/boe) | 11.00 | 9.34 | 11.71 | ||

F&D Recycle Ratio | 1.6 | 1.7 | 1.1 | ||

F&D Costs – Three-year Average ($/boe) | 10.56 | 7.91 | 10.11 | ||

F&D Recycle Ratio – Three-year Average | 1.5 | 1.9 | 2.1 | ||

Proved plus Probable | |||||

Change in FDC ($ millions) | 491.2 | 461.9 | 236.5 | ||

Reserve Additions (MMboe) | 118.0 | 144.6 | 113.5 | ||

F&D Costs ($/boe) | 9.93 | 9.61 | 6.10 | ||

F&D Recycle Ratio | 1.7 | 1.6 | 2.2 | ||

F&D Costs – Three-year Average ($/boe) | 8.65 | 5.52 | 6.48 | ||

F&D Recycle Ratio – Three-year Average | 1.8 | 2.8 | 3.2 | ||

(1) | F&D costs take into account reserves revisions during the year on a per boe basis. |

(2) | The aggregate of the exploration and development costs incurred in the financial year and the changes during that year in estimated future development costs may not reflect the total F&D costs related to reserves additions for that year. |

(3) | "Finding and development recycle ratio" or "F&D recycle ratio" does not have a standardized meaning. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

(4) | 2017 recycle ratios have been restated. Refer to Note 4 "Changes in Accounting Policies" in ARC's financial statements for details on revised presentation of certain items in the statement of income for the year ended December 31, 2017. |

Table 8c

Finding, Development and Acquisition Costs, excluding FDC (1)(2)(3)(4) Company Gross | 2018 | 2017 | 2016 | ||

Proved Producing | |||||

Reserve Additions, including Net Acquisitions (Dispositions) (MMboe) | 62.9 | 61.9 | 34.0 | ||

FD&A Costs ($/boe) | 7.70 | 15.03 | (2.25) | ||

FD&A Recycle Ratio | 2.2 | 1.0 | (6.0) | ||

FD&A Costs – Three-year Average ($/boe) | 8.42 | 8.89 | 11.15 | ||

FD&A Recycle Ratio – Three-year Average | 1.8 | 1.7 | 1.9 | ||

Total Proved | |||||

Reserve Additions, including Net Acquisitions (Dispositions) (MMboe) | 92.7 | 125.1 | 75.7 | ||

FD&A Costs ($/boe) | 5.22 | 7.43 | (1.01) | ||

FD&A Recycle Ratio | 3.3 | 2.1 | (13.3) | ||

FD&A Costs – Three-year Average ($/boe) | 4.56 | 5.24 | 8.13 | ||

FD&A Recycle Ratio – Three-year Average | 3.4 | 2.9 | 2.6 | ||

Proved plus Probable | |||||

Reserve Additions, including Net Acquisitions (Dispositions) (MMboe) | 91.0 | 144.1 | 93.0 | ||

FD&A Costs ($/boe) | 5.32 | 6.45 | (0.82) | ||

FD&A Recycle Ratio | 3.2 | 2.4 | (16.4) | ||

FD&A Costs – Three-year Average ($/boe) | 4.08 | 4.54 | 6.31 | ||

FD&A Recycle Ratio – Three-year Average | 3.8 | 3.4 | 3.3 | ||

(1) | FD&A costs take into account reserves revisions during the year on a per boe basis. |

(2) | The aggregate of the exploration and development costs incurred in the financial year and the changes during that year in estimated future development costs may not reflect the total F&D costs related to reserves additions for that year. |

(3) | "Finding, development and acquisition recycle ratio" or "FD&A recycle ratio" does not have a standardized meaning. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

(4) | 2017 recycle ratios have been restated. Refer to Note 4 "Changes in Accounting Policies" in ARC's financial statements for details on revised presentation of certain items in the statement of income for the year ended December 31, 2017. |

Table 8d

Finding, Development and Acquisition Costs, including FDC (1)(2)(3)(4) Company Gross | 2018 | 2017 | 2016 | ||

Proved Producing | |||||

Change in FDC ($ millions) | 114.3 | 35.5 | (95.9) | ||

Reserve Additions, including Net Acquisitions (Dispositions) (MMboe) | 62.9 | 61.9 | 34.0 | ||

FD&A Costs ($/boe) | 9.51 | 15.60 | (5.07) | ||

FD&A Recycle Ratio | 1.8 | 1.0 | (2.7) | ||

FD&A Costs – Three-year Average ($/boe) | 8.76 | 8.06 | 10.16 | ||

FD&A Recycle Ratio – Three-year Average | 1.8 | 1.9 | 2.1 | ||

Total Proved | |||||

Change in FDC ($ millions) | 549.5 | 241.6 | 419.7 | ||

Reserve Additions, including Net Acquisitions (Dispositions) (MMboe) | 92.7 | 125.1 | 75.7 | ||

FD&A Costs ($/boe) | 11.15 | 9.37 | 4.53 | ||

FD&A Recycle Ratio | 1.5 | 1.7 | 3.0 | ||

FD&A Costs – Three-year Average ($/boe) | 8.68 | 5.52 | 7.56 | ||

FD&A Recycle Ratio – Three-year Average | 1.8 | 2.8 | 2.8 | ||

Proved plus Probable | |||||

Change in FDC ($ millions) | 456.0 | 459.4 | 25.0 | ||

Reserve Additions, including Net Acquisitions (Dispositions) (MMboe) | 91.0 | 144.1 | 93.0 | ||

FD&A Costs ($/boe) | 10.33 | 9.64 | (0.55) | ||

FD&A Recycle Ratio | 1.7 | 1.6 | (24.5) | ||

FD&A Costs – Three-year Average ($/boe) | 6.94 | 3.09 | 3.91 | ||

FD&A Recycle Ratio – Three-year Average | 2.2 | 4.9 | 5.3 | ||

(1) | FD&A costs take into account reserves revisions during the year on a per boe basis. |

(2) | The aggregate of the exploration and development costs incurred in the financial year and the changes during that year in estimated future development costs may not reflect the total F&D costs related to reserves additions for that year. |

(3) | "Finding, development and acquisition recycle ratio" or "FD&A recycle ratio" does not have a standardized meaning. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" contained in this news release. |

(4) | 2017 recycle ratios have been restated. Refer to Note 4 "Changes in Accounting Policies" in ARC's financial statements for details on revised presentation of certain items in the statement of income for the year ended December 31, 2017. |

MONTNEY RESOURCES EVALUATION

The following discussion is subject to a number of cautionary statements, assumptions, and risks as set forth therein. See "Information Regarding Disclosure on Oil and Gas Reserves, Resources and Operational Information" at the end of this news release for additional cautionary language, explanations, and discussion, and see "Forward-looking Information and Statements" for a statement of principal assumptions and risks that may apply. See also "Definitions of Oil and Gas Resources and Reserves" in this news release. The discussion includes reference to TPIIP, Discovered Petroleum Initially-in-Place ("DPIIP"), Undiscovered Petroleum Initially-in-Place ("UPIIP") and Economic Contingent Resource ("ECR") as per the GLJ Resources Evaluation as at December 31, 2018, prepared in accordance with the COGE Handbook. Unless otherwise indicated in this news release, all references to ECR and Prospective volumes are Best Estimate ECR and Best Estimate Prospective volumes, respectively.

The Montney formation in northeast British Columbia and Alberta has been identified as a world-class unconventional petroleum resource play with the potential for significant volumes of recoverable resources. The area includes dry gas, liquids-rich gas, and tight oil development opportunities. It is one of the largest and lowest-cost resource plays in North America. ARC has a significant presence in northeast British Columbia and at Ante Creek and Pouce Coupe in Alberta, with a total land position of 1,122 net sections. ARC's land position in the Montney decreased seven per cent relative to year-end 2017, and reflects ARC's active management of its lands. The decrease in 2018 is primarily attributed to the disposition of ARC's Blueberry lands in British Columbia and non-core Montney expiries in Alberta.

GLJ was commissioned in 2018 and in 2017 to conduct independent resources evaluations for ARC's lands in the Montney region, including Dawson, Parkland/Tower, Sunrise/Sunset, Sundown, Septimus, Attachie, and Red Creek in northeast British Columbia, as well as Ante Creek and Pouce Coupe in Alberta (the "Evaluated Areas"). The Ante Creek Resources Evaluation was performed in 2018 only; prior to 2018, Ante Creek was not a part of the evaluation. The Independent Resources Evaluation was effective December 31, 2018 based on GLJ forecast pricing and foreign exchange rates at January 1, 2019. The GLJ Independent Resources Evaluation conducted in respect of 2017 was effective December 31, 2017 based on GLJ forecast pricing and foreign exchange rates at January 1, 2018 (the "2017 Independent Resources Evaluation"). All references in the following discussion to TPIIP, DPIIP, UPIIP, and ECR are in reference to the Evaluated Areas included in the 2018 Independent Resources Evaluation and 2017 Independent Resources Evaluation. The results of the 2018 and 2017 resources evaluations are summarized in the discussion and tables that follow.

The evaluation reaffirmed that ARC's Montney assets provide significant long-term growth opportunities with considerable resources, extending well beyond existing booked reserves and even the current estimates of ECR. ARC's Montney assets provide optionality for future growth through commodity price cycles given the diversity of ARC's Montney landholdings, with exposure to crude oil, liquids-rich natural gas, and dry natural gas. ARC believes that the concentrated nature of its Montney assets will result in additional upside based on expected capital efficiencies.

ARC's 2018 capital development program was primarily focused on Montney development, which was inclusive of crude oil, liquids-rich gas, and dry gas opportunities. In northeast British Columbia and northern Alberta, ARC's capital development program consisted of drilling 72 gross operated wells (72 net wells), comprised of 23 dry gas wells and one disposal well at Sunrise, 15 tight oil wells at Tower, 13 wells at Dawson that were a combination of dry gas and liquids-rich wells, 10 tight oil wells at Ante Creek, eight liquids-rich wells in Parkland, one liquids-rich well at Attachie, and one dry gas well at Sundown.

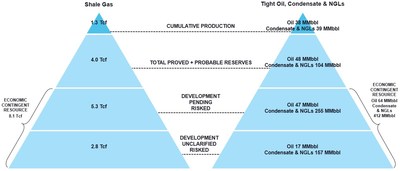

TPIIP for the shale gas-bearing lands in the Evaluated Areas decreased four per cent to 101.8 Tcf relative to 2017, and DPIIP for the shale gas-bearing lands decreased by five per cent to 43.4 Tcf. The decreases in TPIIP and DPIIP were a result of the disposition of ARC's Montney lands at Blueberry in 2018.

Shale gas ECR was evaluated on an unrisked and risked basis in 2018 and was subdivided into the Maturity Subclasses of Development Pending and Development Unclarified. The risked development pending shale gas ECR totaled 5.3 Tcf and risked development unclarified shale gas ECR totaled 2.8 Tcf.

NGLs ECR was evaluated on an unrisked and risked basis in 2018 and was subdivided into the Maturity Subclasses of Development Pending and Development Unclarified. The risked development pending NGLs ECR totaled 255 MMbbl and risked development unclarified NGLs ECR totaled 157 MMbbl.

On the tight oil-bearing lands at Tower, Red Creek, Attachie, and Ante Creek, TPIIP increased 36 per cent from 2017 to 14.3 billion barrels and DPIIP increased 60 per cent to 10.3 billion barrels, primarily due to the addition of Ante Creek into the Resources determination.

Tight Oil ECR was evaluated on an unrisked and risked basis in 2018 and was subdivided into the Maturity Subclasses of Development Pending and Development Unclarified. The risked development pending tight oil ECR totaled 47 MMbbl and risked development unclarified tight oil ECR totaled 17 MMbbl.

Risking of the economic contingent resources included a quantitative assessment of the economic status, the recovery technology status, the project evaluation scenario status, and the development time frame.

Exhibit 1 (1)(2)(3)

(1) | Amounts may not add due to rounding. |

(2) | For prospective resources volume information, refer to Table 13. |

(3) | ARC's Ante Creek lands in Alberta were included in the 2018 Resources Evaluation and are reflected in the values presented in Exhibit 1. |

Table 9

Shale Gas Resources (1)(2)(3)(4) (Tcf) | 2018 | 2017 | |

Total Petroleum Initially-in-Place | 101.8 | 106.0 | |

Discovered Petroleum Initially-in-Place (5) | 43.4 | 45.5 | |

Undiscovered Petroleum Initially-in-Place (6) | 58.4 | 60.5 |

(1) | TPIIP, DPIIP and UPIIP have been estimated using a one per cent porosity cut-off in both 2018 and 2017, which means that essentially all gas-bearing rock has been incorporated into the calculations. |

(2) | The resources categories in this table do not include free crude oil or liquids. |

(3) | All volumes listed in the table are company gross and raw gas volumes. |

(4) | All numbers are "Best Estimates". |

(5) | There is uncertainty that it will be commercially viable to produce any portion of the resources. |

(6) | There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources. |

Table 10

Tight Oil Resources (1)(2)(3)(4) (MMbbl) | 2018 | 2017 | |

Total Petroleum Initially-in-Place | 14,313 | 10,488 | |

Discovered Petroleum Initially-in-Place (5) | 10,280 | 6,427 | |

Undiscovered Petroleum Initially-in-Place (6) | 4,033 | 4,061 |

(1) | TPIIP, DPIIP and UPIIP have been estimated using a one per cent porosity cut-off in both 2018 and 2017 for tight oil. |

(2) | All volumes listed in the table are company gross. |

(3) | The tight oil DPIIP is a Stock Tank Barrel. |

(4) | All numbers are "Best Estimates". |

(5) | There is uncertainty that it will be commercially viable to produce any portion of the resources. |

(6) | There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources. |

Table 11

2018 | 2017 | ||||||||||

Reserves and Risked and Unrisked ECR (1)(2)(3)(4)(5)(6) | Chance of Development | Best Estimate Unrisked | Best Estimate Risked | Chance of Development | Best Estimate Unrisked | Best Estimate Risked | |||||

Shale Gas (Tcf) | |||||||||||

Reserves | 100 | % | 4.0 | 4.0 | 100 | % | 3.5 | 3.5 | |||

Development Pending ECR | 89 | % | 6.0 | 5.3 | 86 | % | 4.6 | 4.0 | |||

Development Unclarified ECR | 71 | % | 4.0 | 2.8 | 74 | % | 4.2 | 3.1 | |||

NGLs (MMbbl) | |||||||||||

Reserves | 100 | % | 104 | 104 | 100 | % | 62 | 62 | |||

Development Pending ECR | 89 | % | 285 | 255 | 85 | % | 106 | 90 | |||

Development Unclarified ECR | 68 | % | 230 | 157 | 72 | % | 140 | 100 | |||

Tight Oil (MMbbl) | |||||||||||

Reserves | 100 | % | 48 | 48 | 100 | % | 31 | 31 | |||

Development Pending ECR | 82 | % | 57 | 47 | 92 | % | 36 | 33 | |||

Development Unclarified ECR | 50 | % | 34 | 17 | 73 | % | 157 | 115 | |||

(1) | All DPIIP, other than cumulative production, reserves, and ECR, has been categorized as unrecoverable. Cumulative raw production to year-end 2018 was 1.3 Tcf of shale gas and 36 MMbbl of tight oil, all of which are immaterial in relation to the magnitude of the reserves and ECR. NGLs cumulative production is calculated based on current NGLs recoveries. |

(2) | All volumes listed in the table are company gross and sales volumes. |

(3) | All numbers are "Best Estimate". |

(4) | All ECR have been risked for chance of development. For ECR, the chance of development is defined as the probability of a project being commercially viable. In quantifying the chance of development, factors that were assessed quantitatively to be less than one in the risking calculation included the economic status, the project evaluation scenario status, and the development time frame. The chance of development is multiplied by the unrisked resource volume estimate, which yields the risked volume estimate. As many of these factors have a wide range of uncertainty and are difficult to quantify, the chance of development is an uncertain value that should be used with caution. |

(5) | For reserves, the volumes under the heading "Best Estimate" are 2P reserves. |

(6) | There is uncertainty that it will be commercially viable to produce any portion of the resources. |

An estimate of risked NPV of future net revenue of the development pending contingent resources subclass only is preliminary in nature and is provided to assist the reader in reaching an opinion on the merit and likelihood of ARC proceeding with the required investment. It includes contingent resources that are considered too uncertain with respect to the chance of development to be classified as reserves. There is uncertainty that the risked NPV of future net revenue will be realized. The other subclasses of resources are not included in this NPV, and therefore, this is not reflective of the value of the resource base.

Table 12

2018 | 2017 | ||||||||||

Risked and Unrisked ECR Development Pending (1)(2)(3)(4) | Chance of Development | Best Estimate Unrisked | Best Estimate Risked | Chance of Development | Best Estimate Unrisked | Best Estimate Risked | |||||

Shale Gas (Tcf) | 89 | % | 6.0 | 5.3 | 86 | % | 4.6 | 4.0 | |||

NGLs (MMbbl) | 89 | % | 285 | 255 | 85 | % | 106 | 90 | |||

Tight Oil (MMbbl) | 82 | % | 57 | 47 | 92 | % | 36 | 33 | |||

Oil Equivalent (MMboe) | 89 | % | 1,340 | 1,190 | 86 | % | 915 | 792 | |||

Before-tax NPV ($ millions) | |||||||||||

Undiscounted | 29,580 | 26,160 | 15,031 | 12,953 | |||||||

Discounted at 5% | 10,520 | 9,298 | 5,417 | 4,675 | |||||||

Discounted at 10% | 4,547 | 4,017 | 2,352 | 2,029 | |||||||

Discounted at 15% | 2,245 | 1,981 | 1,153 | 993 | |||||||

Discounted at 20% | 1,209 | 1,066 | 610 | 524 | |||||||

(1) | All volumes listed in the table are company gross and sales volumes. |

(2) | 2018 NPV as per GLJ Independent Resources Evaluation as of December 31, 2018 and based on GLJ forecast pricing and foreign exchange rates at January 1, 2019. 2017 NPV as per GLJ Independent Resources Evaluation as of December 31, 2017 and based on GLJ forecast pricing and foreign exchange rates at January 1, 2018. |

(3) | Risk in the above table is the chance of development. Contingent resources are discovered resources by definition. |

(4) | There is uncertainty that it will be commercially viable to produce any portion of the resources. |

The estimated cost to bring on commercial production from the Development Pending Contingent Resources for all three product types is approximately $11.6 billion (when discounted at 10 per cent, the estimated cost is approximately $3.9 billion). The expected timeline to bring these resources on production is between two and 26 years. The ECR are expected to be recovered using the same horizontal drilling and multi-stage fracturing technology that ARC has already proven to be effective in the Montney.

Table 13

2018 | 2017 | ||||||||||

Prospective Resources (1)(2)(3)(4)(5) | Chance of Commerciality | Best Estimate Unrisked | Best Estimate Risked | Chance of Commerciality | Best Estimate Unrisked | Best Estimate Risked | |||||

Shale Gas (Tcf) | 46 | % | 9.5 | 4.4 | 46 | % | 13.7 | 6.4 | |||

NGLs (MMbbl) | 51 | % | 650 | 329 | 43 | % | 1,117 | 475 | |||

Tight Oil (MMbbl) | 52 | % | 2 | 1 | 63 | % | 120 | 76 | |||

Oil Equivalent (MMboe) | 47 | % | 2,236 | 1,057 | 46 | % | 3,528 | 1,615 | |||

(1) | All UPIIP, other than prospective resources, has been categorized as unrecoverable. |

(2) | All volumes listed in the table are company gross and sales volumes. |

(3) | Prospective resources have been risked for chance of development and chance of discovery. For prospective resources, the chance of development multiplied by the chance of discovery is defined as the probability of a project being commercially viable. In quantifying the chance of commerciality, factors that were assessed quantitatively to be less than one in the risking calculation included the economic status, the project evaluation scenario status and the development time frame, along with the overall chance of discovery. The chance of commerciality is multiplied by the unrisked prospective resource volume estimate, which yields the risked volume estimate. As many of these factors have a wide range of uncertainty and are difficult to quantify, the chance of commerciality is an uncertain value that should be used with caution. |

(4) | All prospective resources are subclassified as the prospect maturity subclass. |

(5) | There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources. |

Based upon the foregoing analysis, as well as ARC's expertise in the Montney formation in northeast British Columbia and Alberta, it is expected that significant additional reserves will be developed in the future with continued drilling success on currently undeveloped Montney acreage, together with further development, completions refinements, and improved economic conditions. Historic drilling success and recoveries on the more fully-developed Montney acreage, abundant well log and production test data, and the application of increased drilling densities, support ARC's belief that significant additional resources will be recovered. Continuous development through multi-year exploration and development programs and significant levels of future capital expenditures are required in order for additional resources to be recovered in the future. The principal risks that would inhibit the recovery of additional reserves relate to the potential for variations in the quality of the Montney formation where minimal well data currently exists, access to the capital which would be required to develop the resources, low commodity prices that would curtail the economics of development and the future performance of wells, regulatory approvals, access to the required services at the appropriate cost, and the effectiveness of well fracturing technology and applications. For ECR to be converted to reserves, Management and the Board of Directors need to ascertain commercial production rates, then develop firm plans, including timing, infrastructure, and the commitment of capital. Confirmation of commercial productivity is generally required before the Company can prepare firm development plans and commit required capital for the development of the ECR. Additional contingencies are related to the current lack of infrastructure required to develop the resources in a relatively quick time frame. As continued delineation occurs, some resources currently classified as ECR are expected to be re-classified to reserves.

DEFINITIONS OF OIL AND GAS RESOURCES AND RESERVES

Reserves are estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on the analysis of drilling, geological, geophysical, and engineering data; the use of established technology; and specified economic conditions, which are generally accepted as being reasonable. Reserves are classified according to the degree of certainty associated with the estimates as follows:

Proved Reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves.

Probable Reserves are those additional reserves that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved plus probable reserves.

Resources encompasses all petroleum quantities that originally existed on or within the earth's crust in naturally occurring accumulations, including Discovered and Undiscovered (recoverable and unrecoverable) plus quantities already produced. "Total Resources" is equivalent to "Total Petroleum Initially-in-Place". Resources are classified in the following categories:

Total Petroleum Initially-in-Place ("TPIIP") is that quantity of petroleum that is estimated to exist originally in naturally occurring accumulations. It includes that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations, prior to production, plus those estimated quantities in accumulations yet to be discovered.

Discovered Petroleum Initially-in-Place ("DPIIP") is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of DPIIP includes production, reserves, and contingent resources; the remainder is unrecoverable.

Contingent Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development but which are not currently considered to be commercially recoverable due to one or more contingencies.

Economic Contingent Resources ("ECR") are those Contingent Resources which are currently economically recoverable.

Project Maturity Subclass Development Not Viable is defined as a Contingent Resource that is not viable in the conditions prevailing at the effective date of the evaluation, and where no further data acquisition or evaluation is planned and therefore has not been assigned a low chance of development.

Project Maturity Subclass Development Pending is defined as a Contingent Resource that has been assigned a high chance of development and the resolution of final conditions for development are being actively pursued.

Project Maturity Subclass Development Unclarified is defined as a Contingent Resource that requires further appraisal to clarify the potential for development and has been assigned a lower chance of development until contingencies can be clearly defined.

Undiscovered Petroleum Initially-in-Place ("UPIIP") is that quantity of petroleum that is estimated, on a given date, to be contained in accumulations yet to be discovered. The recoverable portion of UPIIP is referred to as "prospective resources" and the remainder as "unrecoverable".

Prospective Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects.

Unrecoverable is that portion of DPIIP and UPIIP quantities which is estimated, as of a given date, not to be recoverable by future development projects. A portion of these quantities may become recoverable in the future as commercial circumstances change or technological developments occur; the remaining portion may never be recovered due to the physical/chemical constraints represented by subsurface interaction of fluids and reservoir rocks.

Uncertainty Ranges are described by the COGE Handbook as low, best, and high estimates for reserves and resources. The Best Estimate is considered to be the best estimate of the quantity that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater or less than the best estimate. If probabilistic methods are used, there should be at least a 50 per cent probability that the quantities actually recovered will equal or exceed the best estimate.

INFORMATION REGARDING DISCLOSURE ON OIL AND GAS RESERVES, RESOURCES AND OPERATIONAL INFORMATION

All amounts in this news release are stated in Canadian dollars unless otherwise specified. Where applicable, natural gas has been converted to barrels of oil equivalent ("boe") based on a six thousand cubic feet of natural gas to one barrel of oil ratio. The boe rate is based on an energy equivalency conversion method primarily applicable at the burner tip, and given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency of the 6:1 conversion ratio, utilizing the 6:1 conversion ratio may be misleading as an indication of value. The boe rate is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. Use of boe in isolation may be misleading. In accordance with Canadian practice, production volumes and revenues are reported on a company gross basis, before deduction of Crown and other royalties, and without including any royalty interest, unless otherwise stated. Unless otherwise specified, all reserves volumes in this news release (and all information derived therefrom) are based on company gross reserves using forecast prices and costs.

This news release contains metrics commonly used in the oil and gas industry. Each of these metrics is determined by ARC as set out below. These metrics are "reserve replacement", "reserve life index", "recycle ratio", "finding and development costs", "finding, development and acquisition costs", "operating netback", "finding and development recycle ratio", and "finding, development and acquisition recycle ratio". These metrics do not have standardized meanings and may not be comparable to similar measures presented by other entities. As such, they should not be used to make comparisons. Management uses these oil and gas metrics for its own performance measurements and to provide shareholders with measures to compare ARC's performance over time, however, such measures are not reliable indicators of ARC's future performance and future performance may not compare to the performance in previous periods.

- "Reserve replacement" is calculated by dividing the annual 2P reserve additions (in boe) by ARC's annual production (in boe). Management uses this measure to determine the relative change of its reserves base over a period of time.

- "Reserve life index" or "RLI" is calculated by dividing the reserves (in boe) in the referenced category by the midpoint production guidance (in boe) for the following year. Management uses this measure to determine how long the booked reserves will last at current production rates if no further reserves were added.

- "Recycle ratio" is calculated by dividing the operating netback for the year (in dollars per boe) by F&D costs or FD&A costs for the year (in dollars per boe).

- "Finding and development costs" or "F&D costs" are calculated by dividing the sum of the total capital expenditures for the year (in dollars) by the change in reserves within the applicable reserves category (in boe). F&D costs, including FDC, includes all capital expenditures in the year as well as the change in FDC required to bring the reserves within the specified reserves category on production.

- "Finding, development and acquisition costs" or "FD&A costs" are calculated by dividing the sum of the total capital expenditures for the year inclusive of the net acquisition costs and disposition proceeds (in dollars) by the change in reserves within the applicable reserves category inclusive of changes due to acquisitions and dispositions (in boe). FD&A costs, including FDC, includes all capital expenditures in the year inclusive of the net acquisition costs and disposition proceeds as well as the change in FDC required to bring the reserves within the specified reserves category on production.

- Both F&D and FD&A costs take into account reserves revisions and capital revisions during the year. The aggregate of the costs incurred in the financial year and changes during that year in estimated FDC may not reflect total F&D costs related to reserves additions for that year. F&D costs and FD&A costs have been presented in this news release because acquisitions and dispositions can have a significant impact on ARC's ongoing reserves replacement costs and excluding these amounts could result in an inaccurate portrayal of its cost structure. Management uses F&D and FD&A costs as measures of its ability to execute its capital programs (and success in doing so) and of its asset quality.

- "Operating netback" is calculated using commodity sales from production, excluding realized gains and losses on commodity risk management contracts, less royalties, operating and transportation expenses, calculated on a per boe equivalent basis. Management uses this measure to benchmark operating results between areas and/or time periods.

- "Finding and development recycle ratio" or "F&D recycle ratio" is calculated by dividing the operating netback (in dollars per boe) by the F&D costs (in dollars per boe) for the year.

- "Finding, development and acquisition recycle ratio" or "FD&A recycle ratio" is calculated by dividing the operating netback (in dollars per boe) by the FD&A costs (in dollars per boe) for the year.

- ARC uses both F&D recycle ratio and FD&A recycle ratio as an indicator of profitability of its oil and gas activities.

ARC's oil and gas reserves statement for the year ended December 31, 2018, which will include complete disclosure of its oil and gas reserves and other oil and gas information in accordance with NI 51-101, will be contained within ARC's AIF which will be available on or before March 29, 2019 on ARC's website at www.arcresources.com and as filed on SEDAR at www.sedar.com.

This news release contains references to estimates of resources other than reserves in the Montney region, which are not, and should not be confused with, oil and gas reserves. See "Definitions of Oil and Gas Resources and Reserves".

Projects have not been defined to develop the resources in the Evaluated Areas as at the evaluation date. Such projects, in the case of the Montney resource development, have historically been developed sequentially over a number of drilling seasons and are subject to annual budget constraints, ARC's policy of orderly development on a staged basis, the timing of the growth of third-party infrastructure, the short- and long-term view of ARC on oil and gas prices, the results of exploration and development activities of ARC and others in the area, and possible infrastructure capacity constraints.

ARC's belief that it will establish significant additional reserves over time with conversion of DPIIP into ECR, ECR into 2P reserves, and probable reserves into proved reserves, is a forward-looking statement and is based on certain assumptions and is subject to certain risks, as discussed below under the heading "Forward-looking Information and Statements".

FORWARD-LOOKING INFORMATION AND STATEMENTS

This news release contains certain forward-looking information and statements within the meaning of applicable securities laws. The use of any of the words "expect," "anticipate," "continue," "estimate," "objective," "ongoing," "may," "will," "project," "should," "believe," "plans," "intends," "strategy," and similar expressions are intended to identify forward-looking information or statements. In particular, but without limiting the foregoing, this news release contains forward-looking information and statements pertaining to the following: the recognition of significant additional reserves under the heading "2018 Independent Reserves Evaluation" and the recognition of significant resources under the heading "Montney Resources Evaluation"; the volumes and estimated value of ARC's oil and gas reserves; the future net value of ARC's reserves; the future development costs; the future abandonment and reclamation costs; the 2019 capital expenditure budget; the life of ARC's reserves; the volume and product mix of ARC's oil and gas production; future oil and natural gas prices; future results from operations and operating metrics; and future development, exploration, acquisition, and development activities (including drilling plans) and related production expectations.

The forward-looking information and statements contained in this news release reflect several material factors and expectations and assumptions of ARC including, without limitation: that ARC will continue to conduct its operations in a manner consistent with past operations; results from drilling and development activities are consistent with past results; the continued and timely development of infrastructure in areas of new production; the general continuance of current industry conditions; the continuance of existing (and in certain circumstances, the implementation of proposed) tax, royalty and regulatory regimes; the accuracy of the estimates of ARC's reserve and resource volumes; certain commodity price and other cost assumptions; and the continued availability of adequate debt and equity financing and cash flow to fund its planned expenditures. There are a number of assumptions associated with the development of the Evaluated Areas, including the quality of the Montney reservoir, continued performance from existing wells, future drilling programs and performance from new wells, the growth of infrastructure, well density per section, and recovery factors and development necessary involves known and unknown risks and uncertainties, including those risks identified in this news release. ARC believes the material factors, expectations and assumptions reflected in the forward-looking information and statements are reasonable but no assurance can be given that these factors, expectations and assumptions will prove to be correct.

The forward-looking information and statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such information and statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information or statements including, without limitation: changes in commodity prices; the early stage of development of some areas in the Evaluated Areas; the potential for variation in the quality of the Montney formation, changes in the demand for or supply of ARC's products; unanticipated operating results or production declines; unanticipated results from ARC's exploration and development activities; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans of ARC or by third-party operators of ARC's properties, increased debt levels or debt service requirements; inaccurate estimation of ARC's oil and gas reserve and resource volumes; limited, unfavorable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time to time in ARC's public disclosure documents (including, without limitation, those risks identified in this news release and in ARC's AIF).

The forward-looking information and statements contained in this news release speak only as of the date of this news release, and ARC assumes no obligation to publicly update or revise them to reflect new events or circumstances, except as may be required pursuant to applicable laws.

ARC Resources Ltd. is one of Canada's largest conventional oil and gas companies with an enterprise value (1) of approximately $3.9 billion. ARC's common shares trade on the TSX under the symbol ARX.

ARC RESOURCES LTD.

Myron M. Stadnyk

President and Chief Executive Officer

For further information about ARC Resources Ltd., please visit our website

www.arcresources.com

or contact:

Investor Relations

E-mail: [email protected]

Telephone: (403) 503-8600 Fax: (403) 509-6427

Toll Free: 1-888-272-4900

ARC Resources Ltd.

Suite 1200, 308 - 4th Avenue SW

Calgary, AB T2P 0H7

(1) | Enterprise value is also referred to as total capitalization. Refer to Note 16 "Capital Management" in ARC's financial statements for the year ended December 31, 2018 and to the section entitled "Capitalization, Financial Resources and Liquidity" contained within ARC's MD&A. |

SOURCE ARC Resources Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/07/c1475.html